Chainlink Price Analysis: Why it is so important to hear what Lagarde and the ECB have to say

- Chainlink price in a negative scenario that could see this rally halt.

- LINK is exposed to the ECB rate decision this afternoon with the risk of US Dollar strength.

- Expect to see the ECB miss the mark and trigger a sell-off in markets, unwinding the move of Wednesday.

-637336005550289133_XtraLarge.jpg)

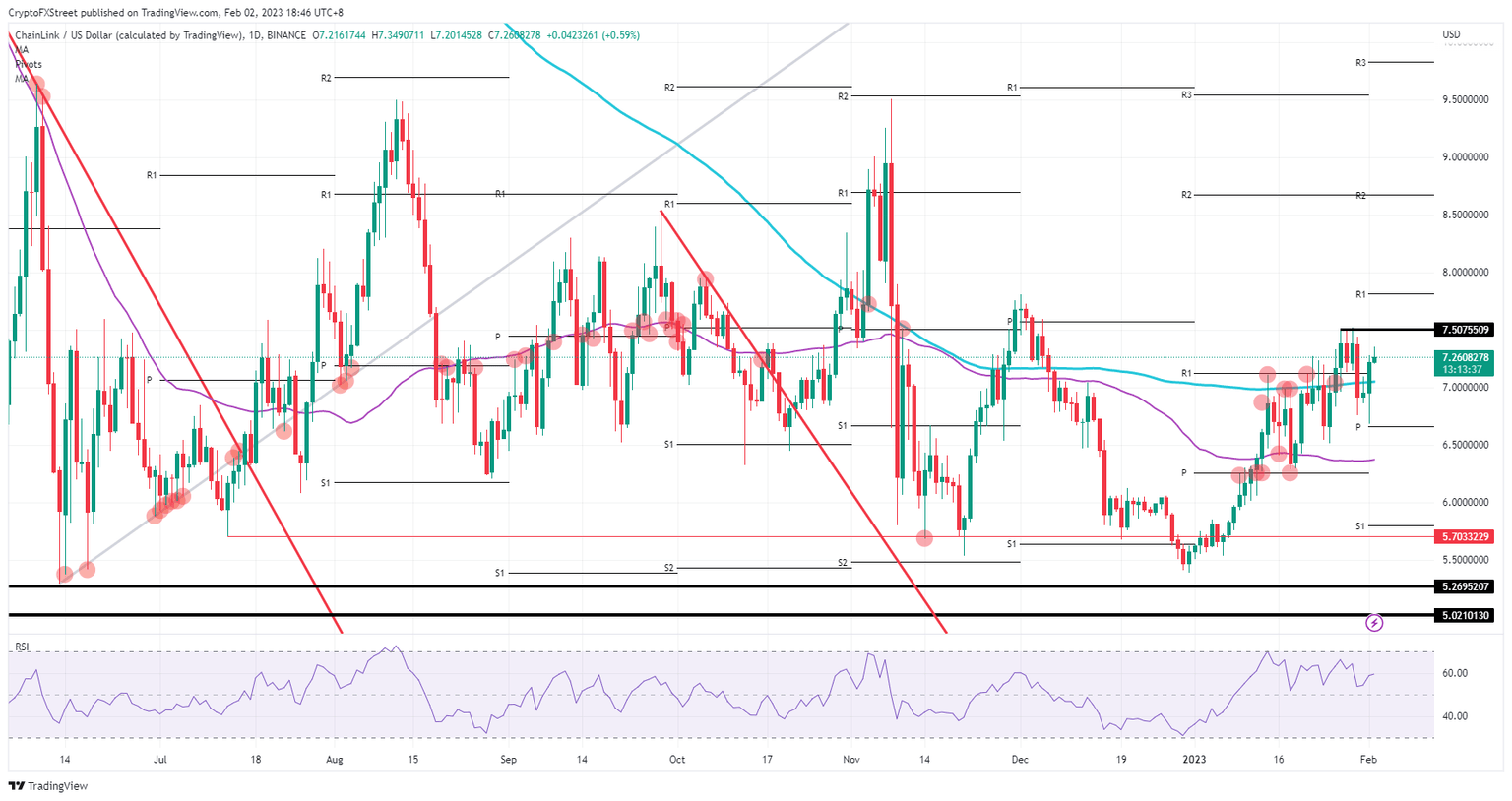

Chainlink (LINK) price is not on the right spot of the chart after the Fed rate decision from Wednesday. A break of the triple top would have been ideal as now bulls seem to have lost interest and morale, and a decline in search of support could be at hand. Expect the ECB to be the catalyst and push price action back to $6.50.

Chainlink price only gained 3% on the back of the Fed instead of the projected 8%

Chainlink price is now at risk of the next central bank decision. If the Bank of England is left out of the analysis, the European Central Bank (ECB) and its Chair, Christine Lagarde, could become the counter-cyclical force in this volatile week. Although the ECB is set to hike 50 basis points and still has elevated inflation, in Italy inflation has dropped, and the combined European inflation figure came out lower than last month.

The risk at hand for LINK is that the ECB on Thursday afternoon will pat itself on the back for what it has realized thus far, and the markets might perceive that as too soon to scream victory already. The good news show Lagarde will try to perform on camera will make markets second guess and erase all the gains from Wednesday night, with LINK at risk of tanking back to $6.50 and making a new low for this week.

LINK/USD daily chart

If the ECB becomes outright hawkish with its announcement, markets will applaud the close control of the central bank. By gaining credibility, risk assets will jump another nudge higher, certainly if Lagarde provides some forward guidance. Expect a break above $7.50 with $8.00 as a psychological candidate for the ideal nearby price target.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.