Cardano teeters towards $1.50 as buyers avoid ADA

- Cardano price continues to depreciate against its peers, finding little reprieve.

- Dismal trading conditions likely to persist.

- Cardano is on track to close its tenth consecutive weekly close below its weekly open.

Cardano price has been a leader of the top market cap cryptocurrencies in one variable and one variable alone: length of consecutive weekly losses. Despite prime conditions for capitalizing on primary oversold levels, buyers stay away from Cardano.

Cardano price fails to entice even speculative long traders despite strong oversold readings

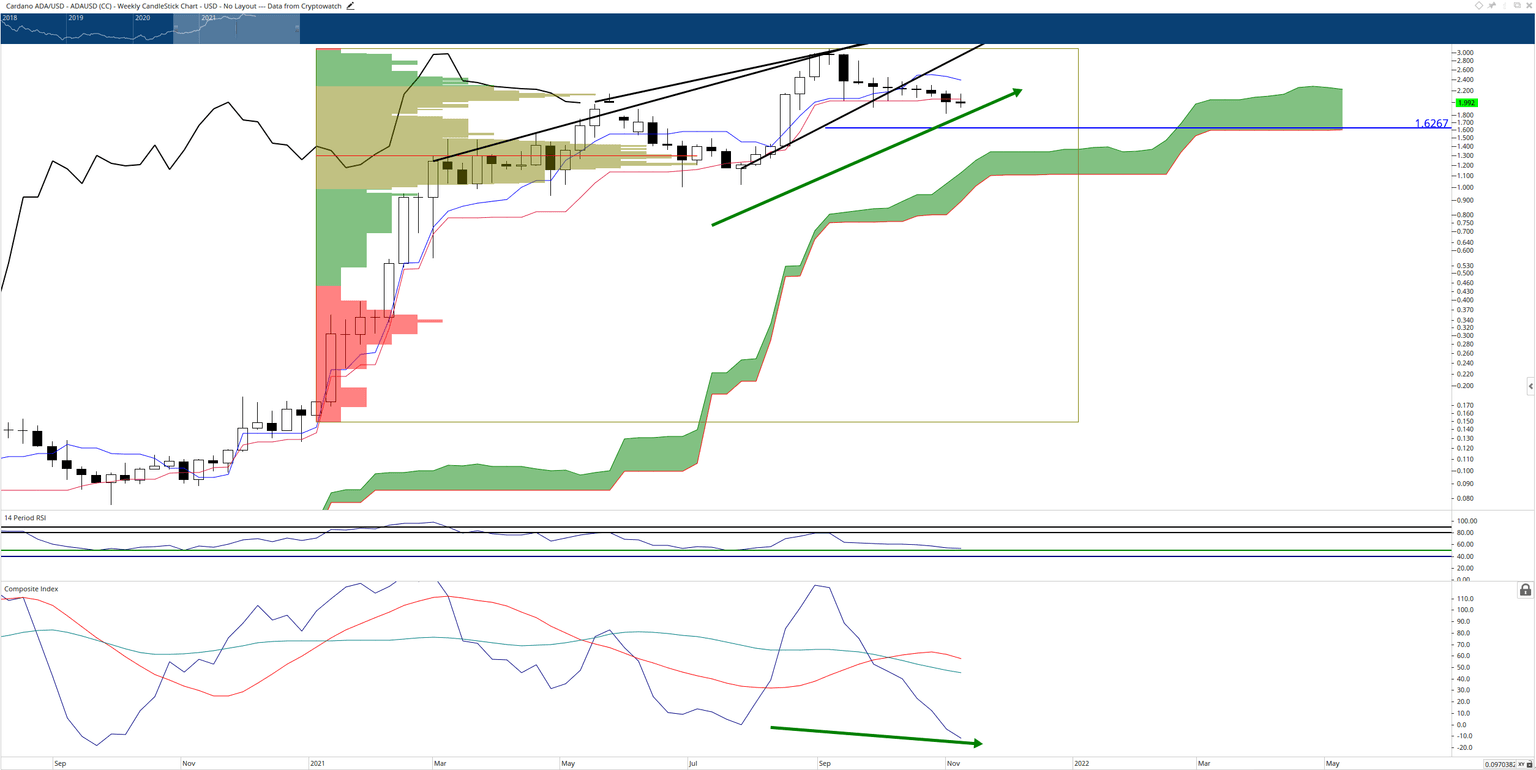

Cardano price action is very interesting from a technical analysis perspective. One of the most peculiar behaviors that Cardano has exhibited is the nature of its Optex Bands. Cardano is singular amongst its peers and the cryptocurrency space for how long it has spent trading at extreme lows in the Optex Bands. When cryptocurrencies enter the extreme oversold levels in the Optex Bands, they nearly always bounce out of that zone. Cardano is the opposite – it’s stuck at the extreme lows and has been for almost two months.

Another significant oversold level for Cardano price is the Composite Index reading on the weekly chart. The current Composite Index value of -11.2 is the second-lowest reading on Cardano’s weekly chart in its entire history! However, the hidden bullish divergence is very interesting with the Composite Index value and the candlestick chart. Hidden bullish divergence occurs when an oscillator prints a lower low and the candlestick chart prints a higher low – it’s a warning that a continuation of the prior uptrend is imminent.

ADA/USD Weekly Ichimoku Chart

Failure to hold $1.90 as support would likely invalidate any anticipated upside potential. In that event, the $1.50 level is the next likely support zone.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.