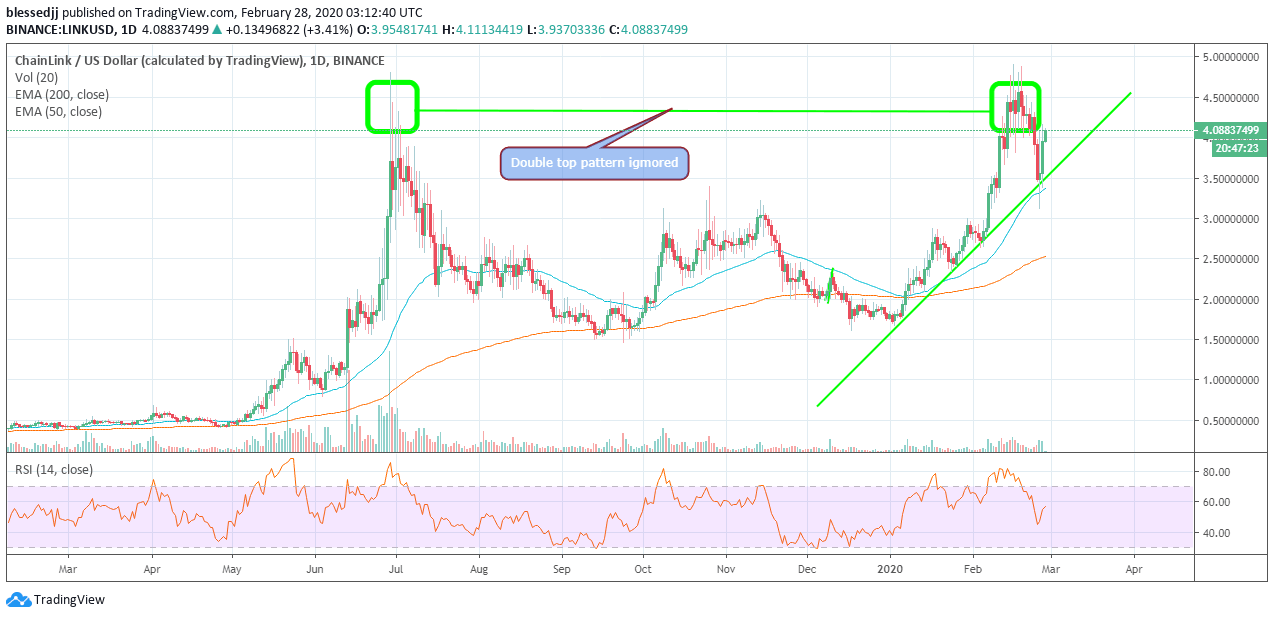

Chainlink 15% growth in a Bitcoin bear market ignores double-top pattern impact

- Chainlink recovers above $4.00 amid a building bullish momentum focused on $5.00.

- Ethereum Classic Labs partners with Chainlink to implement its oracle network, boosting the adoption of ETC.

Chainlink (LINK) and Tezos (XTZ) are arguably the best performing cryptocurrencies in the market this week. Unlike the losses recorded across the market led by the cryptos’ granddaddy, Bitcoin (BTC), LINK and XTZ quickly found support and reversed the trend upwards, sustaining formidable gains.

For instance, Chainlink's rejection from $4.90 (yearly high) failed to find support at $4.00. The crypto then explored the rabbit hole towards $3.00. However, buyers waiting to enter the market halted the freefall, allowing a reversal at $3.50. The bulls have since been in charge and LINK is now exchanging hands above $4.00 after soaring 15% higher in the last 24 hours.

Chainlink collaborates with Ethereum Classic Labs to achieve decentralized oracle integration

Ethereum Classic Labs is pushing hard towards the development and adoption of Ethereum Classic (ETC). For this reason, it recently entered into an agreement with Chainlink which will see it integrate Chainlink’s decentralized oracle network into ETC.

Ethereum Classic and Ethereum are closed network systems, in other words, they do not permit interaction with data from external sources. While this feature greatly increases security and stability it limits the network to internal processing and interaction with data. Therefore, the implementation of Chainlink’s oracle will reformat the external connection points to allow the external exchange of data.

Chainlink technical picture

LINK is trading at $4.08 amid a building bullish momentum. The recovery from the support at $3.50 cut short the impact of a double-top pattern. LINK/USD is focused on growth towards $5.00. The momentum is supported by the up-trending RSI. Support at $4.00 will go a long way in containing the gains made in the last 24 hours in addition to allowing the bulls to focus on higher levels. A reversal from current price level is likely to find support at $4.00, $3.50, the ascending trendline, the 50-day EMA and $3.00

LINK/USD daily chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren