Chainlink price carries small gains for this week, while a recovery is out of the question

- Chainlink price holds very marginal gains and is actually rather unchanged for the week thus far.

- LINK could see downside energy come as several indicators point to more selling pressure.

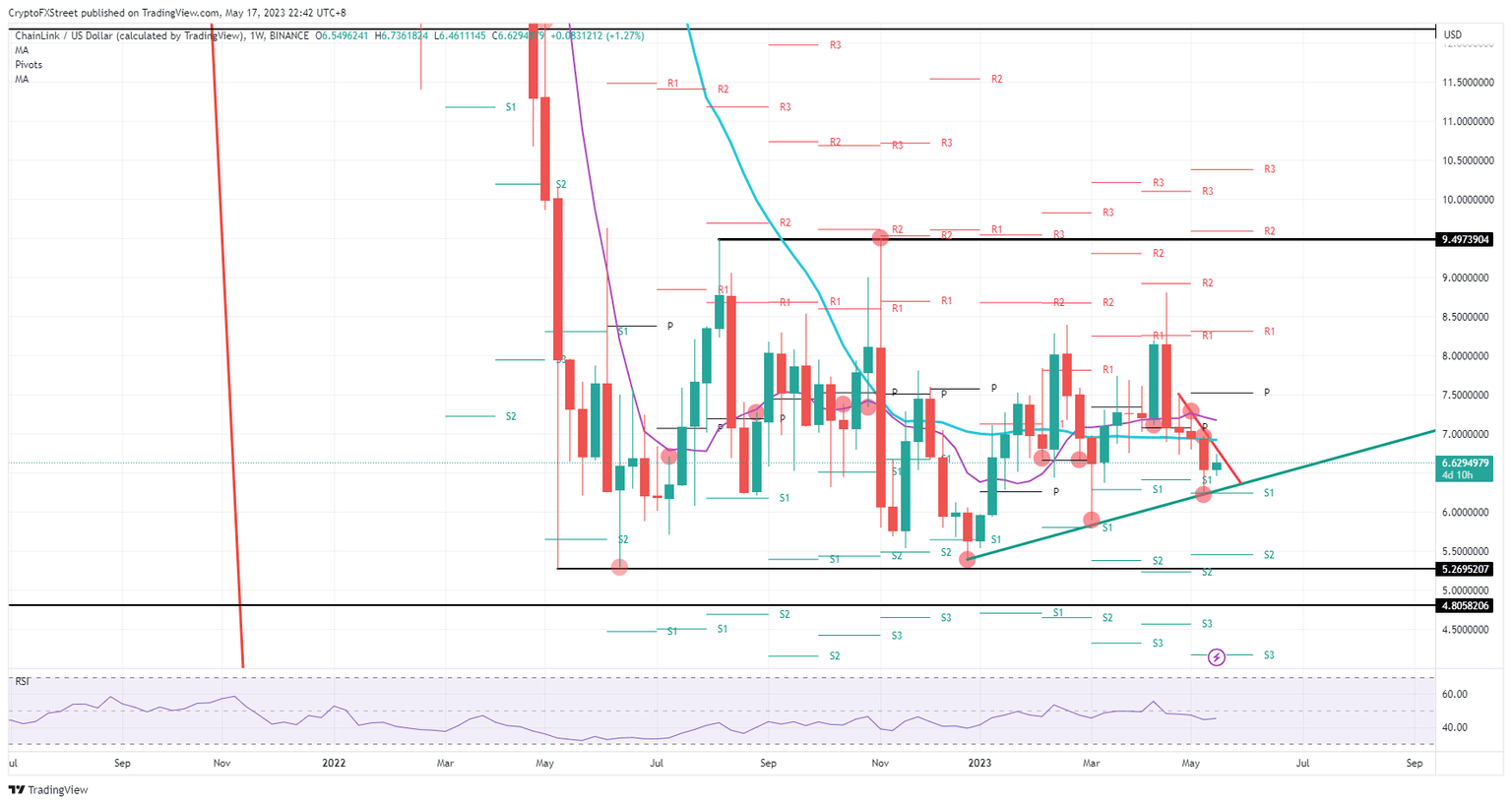

- Expect to see a possible break to the downside should the green ascending trendline break lower and head to $5.25.

-637336005550289133_XtraLarge.jpg)

Chainlink (LINK) price has a few tailwinds to enjoy at the moment as several elements and indicators are pointing to heavy selling getting underway. The 55-day Simple Moving Average (SMA) is heading to the downside, while the Relative Strength Index (RSI) is trading sub 50. The red descending trend line also remains unchallenged for now.

Chainlink price to drop 20% if this line in the sand gets scrambled

Chainlink price thus sees plenty of forces starting to close in on its price action. To make matters worse, bears were able to push the price action below the 200-day SMA last week and keep it there. Without a strong bullish breakout signal, LINK is bound to head much lower.

LINK will see pressure start to build around $6.50 at the green ascending trendline, which has been tested twice already in recent weeks. The third time’s the charm, and I could snap that line with a quick slide lower to $5.25. That was the low of 2022, and LINK could make a new multi-year low.

LINK/USD weekly chart

To the upside, that line in the sand comes in the form of the red descending trendline, which is quite steep. Often steep trendlines tend to snap more easily, and in this case that would open the door for a quick jump up to $7. Once that is cleared and reclaimed by bulls, expect to see a jump higher to $7.50 that slowly but steadily heads to $9.50 in the long run.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.