Chainlink price attempts breakout, but LINK is capped at $30

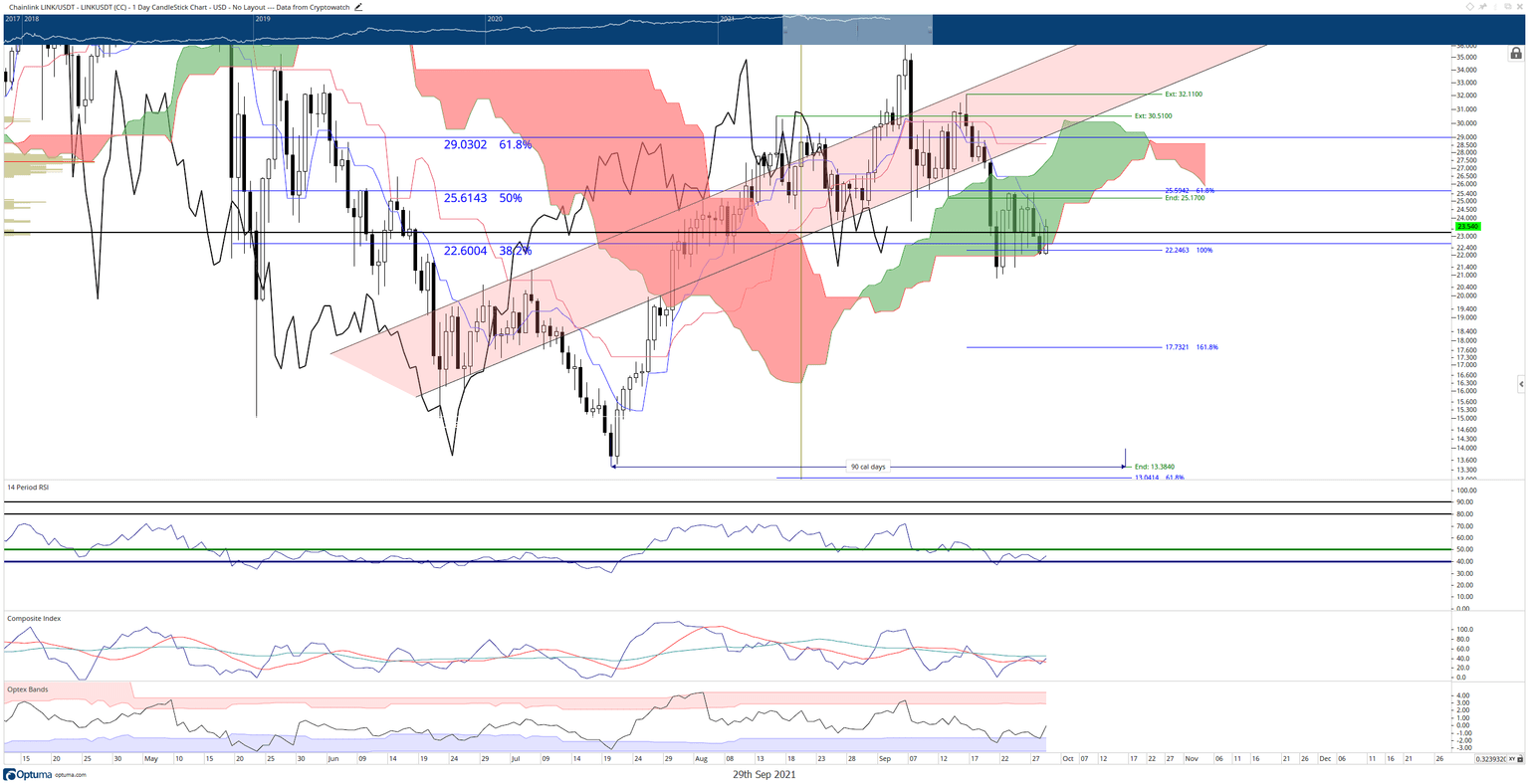

- Chainlink price gets massive support against the $22.25 value area.

- Bulls push for a close above the Tenkan-Sen at $23.60.

- A flash spike in price higher could generate Chainlink bulls a +36% gain from the Wednesday open – but intense resistance would prevent any further increase.

-637336005550289133_XtraLarge.jpg)

Chainlink could pull off an extreme bullish close today if it remains above $23.02. A close at or above $23.02 would confirm a bullish engulfing candlestick as well as a close above the daily Tenkan-Sen, granting bulls some reprieve.

Chainlink price eyes some relief for beleaguered bulls, but the upside potential is limited

Chainlink price may see a few days of bullish gains. Many buyers have entered the market to support Chainlink at the significant $22.25 support level. The immediate target for buyers is the psychological number of $25.00, which also contains the 50% Fibonacci retracement ($25.61) and the 61.8% Fibonacci extension at %61.8%.

The $30 value area is likely to cap any further upside momentum by buyers. A large number of price levels near $30 will act as resistance: the top of the Cloud (Senkou Span A - $28.75), Kijun-Sen ($28.59), 61.8% Fibonacci retracement ($20.03, and the bottom of a primary bear flag channel ($30). Thus, it is unlikely that Chainlink price would move higher without a retracement from the $30 level.

LINK/USD Daily Ichimoku Chart

However, buyers should be warned that significant risk-off sentiment continues to wear on the cryptocurrency market, and Chainlink is not immune to aggregate market weakness. Note that Chainlink opened the new daily candlestick below the Cloud marking an extremely bearish condition. Any return to the Wednesday open and lower will likely push Chainlink to the $17.00 value area.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.