Cardano whale activity signals this move in ADA price

- Cardano witnessed a massive uptick in whale activity, with a large volume of whale transactions, hitting a seven-day high.

- ADA price is currently in an uptrend and yielded 5% gains for holders overnight.

- Experts believe that whale activity when combined with an uptrend in price is bullish for Cardano.

Cardano, popular as an Ethereum-killer and alternative, witnessed a spike in activity of large wallet investors on its blockchain. While whale activity is typically associated with a pullback or correction, the recent uptrend in ADA signals this could be a catalyst for the altcoin’s price.

Also read: Shiba Inu scaling solution Shibarium hits key milestone, SHIB price eyes recovery

Cardano whale activity climbs, what this means for ADA

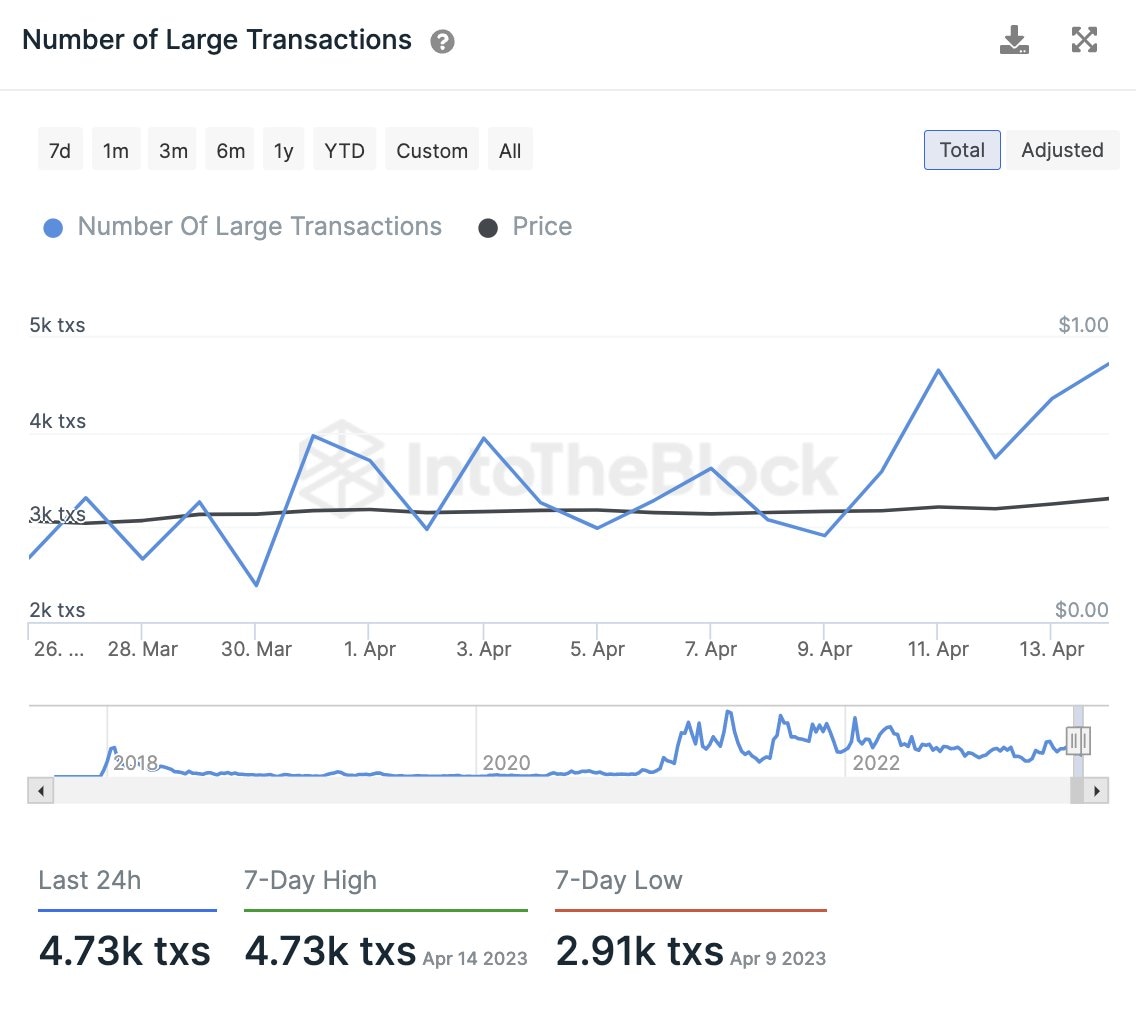

Experts have noted a spike in large volume transactions on the Cardano blockchain, based on data from crypto intelligence tracker IntoTheBlock. According to data from the firm, large volume transactions hit a seven-day peak of 4,730 in the past 24 hours.

Large volume transactions on the Cardano blockchain

While typically, experts associate whale activity and transactions with a pullback or correction in an asset, when accompanied by a rally in the asset’s price, it can act as a bullish catalyst. The surge in activity is associated with whales, institutional investors and large volume players tapping into the bullish potential of the Ethereum-killer token.

Interestingly, whale accumulation is another metric that supports the bullish thesis for Cardano price. Over the past 30 days, whales holding between 1 million and 10 million ADA, scooped up 150 million more Cardano tokens, adding them to their portfolio.

Accumulation by whales is a bullish sign for an asset, and it signals large wallet investors’ confidence in the asset.

Cardano price is in uptrend, what’s next

The Ethereum-killer altcoin is currently in an uptrend, yielding nearly 20% gains for holders over the past week. Analysts predict a continuation of ADA price rally, with the support of the bullish on-chain metrics.

Experts have predicted a 44% breakout in Cardano price, identifying an inverse head-and-shoulders pattern in the ADA price chart. The pattern is considered one of the most reliable technical indicators that predicts a bearish to bullish trend reversal in an asset.

As seen in the price chart below, the technical analyst behind the handle ali_charts has identified the head at $0.2410 and the shoulders (right) at $0.29, the left at nearly $0.31. The neckline at $0.41 acts as a resistance that the altcoin needs to tackle, to witness a 44% upswing to its bullish target of $0.61.

ADA/USDT 1D price chart

Cardano’s recent uptrend has garnered strength from whale activity and accumulation by large wallet investors. A sustained uptrend could push the altcoin to its target at $0.61. A drop below the shoulder level, at $0.31 could invalidate the bullish thesis of the expert.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.