- ARK Investment Management’s strategists stuck with their notion of Bitcoin being a long-term opportunity.

- In order for Bitcoin price to touch $1 million by the decade's end, the king coin would need to rise by more than 4,200%.

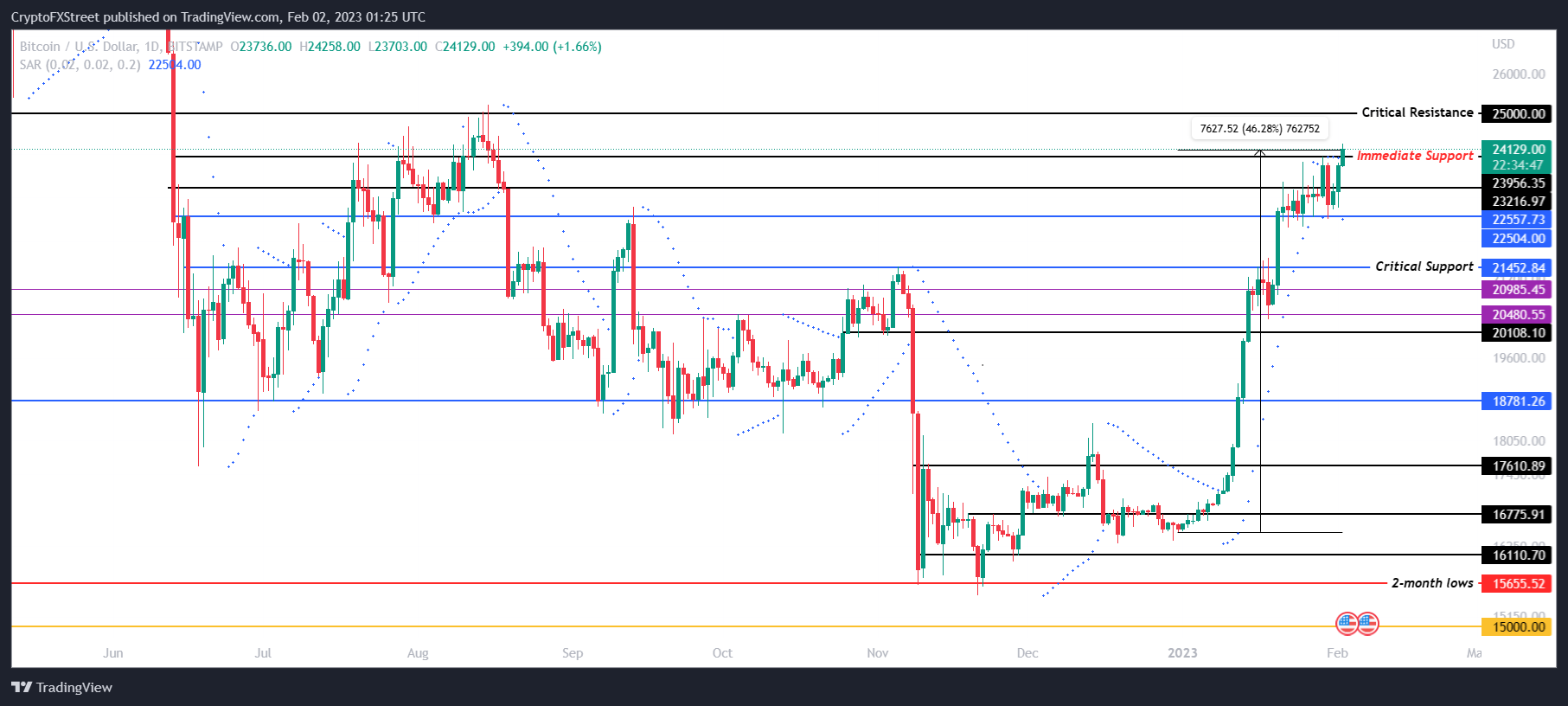

- Bitcoin price is fluctuating around the $24,000 mark, which also represents a critical support level, reclaiming which will strengthen BTC’s presence near $25,000.

Bitcoin, the leader of the crypto market, has had a fairly turbulent year in 2022, but starting this year, the cryptocurrency has proved to be far better. This has imbued confidence in BTC investors and traders, which could, in return, increase interest in the asset, leading to an increase in price and profits, essentially proving ARK Investment Management is likely.

Cathie Wood’s ARK Investment believes in Bitcoin

Cathie Wood’s investment management company ARK Investment’s strategist team is one of the most optimistic bunch of people in the world at the moment. Despite Bitcoin slipping from its highs of $67,000 in November 2021 to trade at $24,000 at the time of writing, ARK Investment remains confident.

This has led the team led by Yassine Elmandjra to reaffirm their faith in the future value of the king coin. Publishing in the company’s annual “Big Ideas” paper on Monday, the strategists' team stated,

“Bitcoin’s long-term opportunity is strengthening. Despite a turbulent year, Bitcoin has not skipped a beat. Its network fundamentals have strengthened and its holder base has become more long-term focused.”

ARK Investment is hung on the belief that Bitcoin price by the end of 2030 would reach $1.48 million, and in the worst case, the bearish outlook places BTC at $258,500. While the former is a 6066% increase from the current price of $24,000, the latter would also need BTC to note a 977% rally in the next seven years.

The company’s Innovation ETF - ARKK is also following the king coin’s cue as the exchange-traded fund rallied by nearly 39% in the span of a month. Recording one of the best months since its inception, ARKK’s premium to Net Asset Value (NAV) since its inception lies at 6.84%.

Bitcoin price rally continues

Bitcoin price has been hovering around the $24,000 mark over the last few hours as the king coin noted a 46.28% rally in the month of January 2023. The cryptocurrency is well on its way to tagging the next critical resistance at $25,000, provided it can maintain its current heading.

The Parabolic Stop and Reverse (SAR) indicator is highly suggestive of consistent green candles, which is essential for a rise. The presence of the blue dots of the indicator below the candlesticks highlights an uptrend.

If this uptrend persists, the immediate support level at $23,956 will be strengthened into a support floor. This would enable BTC to breach the critical resistance at the $25,000 mark and initiate a recovery rally.

BTC/USD 1-day chart

However, if the bullish narrative fails and the king coin loses its ground, it would slip to $23,216. Bitcoin price would have the opportunity to bounce off the support level at $22,557 before hitting the critical support at $21,452. A daily candlestick close below this level would invalidate the bullish thesis, pushing the price below $21,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin falls below $94,000 as over $568 million outflows from ETFs

Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot ETFs recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand.

Altcoins Tron and Toncoin Price Prediction: TRX and TON show signs of weakness

Tron and Toncoin prices extend the decline on Thursday after falling more than 6% this week. TRX and TON face rejection from key levels, suggesting double-digit cash ahead. Traders should be cautious as both altcoins show signs of weakness in momentum indicators.

BNB Price Forecast: Poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) show bearish signals.

Ripple's XRP eyes recovery following executives' dinner with Donald Trump

Ripple's XRP is up 2% on Wednesday following positive sentiments surrounding its CEO Brad Garlinghouse's recent dinner with incoming US President Donald Trump. If the recent recovery sentiment prevails, XRP could stage a breakout above the upper boundary line of a bullish pennant pattern.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.