- Cardano price is still at extremely bearish levels, but some relief may be coming due to recent updates in the Russian invasion of Ukraine.

- The bounce may be temporary as broader concerns and uncertainty persists.

- Downside risks remain despite the recent jump.

Cardano price saw some bullish price action return during the latter half of the trading day. News regarding Ukraine's new stance on NATO flipped markets on their heals worldwide, turning equity markets bullish and commodity markets reversing most of the daily gains. How long this change will last remains to be seen.

Cardano price action sees some relief, but the overall structure remains exceptionally bearish

Cardano price had a strong intraday spike during Tuesday's session. Ukraine President Zelinsky announced that Ukraine might no longer seek NATO membership during a live press conference. Russia's Putin had previously announced that Ukraine abstaining from joining NATO was one requirement for their invasion of Ukraine to end.

Upon release of President Zelinksy's comments, equity markets turned positive, with the NASDAQ moving up 2%, WTI dropped from 6% to 2%, Cardano hit a high of 3.4%, and Bitcoin up 3.6%. Prices have since cooled a little, but Cardano price and the wider cryptocurrency market remain green.

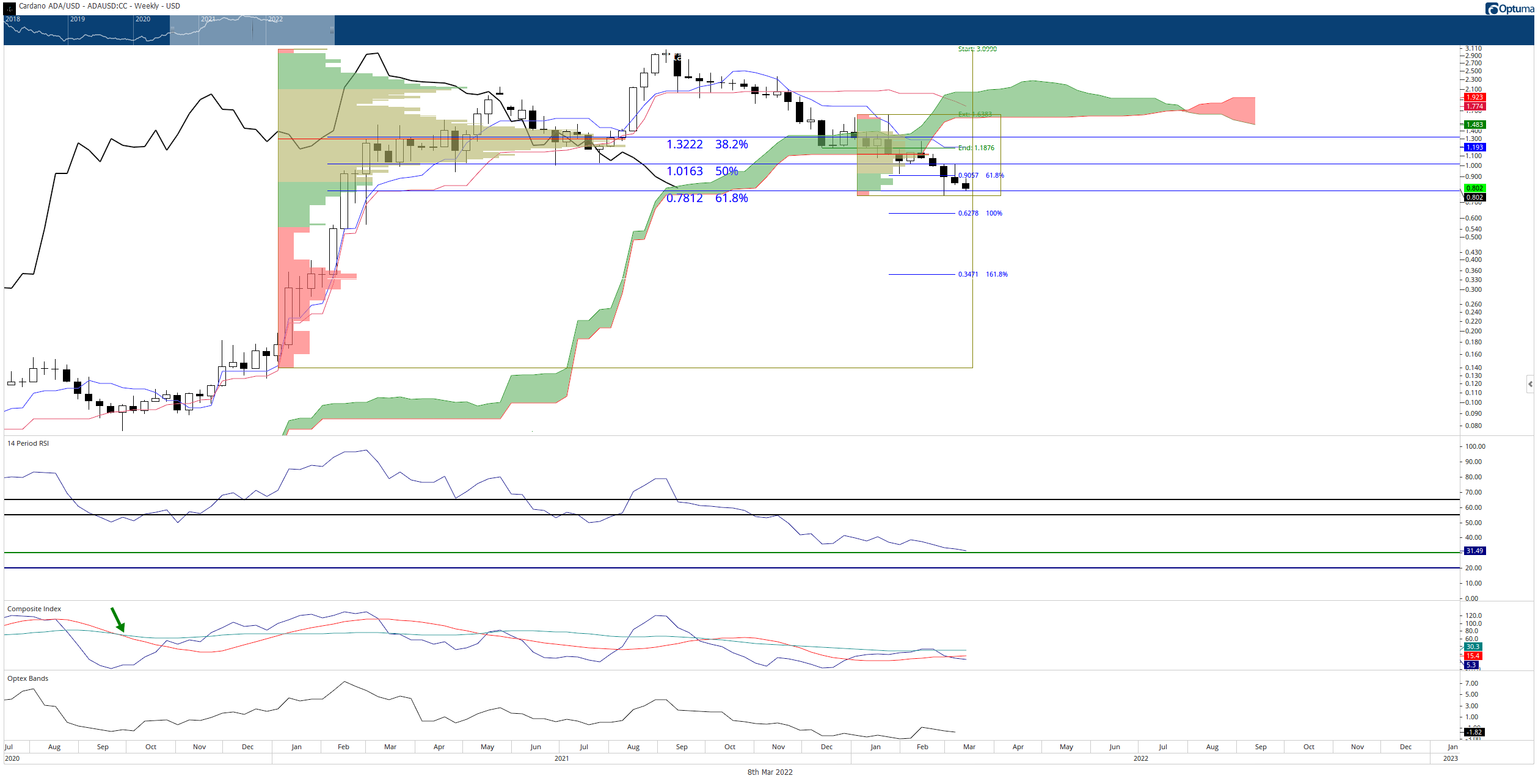

However, Cardano price remains in very bearish conditions. It is trading just below a major capitulation level that could generate a major crash towards the $0.34 value area. Furthermore, the Volume Profile becomes nearly non-existent between $0.79 and $0.35, warning of tremendous crash very soon if bulls fail to support ADA.

Near-term support for Cardano price is the 61.8% Fibonacci retracement at $0.78. Additionally, the Chikou Span is also reacting to the top of the Ichimoku Cloud as a support zone.

ADA/USD Weekly Ichimoku Kinko Hyo Chart

The weekly oscillators provide some early indications that a bullish bounce may soon occur. For example, the Relative Strength Index is just above the first oversold level in a bear market at 30 and has held it as support. Additionally, the RSI is currently trading at the lowest levels since March 2019. Similarly, the Composite Index is near historic lows and has formed a regular bullish divergence, giving another positive signal that a turnaround for Cardano price may be imminent.

If bulls wish to invalidate any near-term bearish projections of a price collapse in the $0.35 value area, then Cardano price must maintain a daily close above $0.79.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto Today: ETH and Bitcoin stabilize as market digest Trump’s 25% auto tariff

Cryptocurrencies market capitalization surges by $14 billion on Thursday, hitting the $2.83 trillion mark. Bitcoin ETFs brought in another $89.6 million, reaching nine successive days of net inflows, according to Farside data.

Crypto Morning: BlackRock spends $107 million on Bitcoin, stablecoin launches, Shiba Inu boss still offline

BlackRock, a giant with $11.5 trillion in assets under management, spent $107.9 million to fund its BTC purchase on Wednesday. The move is consistent with demand for BTC among institutional investors.

Bitcoin range-bound as momentum indicator shows trader indecisiveness

Bitcoin price hovers around $87,000 on Thursday, as RSI indicator suggests indecisiveness among traders. Glassnode reports that BTC trades in a range-bound market, as on-chain profit-and-loss-taking events are declining in magnitude.

Curve DAO rallies as developer activity hits new ATH

Curve DAO price extends its gains by 8% and trades above $0.58 at the time of writing on Thursday, rallying over 15% so far this week. DefiLlama data shows that the CRV’s developer commits hit a new all-time high (ATH), surpassing 900 commits per month.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.