Chainlink, Chiliz, Optimism send mixed technical signals with US midterm elections underway

- Chainlink and Chiliz price ready to flip bullish in anticipation of the US midterm elections outcome.

- Optimism price snaps out of a V-shaped pattern, putting brakes on its recovery to $2.00.

- Republicans are keen on controlling the House of Representatives after the Democratic Party’s two-year stint.

- Inflation and economic uncertainties take center stage in the home stretch to the election results.

-637336005550289133_XtraLarge.jpg)

Chainlink price is playing hide and seek with volatility ahead of the United States midterm elections outcome. The cryptocurrency market is dotted red and green amid a widespread retracement that may have been triggered as Bitcoin price plunged 5.7% from its 24-hour high of $20,659.

The rampant overhead pressure did not spare crypto tokens like Chiliz and Optimism despite positive investor sentiment toward the midterm elections.

The crypto industry is closely watching the US midterm elections

The United States midterm elections get underway two years after the Democratic Party took over. Republicans are confident they will take control of the House of Representatives and, hopefully, the Senate. The Tuesday 8 elections will show if the public is satisfied with the performance of the governing party.

However, it is a tough call, especially with Joe Biden’s government facing uncertain economic conditions stemming from the effects of the COVID-19 pandemic and rising inflation – mainly caused by high gas prices.

The Federal Reserve has continually hiked interest rates month-over-month, citing the need to battle ballooning inflation levels. Although the economy appears weary of the hikes, the Fed still has approximately four months of subsequent raises before achieving its 2% inflation target.

Cryptos could experience more volatility

The US economy is far from stabilizing, especially with the Treasury’s short-term bond yields still rising. At the same time, the stock market continues to struggle, stifled by the lack of investor interest.

Global financial markets, including digital currencies like Chainlink, Chiliz and Optimism, will likely run into heightened volatility as investors follow the progress of the midterm elections on Tuesday night. Howard Greenberg from Proper Trading Academy believes that a win by the Republicans could be bullish for cryptocurrencies.

“Crypto traders might get taken on another roller-coaster ride this week as two big events could trigger a major move for markets. ... If the Democrats somehow keep both chambers, that should be bullish for the dollar and bad news for cryptos,” Greenberg told CoinDesk.

“If the Republicans win the House or both chambers, that should be positive for risky assets, especially cryptos,” he continued.

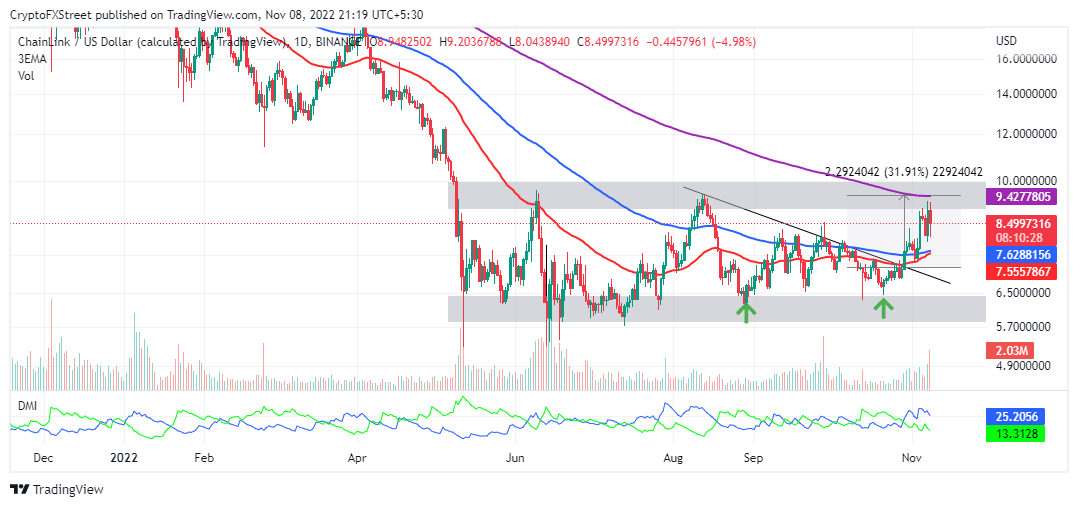

Chainlink price recovery hits a dead end

Chainlink price was among the bullish altcoins in the days leading to the US mid-term elections. A bullish breakout above a key falling trend line propelled LINK to $9.28, where it nearly hit a 32% target as analyzed last week.

LINKUSD daily chart

A break above the 200-day Exponential Moving Average (EMA) is necessary if LINK price is to carry on with the uptrend to $10.00 and even beyond. However, a retracement to $7.51 would provide investors with lower-priced entries as they await the outcome of the midterm elections.

Chiliz price faces a short-term pullback

Chiliz price is retesting support at $0.24 after it exhausted an anticipated V-shaped pattern rally from support established at $0.16. Since it is holding above the main moving averages, as illustrated in the chart below, buyers could still have an opportunity to arrest the declines before they continue unabated – to downstream levels at $0.20, $0.18 and $0.16, respectively.

CHZUSD daily chart

Optimism price back in the red

Increased selling volume appears to have curtailed a $2.10-bound move in Optimism price. Like CHZ, OP’s recovery was guided by a V-shaped pattern. Resistance at $1.40 allowed bears to sweep in, resulting in short-term declines to $1.20.

OPUSD daily chart

If Optimism price holds above the rising trend line, part of the V-shaped pattern, investors can expect a quick positive turnaround. Otherwise, OP could tag support at $0.90 and $0.75 before bulls consider another trend reversal.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren