Chainlink buy the dip opportunity ahead, LINK could retest $31

- Chainlink price lost nearly all of its 12% gains on Wednesday after a broader market sell-off occurred.

- Resistance for Chainlink was not a surprise.

- Chainlink could retest $31, granting a fantastic buy-the-dip opportunity.

-637336005550289133_XtraLarge.jpg)

Chainlink price action sent bulls and bears into a tails spin during the Wednesday trading session. After hitting new five-month highs, Chainlink gave up most of the double-digit percentage gains. The drop was a perfect combination of technicals leading fundamentals.

Chainlink price hammered south, as risk-on markets sell-off in response to Evergrande and inflation data

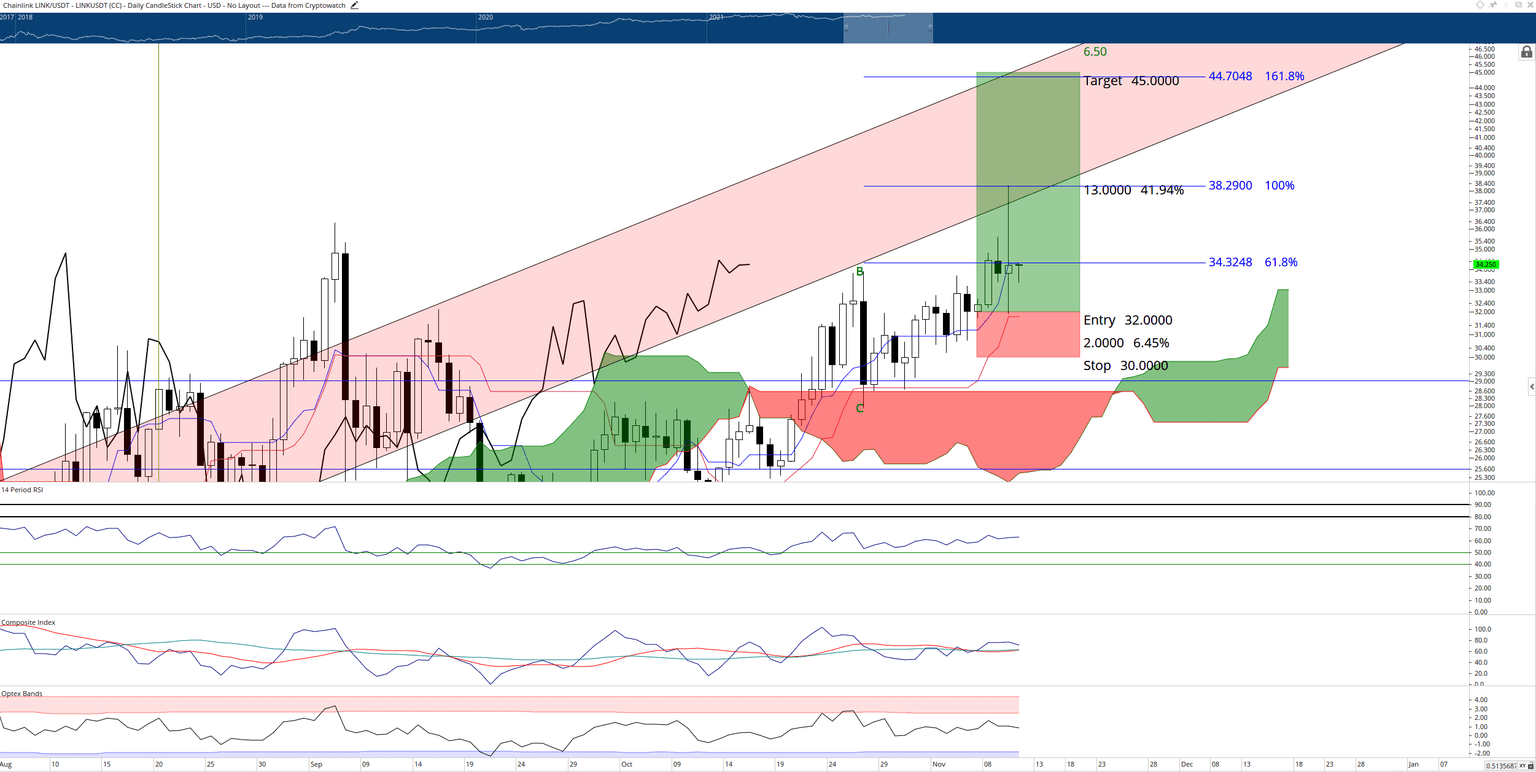

Chainlink price was perfectly positioned for Wednesday’s drop. The high of the day hit right on a confluence zone of resistance levels. The bottom of a primary bear flag channel from June has been the primary stopping point restricting most of Chainlink’s various attempts to make new all-time highs. At the same price level, the 100% Fibonacci expansion contributed to the resistance.

So when news came out regarding China’s Evergrande defaulting on some of its bonds, the selling of risk-on assets like cryptocurrencies happened quickly.

The oscillators on Chainlink’s daily Ichimoku chart show surprisingly neutral conditions. Because Chainlink price is currently trading below the Tenkan-Sen, the following primary support level is the Kijun-Sen at $31. A move to test the Kijun-Sen as support would position the Relative Strength Index on the first oversold level of 50. At the same time, the Optex Bands would be close to the lower extremes.

LINK/USDT Daily Ichimoku Chart

A hypothetical long entry for Chainlink price would be a buy limit order slightly above the Kijun-Sen at $32, with a stop loss at $30 and a profit target at $45. $45 is the top of the bear channel and the 161.8% Fibonacci expansion. A $0.25 trailing stop would help protect any implied profits on the long trade idea.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.