Chainlink presents buy opportunity before LINK spikes to $30

- Chainlink price experiences deep pullback, giving buyers another discount.

- A bullish Point and Figure setup presents a low risk, high reward trade possibility.

- Downside risks remain but should be limited.

-637336005550289133_XtraLarge.jpg)

Chainlink price has been quite bearish during the Tuesday trading session. LINK has moved lower by nearly 12% at one point during the day. However, the pullback was warranted as Chainlink had gained over 41% from the December 15 swing low.

Chainlink price pulls back from monster rally, giving buyers a re-entry opportunity

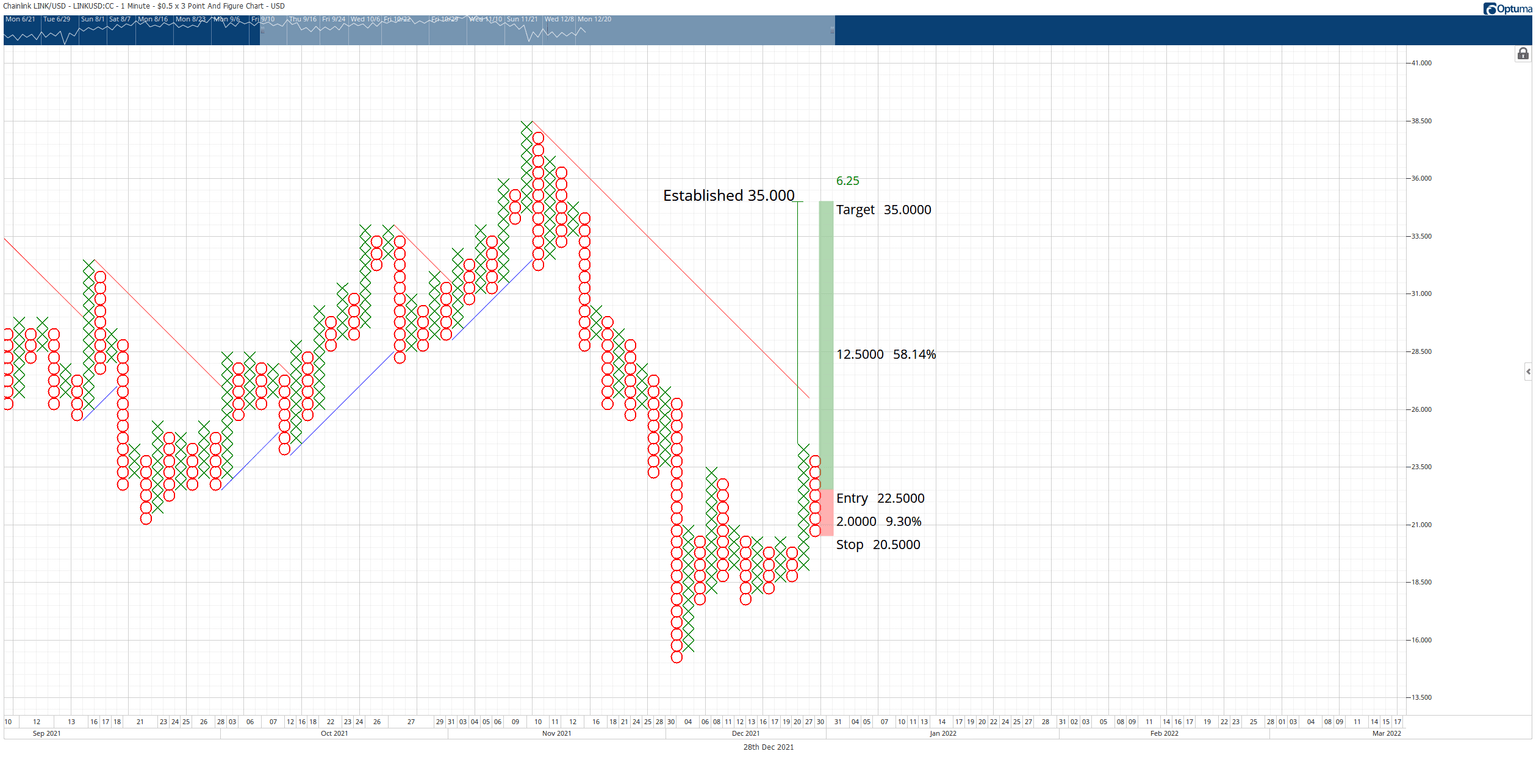

Chainlink price remains very bullish despite the current down drive. On Chainlink’s $0.50/3-box reversal Point and Figure chart, the prior X-column represented a 29% increase after breaking out above a triple-top. The current pattern was just shy of creating a Spike Pattern; instead, it has developed a Pole Pattern.

The entry rule on a Pole Pattern that has made its retracement is to enter on the 3-box reversal with a 4-box stop loss. At the time of publication, the hypothetical long setup for Chainlink price is a buy stop order at $22.50, a stop loss at $20.50, and a profit target at $35.00. This trade setup provides a 6.5:1 reward for the risk trade setup.

However, be aware that the current O-column can continue to move lower. That means the hypothetical buy stop for Chainlink price would also move lower – the 4-box stop loss and profit target remain the same. A two to three-box trailing stop would help protect any implied profit post entry.

For example, if the current O-column were to move lower by five boxes to $18.00, the hypothetical buy stop entry would be at $19.50 and the stop loss at $17.50 while the profit target remains at $35.00.

LINK/USDT $0.50/3-box Reversal Point and Figure Chart

Due to the nature of this Point and Figure pattern for Chainlink price, there is no invalidation point for this pattern. Therefore, the hypothetical long setup remains on the 3-box reversal no matter how low the current O-column moves.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.