Chainlink develops a bear trap that could return LINK to $31

- Chainlink price forms a powerful bullish reversal pattern on its Point and Figure chart.

- LINK lags in performance against its peers.

- Downside risks remain but are limited in scope.

-637336005550289133_XtraLarge.jpg)

Chainlink price is having difficulty completing a weekly close above its open. Price action during the week has been very neutral to slightly bearish given the range traded above the open versus below. However, bullish pressure may return very soon.

Chainlink price eyes a strong reversal, creating a probable short squeeze

Chainlink price has undoubtedly been indecisive this week. Bulls have made several attempts to return towards the $20 value area but have been denied, facing intense selling pressure at the $18 level before returning to the weekly open at $16. However, the result of this price action has formed a powerful bull trap set up on the $1.00/3-box reversal Point and Figure chart.

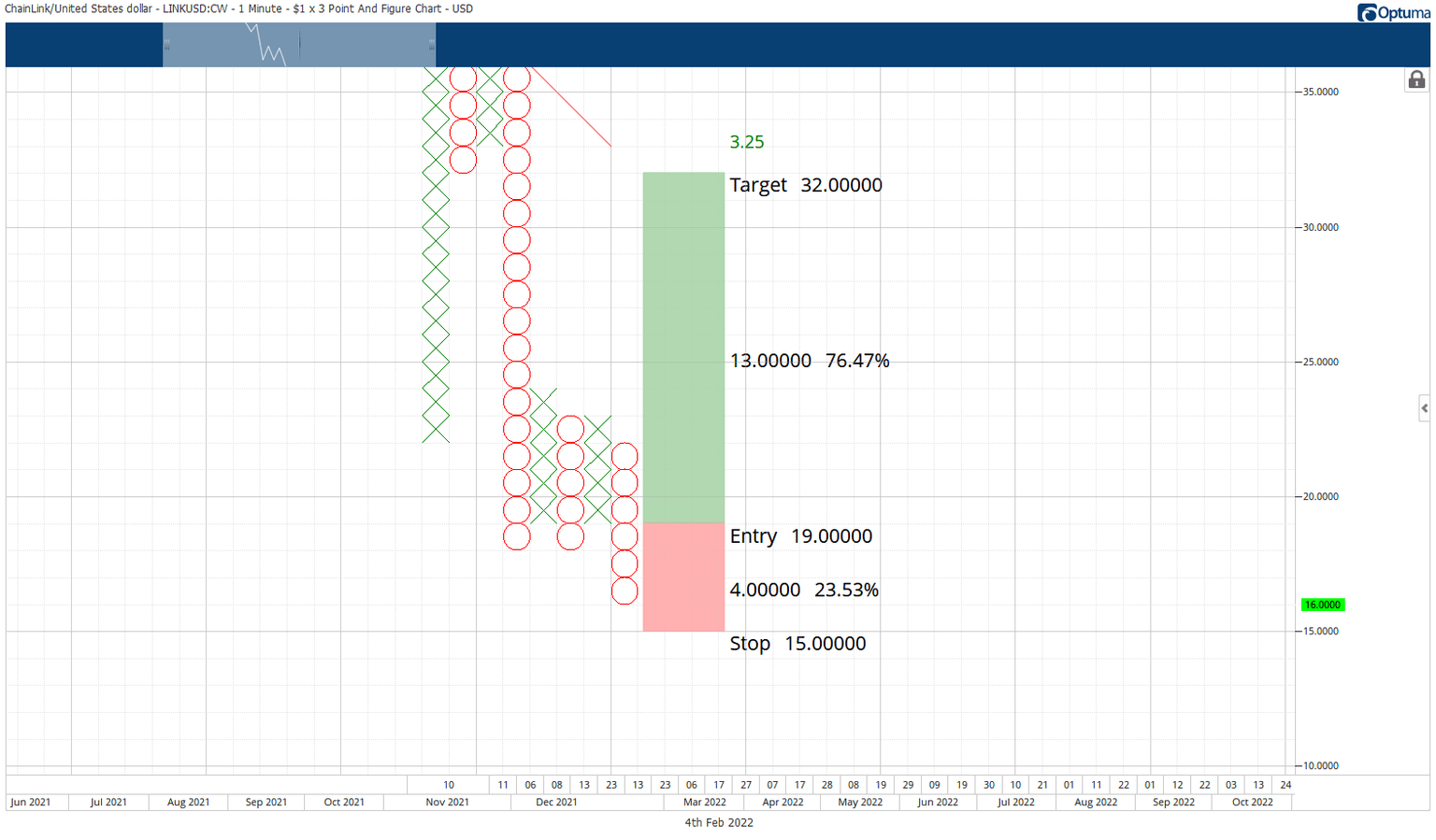

The theoretical long setup is a buy stop order at $19, a stop loss at $15, and a profit target at $31. The trade represents a 3.25:1 reward/risk with an implied profit target of 76% from the entry. A trailing stop two-box trailing stop would protect any profit made post entry.

LINK/USD $1.00/3-box Reversal Point and Figure Chart

The entry is based on a bullish reversal pattern known as a Bearish Fakeout (a type of bear trap). The Bearish Fakeout requires two Os below the multiple-bottom pattern. In addition, this pattern must have only two Os below the multiple-bottom. The entry is at the mid-point of the current O-column.

The theoretical long entry for Chainlink price is invalidated if the current O column moves to $15 before the buy stop is triggered. Downside risks are likely limited to the $12 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.