BTC, ETH and altcoins spent most of May trading in the red. So, what’s behind XCN’s near-month-long 100%+ rally?

May was an incredibly challenging month for the cryptocurrency market as the majority of tokens booked heavy losses as a bear market was confirmed, but not every project dropped back to pre-bull market lows.

Chain (XCN), a protocol designed to help organizations launch their own blockchain network or connect with other more established networks, has managed to rally more than 120% since May 19.

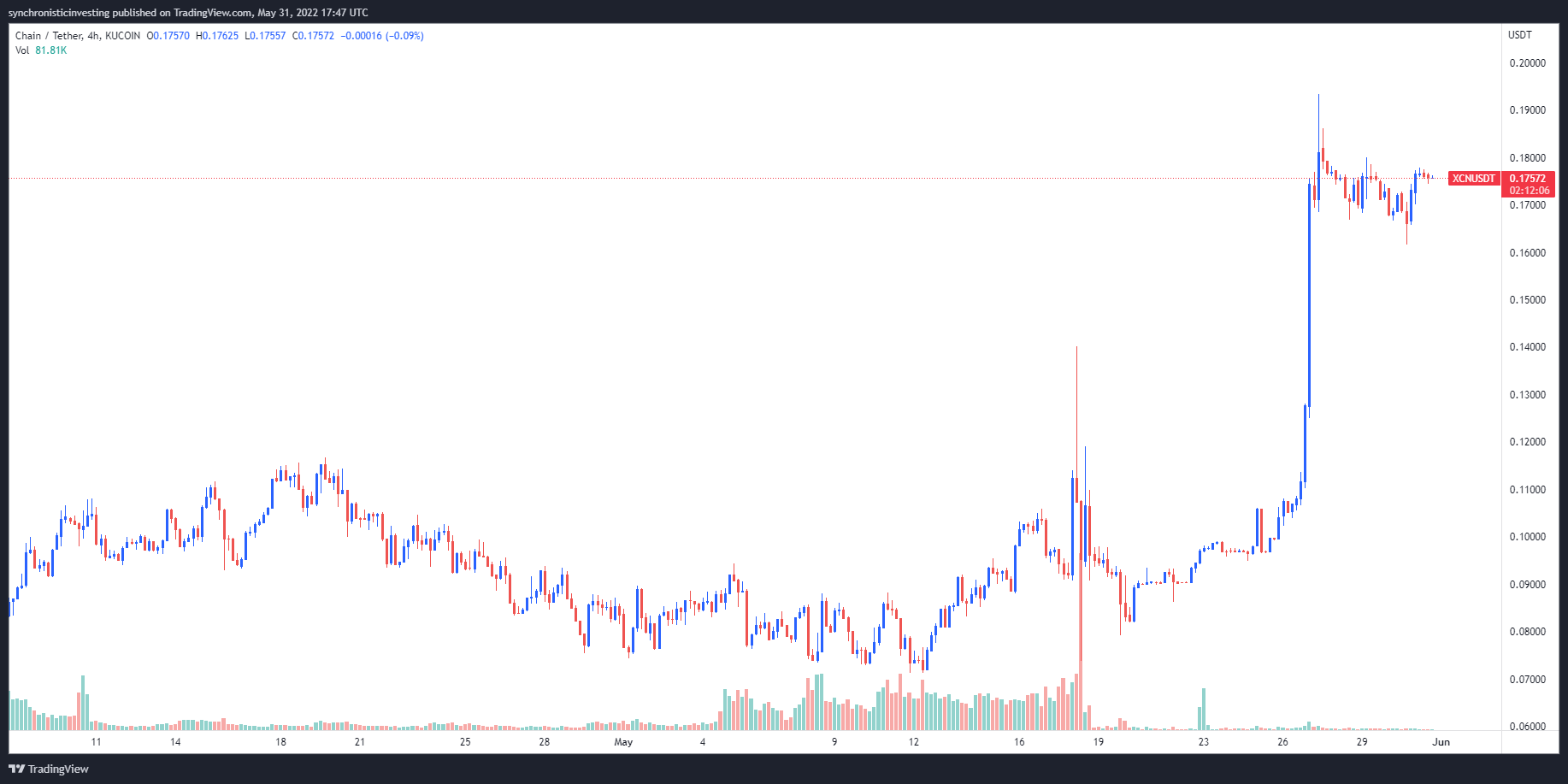

Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.0712 on May 11, XCN has reversed course to hit a record-high at $0.176 on May 31.

XCN/USDT 4-hour chart. Source: TradingView

The three reasons for the strong showing from XCN are multiple exchange listings, launching on BNB Chain and several notable partnerships, including a long-standing collaboration with the Stellar Foundation.

Exchange listings pump up the volume

In March 2022, Chain deployed a new smart contract for its token and rebranded from CHN to XCN. Following the rebrand, XCN listed on KuCoin and subsequent listings on Huobi, Gate.io, Bitrue and Hotbit were accompanied by sharp upticks in trading volume.

Several of the supporting exchanges have also launched perpetual contracts for the XCN token, including Gate.io, Huobi, Bybit and Poloniex, which has helped generate increased awareness for the project and initially led to a spike in trading volume.

XCN is also part of a cross-chain integration with BNB Chain, which enables inexpensive token transfers and trading on PancakeSwap, where holders can earn yield for providing liquidity to the exchange.

Following the integration with BNB Chain, the price of XCN rallied from $0.0712 on May 11 to $0.14 over the next week.

Notable partnerships

Since 2014, Chain has had several notable partnerships and funding rounds, including an initial fundraise of over $40 million from Khosla Ventures, Pantera Capital, Capital One, Citigroup, Fiserv, Nasdaq, Orange and Visa.

In 2018, the project was acquired and became part of the commercial arm of the Stellar Foundation known as Interstellar. Chain was reacquired in 2020 as part of a ledger-as-a-service platform called Sequence.

It’s possible the recent developments with the Stellar protocol, including its partnership with MoneyGram to create a stablecoin-based platform for money transfers, could have positive effects on the price of XCN due to their close ties.

In April 2022, Chain also announced a strategic partnership with Alameda Research, which established the private equity and quantitative cryptocurrency trading firm as Chain’s primary market maker. While none of these partnerships appears significant enough to explain XCN’s current gains, it is notable that the altcoin’s price action has diverged from the wider crypto market for nearly an entire month.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC bloodbath continues, near 30% down from its ATH

Bitcoin price extends its decline and trades below $80,000 at the time of writing on Friday, falling over 15% so far this week. This price correction wiped $660 billion of market capitalization from the overall crypto market and saw $3.68 billion in total liquidations this week.

Cardano poised for double-digit drop amid market weakness

Cardano price is extending its decline by nearly 7%, trading around $0.60 on Friday after falling 23% this week. Santiment data support this decline as ADA daily active addresses are falling, and the technical outlook indicates a continued correction, with ADA potentially facing an additional double-digit decline.

XRP short-term holders dominate sell-off as whales buy the dip

XRP short-term holders dominated the selling activity during the recent market crash. XRP whales have been accumulating more tokens during the crash, adding over $1 billion worth of tokens. XRP could bounce off the lower boundary of a descending channel if it fails to hold the $1.96 support level.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP continue to sell off

Bitcoin (BTC) price continues declining on Friday after falling more than 15% this week. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and declined by nearly 24% and 21%, respectively.

Bitcoin: BTC bloodbath continues, near 30% down from its ATH

Bitcoin (BTC) price extends its decline and trades below $80,000 at the time of writing on Friday, falling over 15% so far this week. This price correction wiped $660 billion of market capitalization from the overall crypto market and saw $3.68 billion in total liquidations this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.