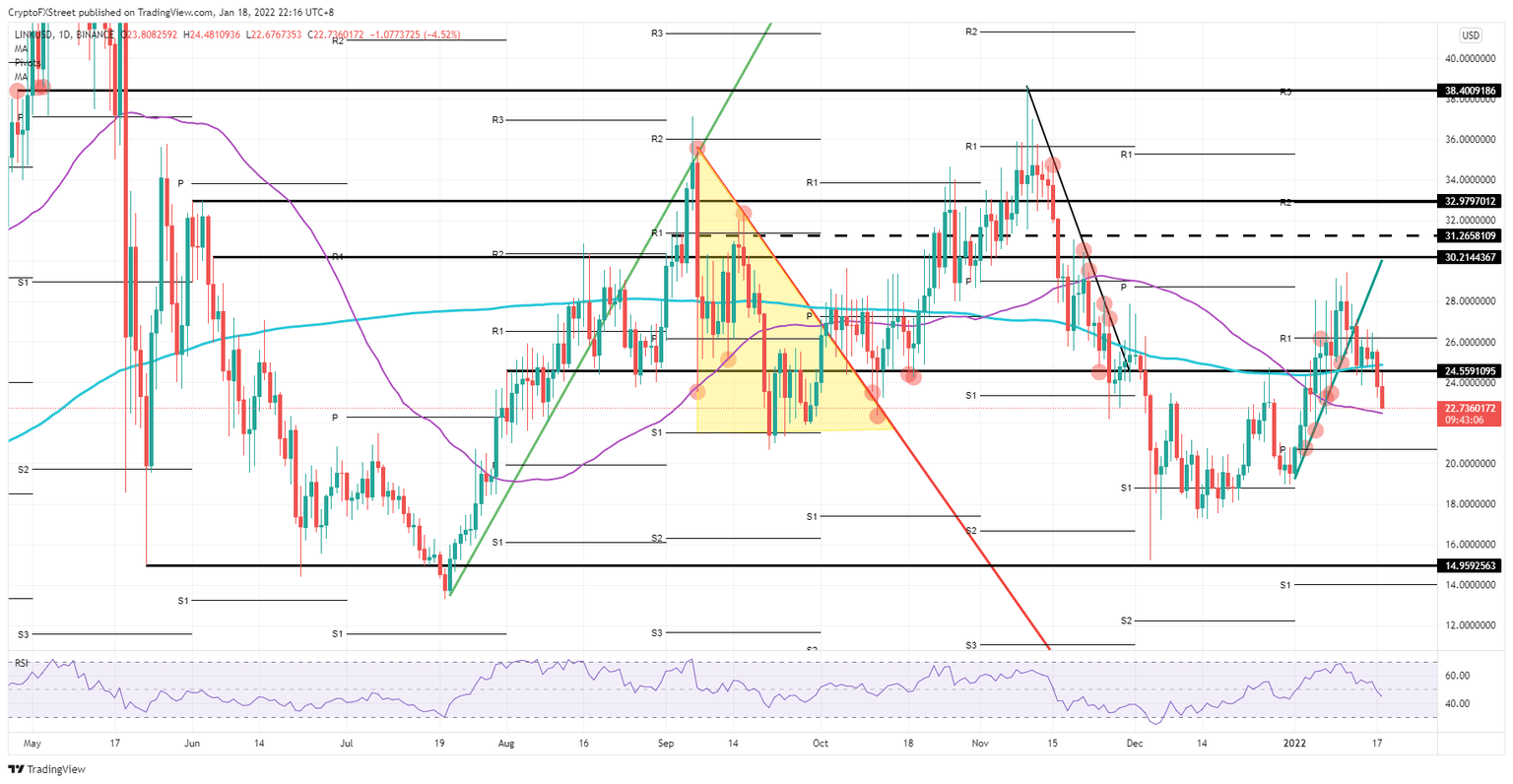

Chainlink price could crash by 35% before LINK marines pick it up

- Chainlink sees bears accelerating the downward price action.

- LINK price is drilling on the 55-day SMA, which could open the door towards $20.00

- As global market sentiment weighs, expect even a nose dive if a fire sale starts, with LINK dropping towards $15.

-637336005550289133_XtraLarge.jpg)

Chainlink (LINK) price action looked to be flying high at the start of 2022, but a crash is unfolding this week that is seriously hurting investors in Chainlink. Currently, LINK price is nearing the 55-day Simple Moving Average (SMA) that has acted as support and resistance several times in the past. A break lower would see price action dip lower towards either $20.70 best-case or $15.00 worst-case scenario.

Chainlink drafts worst-case scenario of 35% devaluation

Chainlink investors are on the ropes as bears push them up against a wall, attempting to get them to ‘hand all their money over’. As more stops are being hit below $24.55, with price action further losing value, the 55-day SMA starts to come into play as the last line of defense from what will be at least a 12% loss. A break below the 55-day SMA at $22.50 would open up the road towards the monthly pivot at around $20.70.

But that is not where the pain will stop for LINK bulls as the monthly pivot is effectively a no man's land, with the level not holding any significance as it has been chopped up quite a lot during December. With current market sentiment possibly not turning risk on overnight, expect more pressure on the monthly pivot with a possible break sub $20.00. A substantial penetration would see an accelerated selloff towards $15.00, which coincides with the low of May 23 and December 04.

LINK/USD daily chart

A bounce off the 55-day SMA or the monthly pivot could be possible if sellers respect the Relative Strength Index (RSI), which by then will be trading in the oversold area. This would see a slowdown in selling pressure and a slight pickup in buying volume as sellers need to buy LINK coins to book gains. A bounce off one of those levels is possible but would need to be managed with quite a tight stop and respect for the levels in between, prior to hitting the broad support at $15.00.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.