CFD on Ethereum futures technical analysis – Will the ETH/USD quotes continue to rise?

CFD on Ethereum futures technical analysis summary

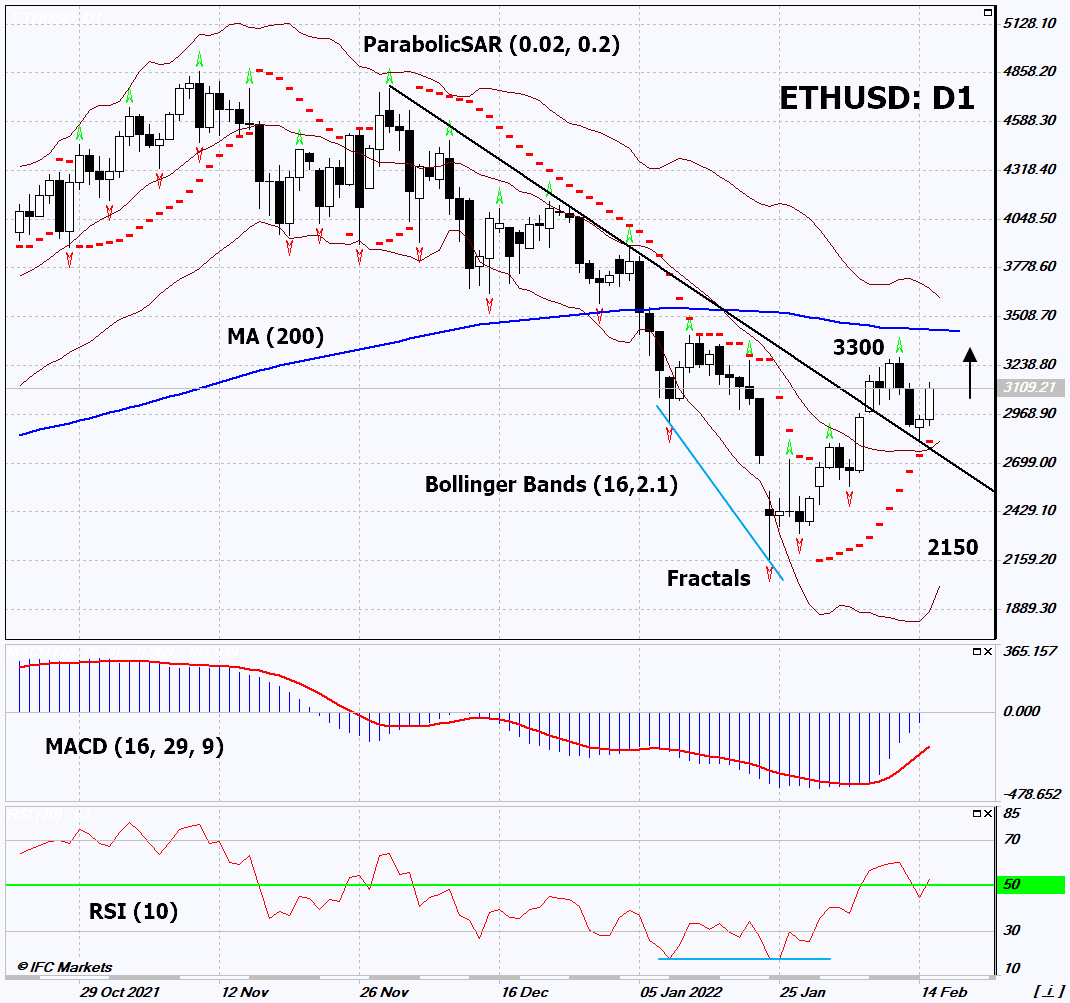

Buy Stop։ Above 3300.

Stop Loss: Below 2150.

| Indicator | Signal |

| RSI | Buy |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

CFD on Ethereum futures chart analysis

On the daily timeframe, ETHUSD: D1 has overcome the downtrend resistance line. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish movement if ETHUSD rises above the latest up fractal: 3300. This level can be used as an entry point. The initial risk limit is possible below the low since July 2021, the last 3 lower fractals and the Parabolic signal: 2150. After opening a pending order, we move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most cautious traders after making a trade can switch to a four-hour chart and set a stop loss, moving it in the direction of movement. If the price overcomes the stop level (2150) without activating the order (3300), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental analysis of crypto - CFD on Ethereum futures

Berkshire Hathaway has increased investment in a bank that works with cryptocurrencies. Will the ETHUSD quotes continue to rise?

American investment company Berkshire Hathaway, owned by well-known billionaire Warren Buffett, has acquired $1 billion worth of Brazilian Nubank shares. It is the world's largest online bank that also deals with cryptocurrencies using its Easynvest trading platform. Crypto market participants hope that, following Berkshire Hathaway, other conservative investors may become interested in cryptocurrency assets. Recall that earlier Warren Buffett was skeptical about bitcoin and described it as "rat poison squared" (rat poison squared). However, the credibility of cryptocurrencies is growing. In particular, the Mastercard payment system has entered into an agreement with Coinbase to facilitate nonfungible token (NFT) transactions. The quotes of cryptocurrencies and Ethereum may be affected by the draft law on the regulation of mining and the crypto market in Russia. It will be presented by the Russian Central Bank and the Ministry of Finance to the Russian government on February 18.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

Author

Dmitry Lukashov

IFC Markets

Dimtry Lukashov is the senior analyst of IFC Markets. He started his professional career in the financial market as a trader interested in stocks and obligations.