Chainlink introduces Keepers to decentralize smart contract functions as LINK price prepares comeback

- Chainlink announced the launch of Keepers beta to upgrade smart contract functions.

- Keepers provides developers an opportunity to automate smart contracts, regular contract maintenance and more.

- LINK price retests a critical support barrier, taking another jab at the upswing.

-637336005550289133_XtraLarge.jpg)

Chainlink has taken a new step forward to improve smart contracts and its features via the newly launched Keepers. Although the product is still in beta, it will help developers with decentralized DevOps capabilities.

LINK price shows its reentry into a critical support level after getting rejected at the recent swing high. A bounce from the said demand barrier will open the possibility of a retest of the recent swing high.

Chainlink Keepers Open Beta goes live

Chainlink has been at the forefront of crypto oracles providing a plethora of projects with highly reliable data. However, the launch of Keepers will benefit developers, dApps, and Decentralized Autonomous Organizations (DAOs) by improving the utility of smart contracts and making them more efficient.

Keepers will provide individuals and organizations

with a highly reliable, decentralized, and cost-efficient method of automating smart contract functions and regular contract maintenance, creating a never-before-seen form of fully decentralized DevOps capabilities.

Additionally, Keepers helps remove reliance on an additional layer of trust by introducing end-to-end decentralized automation.

This ability will, in effect, improve the efficiency of smart contracts and make the infrastructure more robust, allowing projects to scale and secure higher amounts of value for users.

Generally, smart contracts are triggered by external sources; with Keepers acting as intermediaries, it will allow developers to set trigger conditions to execute a function, which could be time-based, event-based or other combinations.

The architecture of Chainlink Keeper Network will provide high uptime, low costs, decentralized executions, transparent reputation and more. All of these functionalities will allow the

development teams [to] scale the security and reliability of their decentralized applications to match the increasing TVL they are responsible for securing on behalf of users.

LINK price takes another jab at upswing

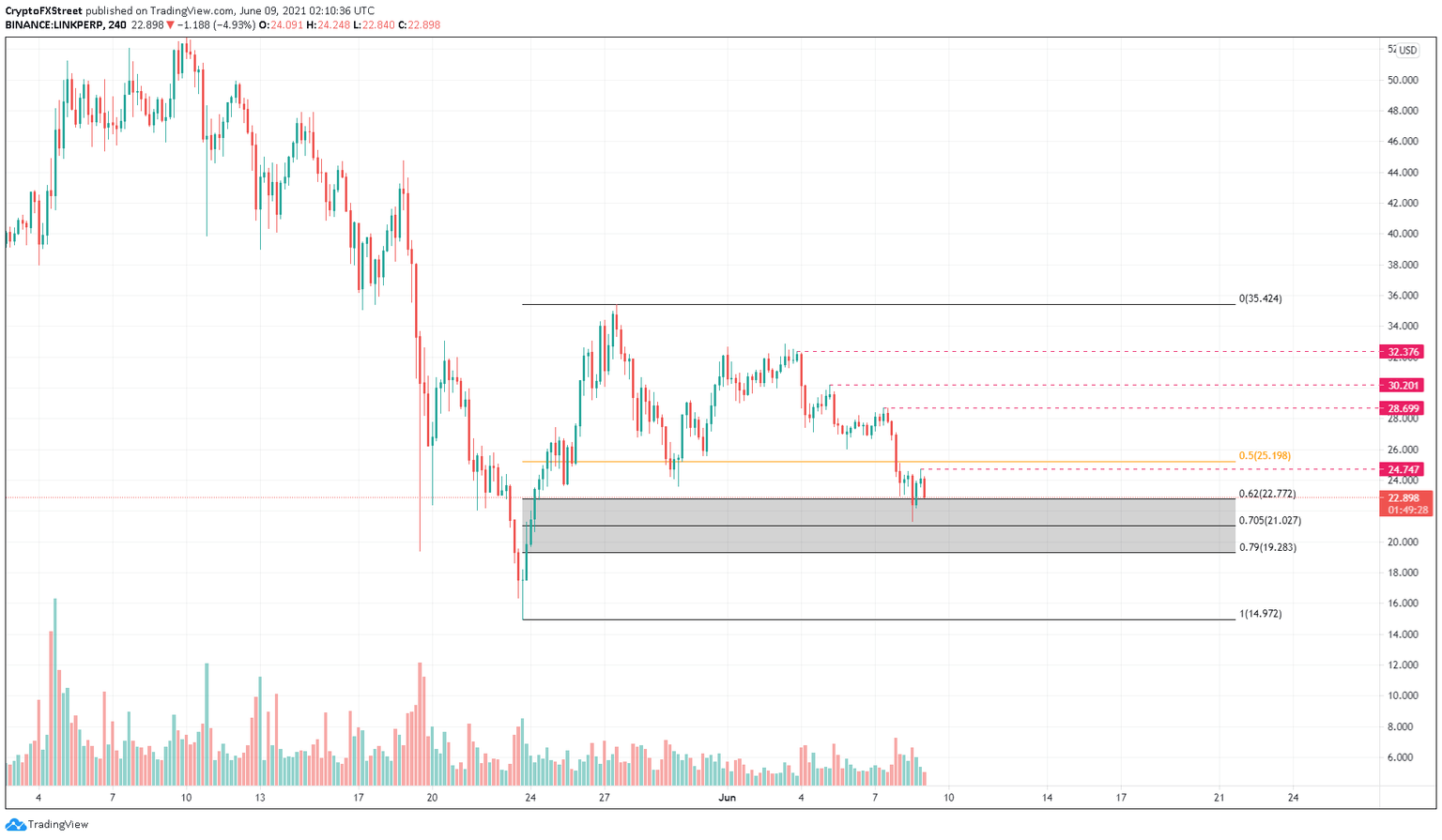

Chainlink price kick-started its uptrend after dipping briefly below 62% Fibonacci retracement level at $22.77. However, this rally seems premature as LINK retraces this move and hints at a retest of $22.77 or the 70.5% Fibonacci retracement level at $21.03.

The bullish outlook for Chainlink price is still intact, and investors can expect it to rally toward the first significant resistance level at $25.20, which coincides with the 50% Fibonacci retracement level.

Breaching this will confirm the resurgence of buyers and kick-start a bull rally that could propel LINK by 28% to $32.38. The resistance levels at $28.70 and $30.20 are critical as well; therefore, investors need to pay close attention to these.

In a highly bullish scenario, Chainlink price might retest the range high at $35.42.

LINK/USDT 4-hour chart

The upswing will trigger after a decisive close above the 50% Fibonacci retracement level at $25.20. However, failure to do so will result in a retracement that could start a new downswing.

A breakdown of the support level at $19.28 will signal weakened buyers, but a convincing close below $19.05 will signal the start of a descent that could push LINK to the range low at $14.97.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.