Cardano’s ADA jumps amid recovery in major cryptos, traders still remain cautious

Terra’s LUNA and Cardano’s ADA tokens surged as much as 16% in the past 24 hours to lead gains in major cryptocurrencies on Wednesday.

LUNA’s 16% jump was buoyed as Singapore-based Luna Foundation Guard (LFG), a nonprofit organization supporting the growth of the Terra ecosystem, said it raised $1 billion through the sale of LUNA to several influential crypto funds and investors.

The funding round, among the largest raises to date in crypto circles, will go toward building a bitcoin-denominated foreign-exchange reserve for UST, an algorithmic-based stablecoin in the Terra ecosystem.

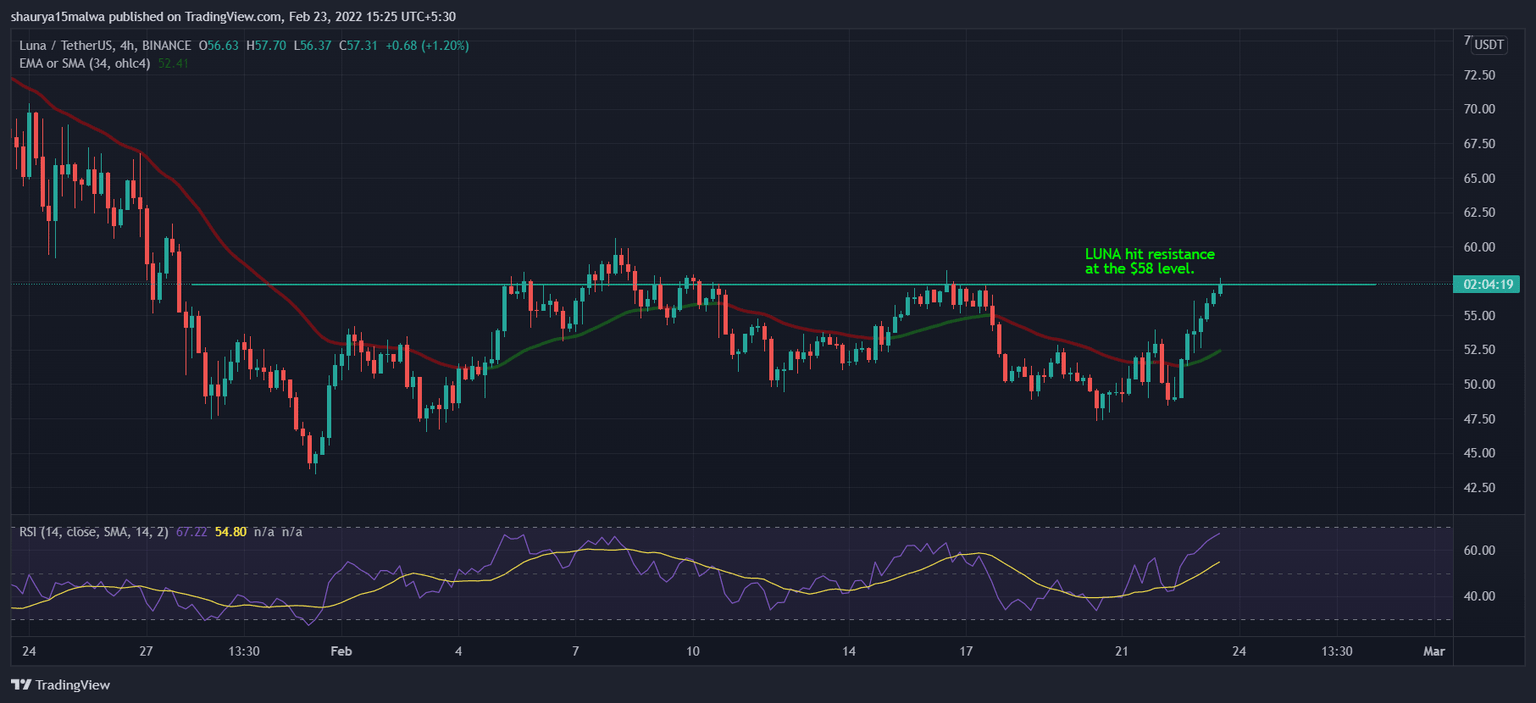

LUNA hit resistance at the $58 level following Tuesday’s rise. Prices could move to the $60 level if they hold above $58, but rejection could mean a move back to the $48 level from last week.

LUNA hit resistance at $58. (TradingView)

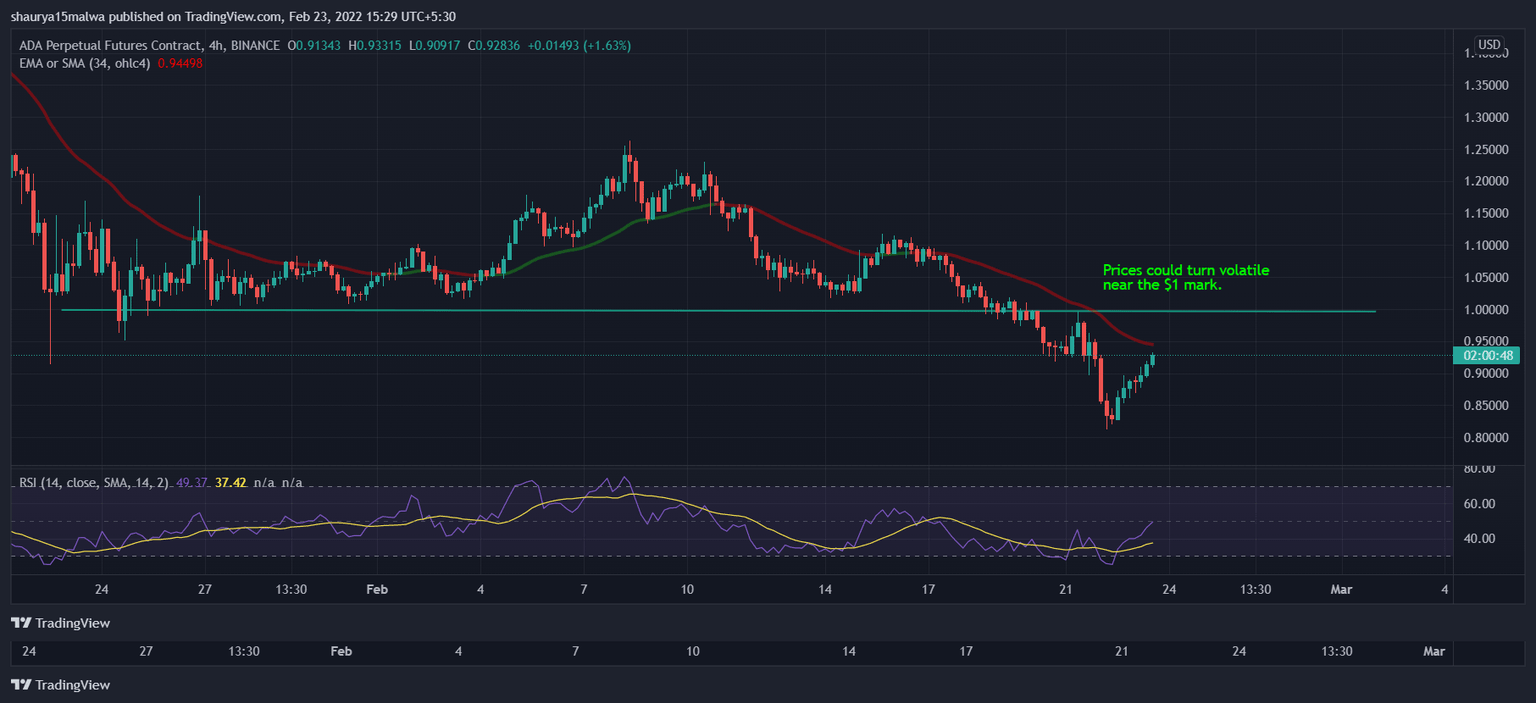

ADA recovered the $0.90 level on Wednesday morning after a sell-off to the $0.81 level over the weekend. No immediate resistance exists at current levels, suggesting prices could move to the $1 level if current buying activity continues. ADA broke below the $1 support last week, a level it held during the final weeks of January.

ADA could run to the $1 mark. (TradingView)

Cryptos up as global markets rebound

The recovery came after a sell-off in risk assets over the past week due to the ongoing Russia-Ukraine conflict. Bitcoin fell 12% to nearly $36,600, a level previously seen in mid-2021. Prices of ADA dropped 16%, with ether, Avalanche's AVAX and Polkadot's DOT falling 14%.

Crypto market capitalization dropped from $2 trillion to as low as $1.7 trillion in the past week as global markets reacted to the macroeconomic effects of Russia-Ukraine tensions, inflation, and hawkish U.S. Federal Reserve policies. The S&P 500 fell for two days since the start of this week, and is now down more than 10% from lifetime highs at the start of 2022.

On Tuesday night, the U.S. imposed sanctions on Russia. President Joe Biden said the country has “cut off Russia's government from Western financing” and threatened tougher steps if Russia "continues its aggression."

Asian and European market futures rose on Wednesday after the sanction announcement. The MSCI Asia Pacific Index rose 0.3% while Stoxx Europe 600 rose 0.8%. Futures on U.S. technology firms tracker Nasdaq 100 rose 1.1%.

A marginal recovery in stocks converted to big moves in crypto in the past 24 hours. Bitcoin rose 4.6%, ether rose 6.8%, while Solana’s SOL and XRP increased 7% each. Total market capitalization rose by 5.8% to $1.85 trillion.

Market watchers remain cautious

Despite Wednesday’s jump, some crypto market professionals said current macroeconomic sentiment was not conducive to sustaining upward movements.

"The current environment mixing uncertainty around inflation, interest rates, and geopolitical risks, is likely to continue to impact crypto markets,” said Jordi Muñoz, CEO of PotionLabs, in an email to CoinDesk.

"We expect the turbulence in markets to continue while the geo-political, interest rates, and inflation risks fully play out. This may continue to impact crypto markets, but we remain bullish over the long-term value of crypto markets,” Muñoz added.

Alex Kuptsikevich, a senior financial analyst at FxPro, echoed the sentiment. “So far, the rebound of risky assets, which includes cryptocurrencies, can be considered as a movement within a downtrend,” he said in an email to CoinDesk.

“Bitcoin has been trying to correct from levels close to the lows of February, but this is probably not the bottom yet. Expectations of a rate hike by the US Federal Reserve and rising geopolitical tensions are putting pressure on all risky assets,” Kuptsikevich added.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.