Chainlink price eyes 35% gains as LINK flips crucial support level

- Chainlink price has flipped a hurdle at $24.61 into a support floor, indicating a potential uptrend.

- If successful, LINK will likely rally 36% to retest the weekly resistance barrier at $33.62.

- A breakdown of the $18.81 support level will create a lower low, invalidating the bullish thesis.

-637336005550289133_XtraLarge.jpg)

Chainlink price shows signs that appear before the start of an uptrend. This outlook has supporting factors from both a technical and an on-chain perspective. Therefore, investors can expect LINK to start a bull rally.

Chainlink price faces a decisive moment

Chainlink price rose 88% since November 29, 2021, setting up a swing high at $28.69. This uptrend sliced through the weekly resistance barrier at $24.61 and the trading range’s midpoint at $25.92.

Although LINK flipped the $24.61 support level, the resulting retracement sliced through $25.92 and is currently retesting the $24.61 foothold. Assuming Chainlink price bounces off this barrier, there is a high chance the oracle token will shatter the midpoint and make a run for the weekly resistance barrier at $33.62.

This run-up will constitute a 36% ascent and is likely where this uptrend will stop and retrace before exploring further hurdles.

LINK/USDT 1-week chart

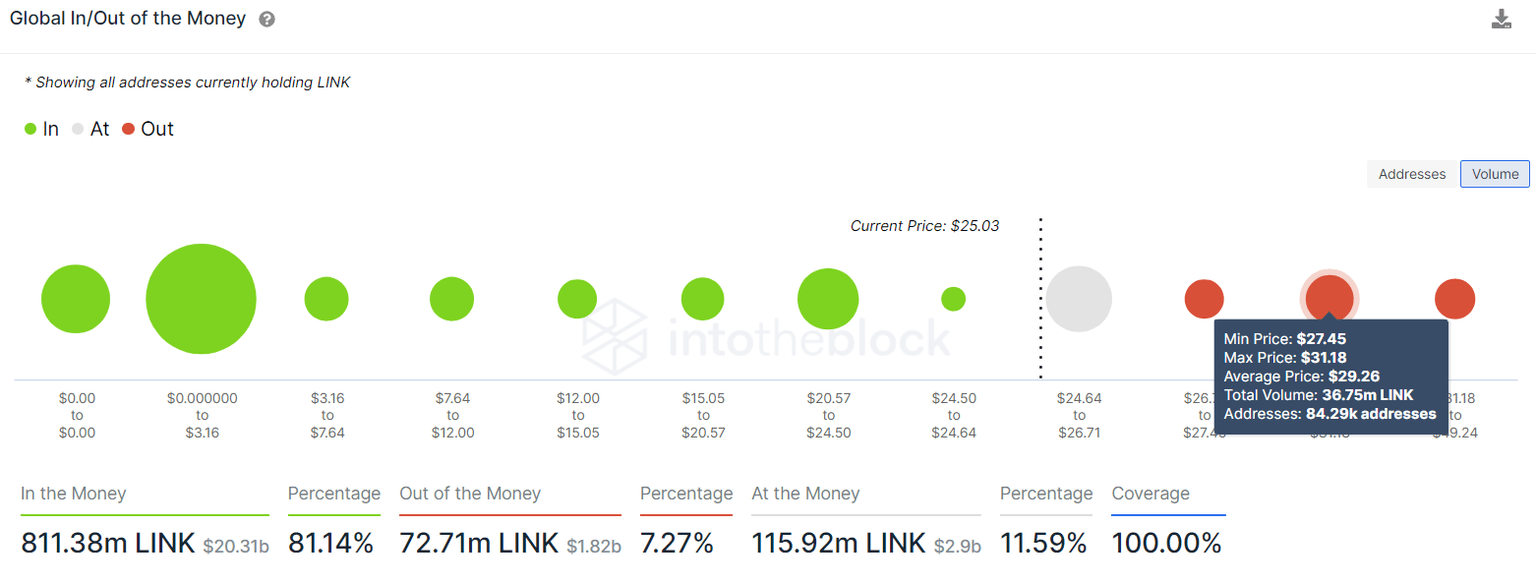

Supporting this outlook for Chainlink price is IntoTheBlock’s Global In/Out of the Money (GIOM) model, which shows little to no resistance barrier plaguing LINK’s path. The only hurdle that matters, extends from $27.45 to $31.18.

Here, roughly 84,290 addresses that purchased nearly 36 million LINK tokens are “Out of the Money.” These investors are likely to sell their holdings and break even if Chainlink price rises higher.

LINK GIOM

The on-chain volume for Chainlink set a higher high between December 4 and January 7, while LINK price set a lower low, creating a divergence. An increase in on-chain volume often represents that a bullish outlook is around the corner. Therefore, investors can expect Chainlink price to see a considerable appreciation, backing the bullish thesis from a technical perspective.

LINK on-chain volume

While things are looking up for Chainlink price, a breach of the $24.61 support level will push LINK down to $18.81. A weekly candlestick close below his barrier will create a lower low, invalidating the bullish thesis for the oracle token.

This development could knock LINK to the range low at $13.38.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%20%5B10.07.16%2C%2017%20Jan%2C%202022%5D-637779922959626118.png&w=1536&q=95)