Chainlink $LINK getting ready for the next daily move

Chainlink $LINK a cryptocurrency and technology platform that enables non-blockchain enterprises to securely connect with blockchain platforms. It’s acting as a bridge between the real world and the crypto universe to facilitate the connection between the two. In today’s article, we’ll dive into the daily cycle taking place and explore the potential path based on the Elliott Wave Theory.

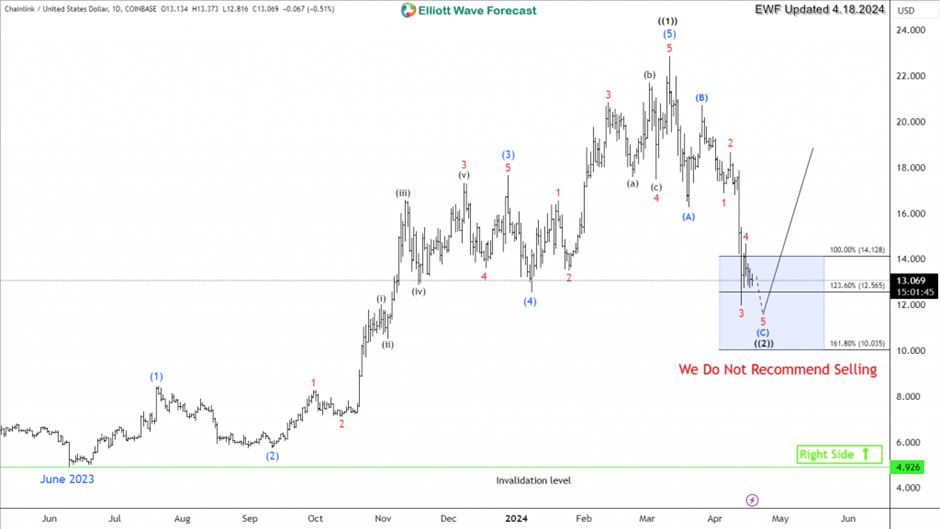

Since June 2023, $LINK rallied 369% within an impulsive 5 waves advance to finish wave ((1)) on March 2024. This rally marked the start of a new bullish cycle to the upside and currently a wave ((2)) is in progress to correct the first leg before the cycle resume the move higher.

The correction in wave ((2)) is unfolding as a 3 waves ZigZag structure (A)(B)(C) and it reached the equal legs area within the blue box at $14 – $10. That extreme area is where we expect the coin the end the decline and start the next leg to the upside or at least react higher within a 3 waves bounce.

The daily bullish structure since 2023 is suggesting that $LINK should remain supported in 3, 7 or 11 swings during pullbacks and it would provide investors with good investment opportunity for a potential higher target in wave ((3)).

$LINK Daily Chart 4.18.2024

Setup Recap

-Time Frame : Daily

-Entry Area : $13 – $10

-Invalidation Condition : Daily Close below $9.5

-Targets / Ratio : Target 1 at $29 (4.57 RR) – Target 2 at $41 (8 RR) – Target 3 at $70 (16.2 RR)

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com