Chainlink price crashes by 15% as investors continue to exhibit this sentiment

- Chainlink price slipped to $7.2 after charting a five-month high earlier this week.

- Nearly 16% of all investors that exited the market between December and January are yet to return to the network.

- The lack of conviction is visible in the whales as well, who dumped about $17 million worth of LINK in less than a week.

-637336005550289133_XtraLarge.jpg)

Chainlink price was performing exceptionally earlier this week when the altcoin charted five-month highs. However, soon after, the cryptocurrency came crashing down, and investors seemed to be doubling down on their skepticism that has been persisting since December 2022.

Chainlink price fall strengthens pessimism

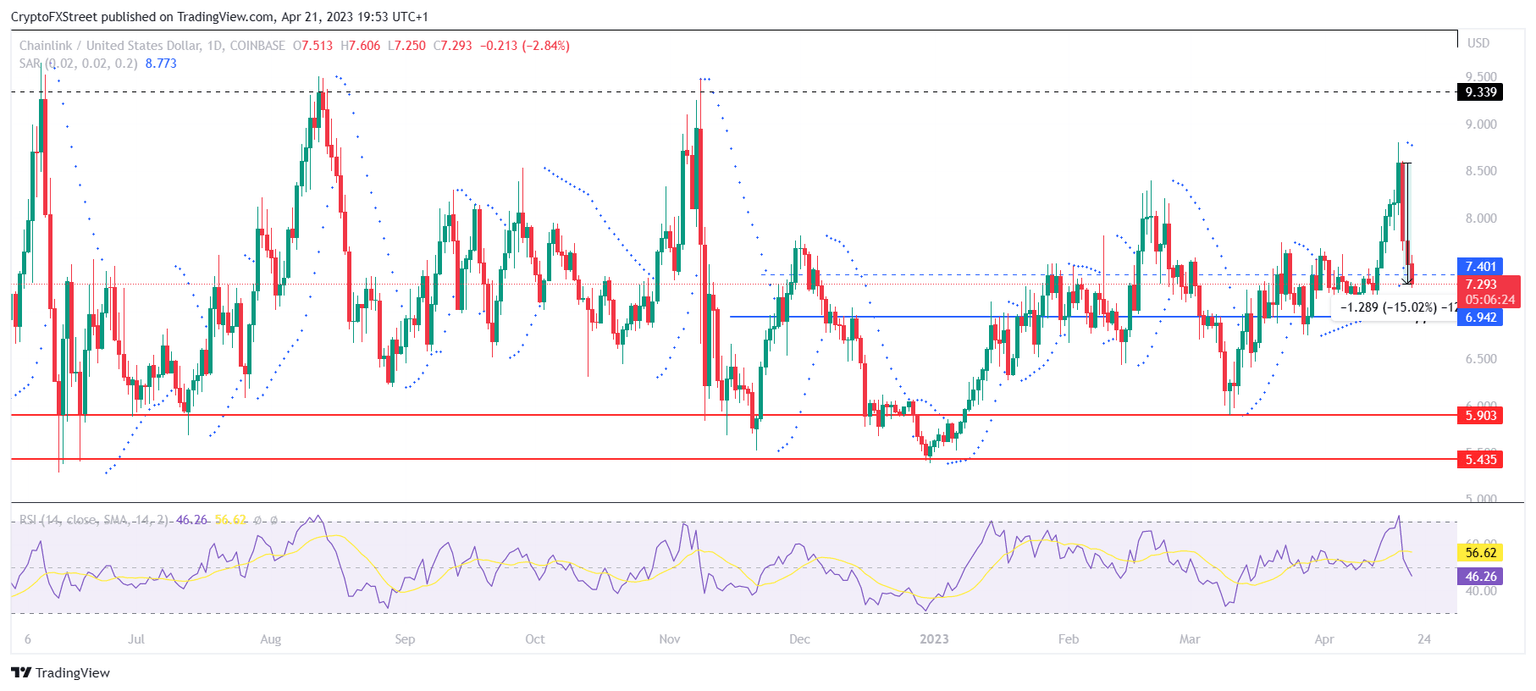

Chainlink price put up solid gains between April 12 and 18 when the altcoin rallied by nearly 20% to mark a new year-to-date high at $8.5. Over the next three days, the Oracle network token declined by more than 15% to trade at $7.2 at the time of writing.

LINK/USD 1-day chart

This fall in Chainlink price reinstated the somewhat dissipating skepticism that investors have been holding out since December 2022. Following the FTX collapse in November, the crypto market began crashing, and LINK holders started exiting the network.

Over the course of the next month until January, over 120,000 addresses were wiped out, and the total addresses that held LINK fell to 619,000.

Chainlink addresses with balance

Even after three months since then, these investors have not returned as total addresses continue to linger at 619,000, with some dips observed in March again. This skepticism extends to the investors that exist on the network as well, given the active addresses have been averaging 2,200.

The active address ratio, which shows the total number of investors conducting transactions against the total 619,000 addresses, currently sits at 0.4%. Lack of support from the token holders will always be a bane for price recovery, which is the case for Chainlink right now.

Chainlink active address ratio

The cryptocurrency’s whales, too, have been meek in their activity. Over the last two days following the 15% crash in Chainlink price, cohorts holding 100,000 to 1 million LINK sold off over 2.4 million LINK worth close to $16.5 million.

Chainlink whale activity

Investors are still holding out hope for an alt season sometime soon, which would be the next major opportunity for Chainlink price to rally again. Should it fail to do so, LINK holders might become even more pessimistic.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B00.48.08%2C%252022%2520Apr%2C%25202023%5D-638177018821248706.png&w=1536&q=95)