Chainlink Price Forecast: LINK aims for a new all-time high at $30 after a potential rebound

- Chainlink price is inside a massive uptrend since the beginning of 2021.

- The digital asset hit a new all-time high at $26.15 in the past 24 hours.

- Technicals suggest that Chainlink is poised for a significant rebound towards a new high above $26.

-637336005550289133_XtraLarge.jpg)

Chainlink has been extremely bullish for the majority of 2021 hitting new all-time highs almost every single day. LINK bulls are not done yet and aim for yet another high after defending a crucial support level.

Chainlink price defends critical support level and aims for $30

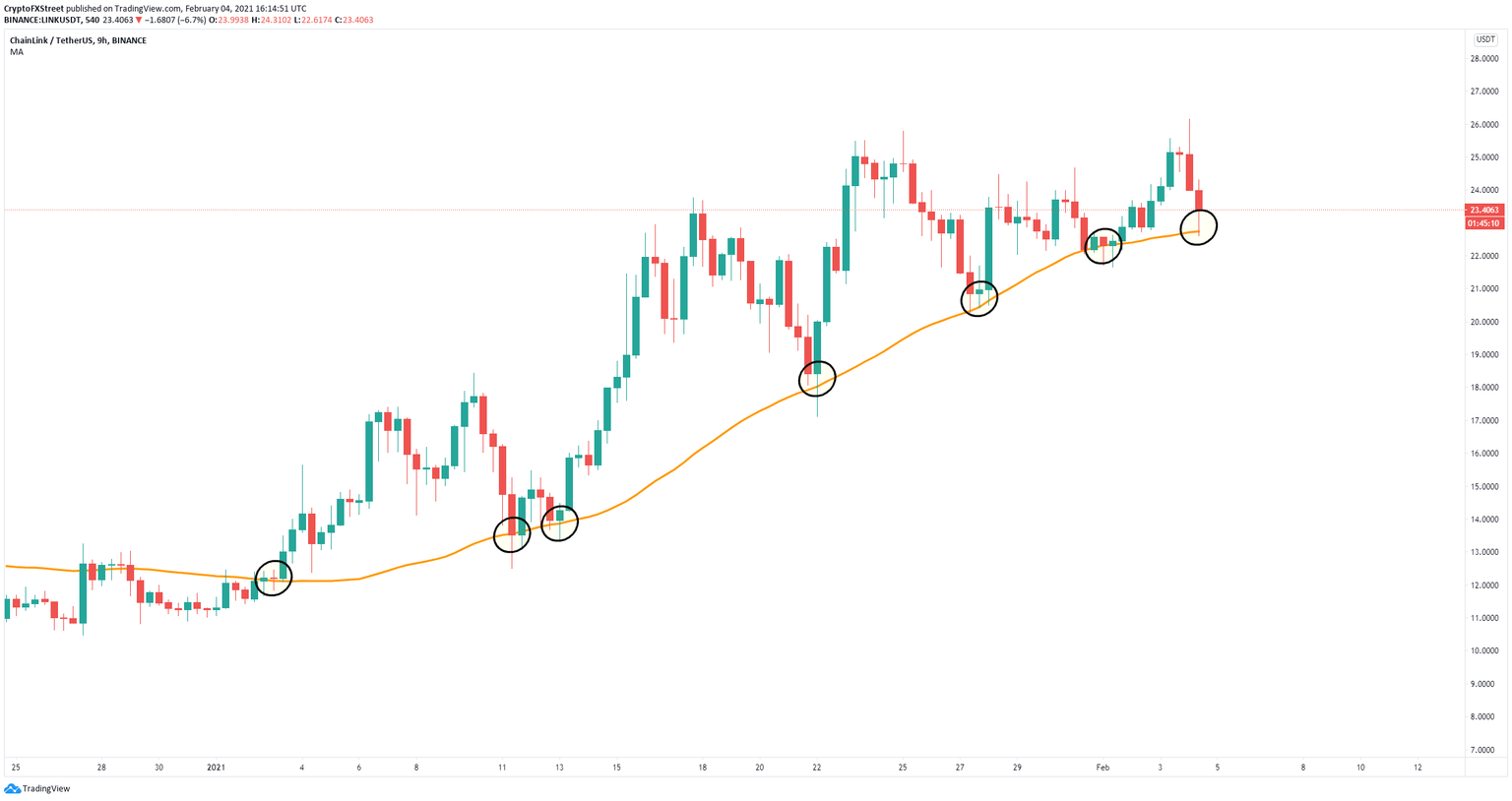

On the 9-hour chart, Chainlink price has been trading above the 50-SMA support level since the beginning of 2021. Every time LINK touched the 50-SMA, it saw a significant rebound within the next few days. In the past 12 hours, Chainlink price has defended the support level again which indicates that a rebound is underway.

LINK/USD 9-hour chart

The nearest and most important resistance level is located at $26.15 which is the last all-time high. A breakout above this point can easily push Chainlink price towards the psychological level at $30.

LINK Holders Distribution chart

Surprisingly, despite Chainlink price rising, the number of whales holding between 100,000 and 1,000,000 coins has increased significantly since January 23 from a low of 266 to 278 currently indicating that large holders are accumulating LINK even at high prices.

LINK/USD 9-hour chart

However, on the same 9-hour chart, the TD Sequential indicator has presented a sell signal despite bulls defending the 50-SMA. If this support level breaks, Chainlink price can fall towards $21.64. Other significant support levels can be found at $20.29 and $17.1.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B17.16.32%2C%252004%2520Feb%2C%25202021%5D-637480618872214609.png&w=1536&q=95)