- Chainlink sits on top of strong support that may become jumping ground of a new bullish trend.

- On-chain metrics support the LINK bullish view.

Chainlink (LINK) is hovering at $13. It is the seventh-largest digital asset with a current market capitalization of $5.1 billion. The coin has gained 1.5% in the recent 24 hours and lost nearly 5% on a week-to-week basis. LINK hit bottom at $11.28 on November 26 and attempted recovery. However, the upside momentum stopped short of $15, while the price entered another consolidation phase.

While the technical picture reflects a state of uncertainty, several on-chain metrics imply that the coin has a potential to retest $18 if bullish momentum gains traction.

Chainlink on-chain metrics are bullish

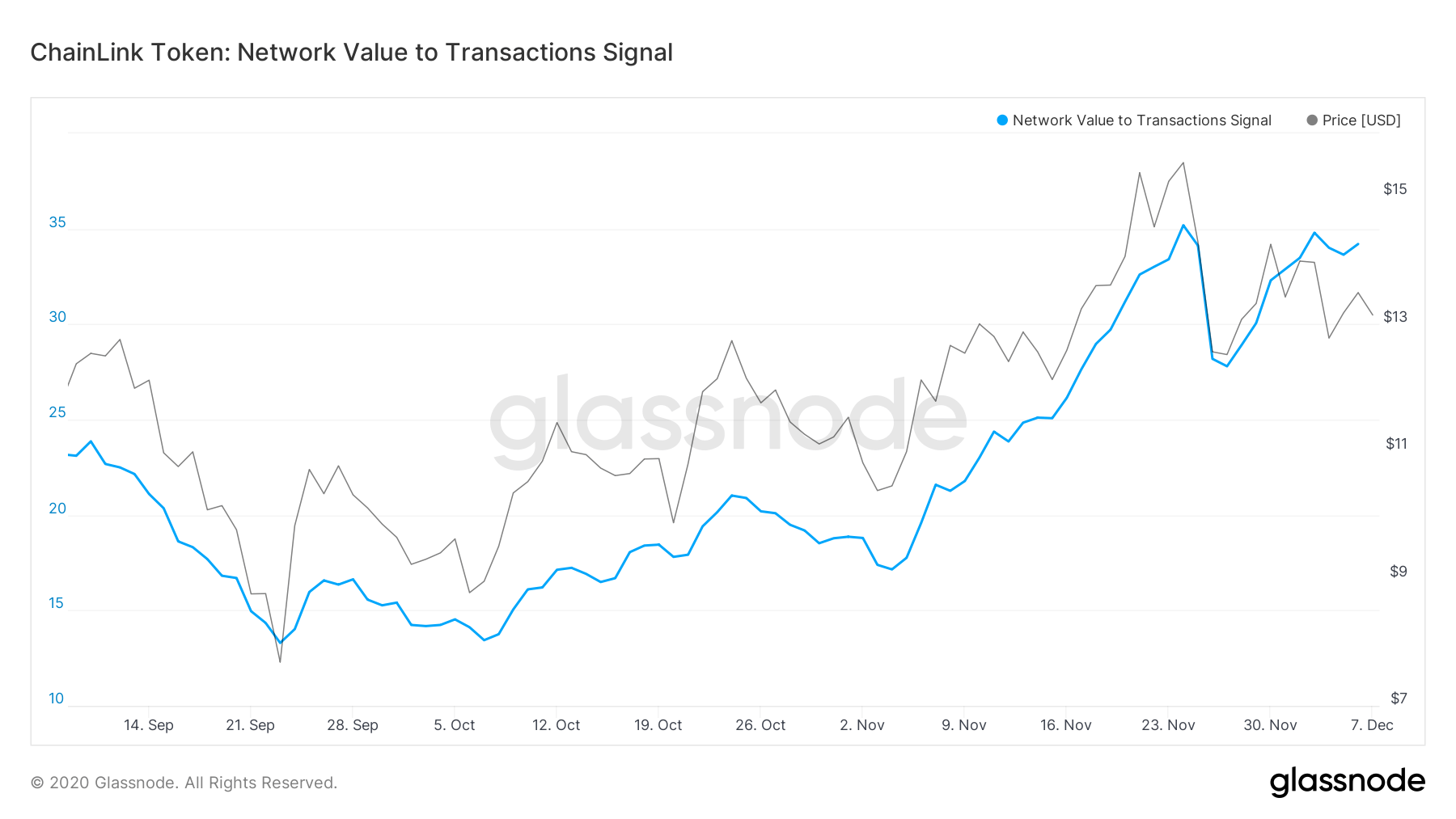

LINK's Network Value for Transactions signal has created a bullish divergence against price, which is a strong positive signal. It implies that the price may be ready for a bullish breakthrough. Network Value for Transactions (NVT) shows whether a certain cryptocurrency is overvalued or undervalued. It is calculated as a ratio between the network value of a crypto asset and the value of its transaction activity. When the indicator goes up, the price tends to follow shortly.

LINK's Network Value for Transactions

Santiment's holders' distribution data confirms the bullish forecast as whales seem to be accumulating LINKs. Over 20 addresses holding between 100,000 and $1,000,000 LINK tokens joined the network in less than a month. The number of super big whales having from 1 million to 10 million coins increased from 48 to 51 in a matter of ten days. While the number may seem insignificant, it is worth noting that each whale controls LINKs worth between $153,000 and $1.5 million.

LINK's Holders' Distribution

LINK price forecast: Massive support around $12

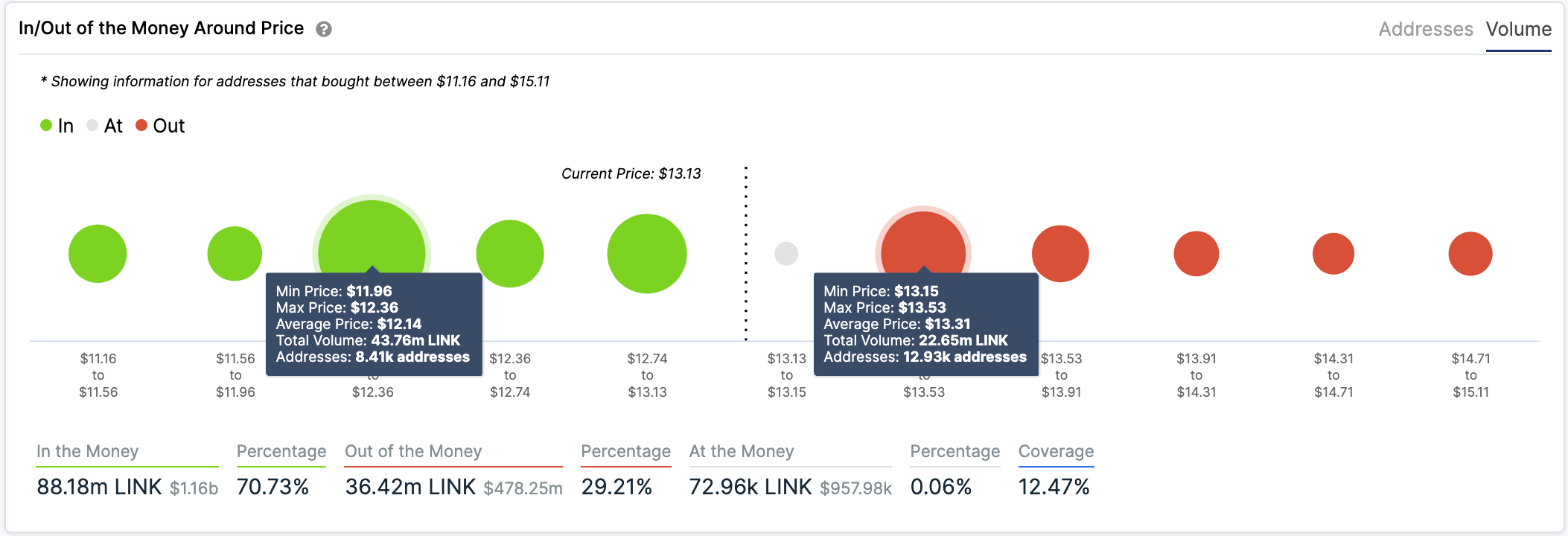

However, based on IntoTheBlock's "In/Out of the Money Around Price" model, LINK sits on top of a significant support area. Over 8,400 addresses previously purchased over 43 million LINK tokens between $11.96 and $12.36, meaning that this barrier has the potential to slow down the downside momentum and trigger a new bullish wave.

LINK In/Out of the Money Around Price

On the other hand, the recovery is capped by the local resistance on approach to $14.50. It is created by nearly 13,00 addresses that bought over 22 million LINK tokens around that level. However, even if this barrier is cleared, the bulls won't face stiff resistance until $18.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[12.19.34,%2007%20Dec,%202020]-637429456222561716.png)