Chainlink price dips by 5% despite deploying on Coinbase’s Etheruem L2 “Base”

- Chainlink integrated with Base’s testnet to provide off-chain price feeds to developers.

- As per Coinbase, the deployment was under the Chainlink Scale program, where Base will support some of the operational expenses.

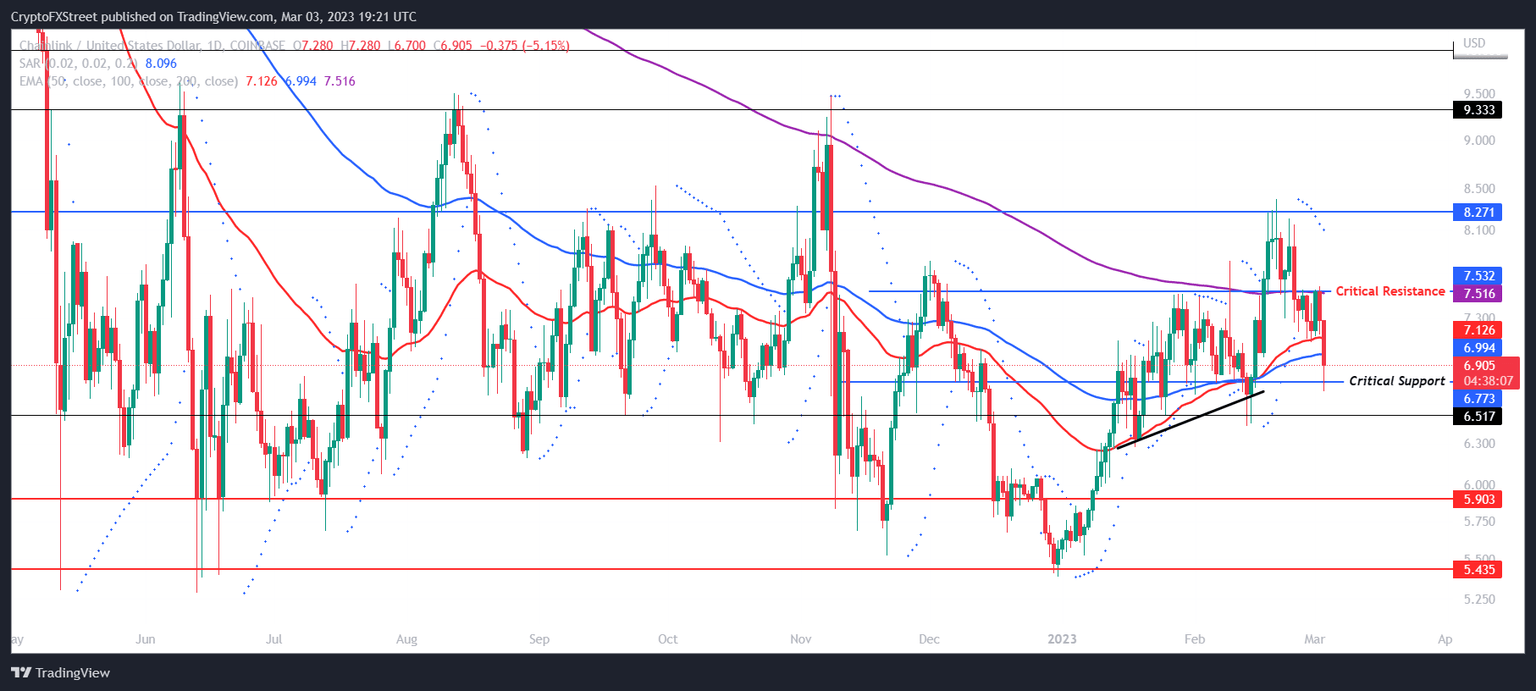

- Chainlink price could be seen nearing the critical support at $6.77 losing, which could result in a 14.4% crash.

-637336005550289133_XtraLarge.jpg)

Chainlink is among the most successful crypto projects in the world thanks to its oracle network, which gives it an edge over most of the other DeFi protocols. This service is now being leveraged by Coinbase for its layer 2 chain Base.

Coinbase X Chainlink

In an announcement on Friday, the second-largest cryptocurrency exchange in the world stated that it had joined hands with Chainlink. The decentralized finance protocol is set to be launched on the testnet of the L2, as this will allow Chainlin to provide secure, off-chain price feeds to the developers building on the chain.

According to the development team behind Coinabse’s Base in the stated that the partnership is part of the Chainlink Scale program. The program is used to offer data to new app developers at a lower price, and to make the same happen, Base will be taking on some of the operational expenses.

Discussing the same, the project lead at Base, Jesses Pollak, stated,

“We’re super excited to launch Base with collaborators such as Chainlink, and to join the Chainlink SCALE program to empower developers with the critical data and services they need to build their applications.”

Chainklink price did not pay heed

Chainlink price is usually pretty reactive to developments surrounding the network. Except for this time, the cryptocurrency took a different path as it declined by more than 5% in the span of a day to trade at $6.95.

The altcoin is actually inching closer to its critical support level at $6.77.and losing this would cause further delay in the recovery of the losses witnessed by LINK in November 2022. If the cryptocurrency declines and Chainlink price falls below it, the altcoin could end up potentially witnessing a 15% crash to $5.90.

LINK/USD 1-day chart

But if the prices bounce off the critical support, it would need some support to breach the critical resistance a$7.51. If this level is flipped into a support floor, allowing LINK to mark a four-month high and keep rising further around the $8.27 mark.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.