Cardano sits on strong fundamentals that are not priced in yet

- Cardano price is hovering above an ascending parallel channel’s upper trend line, indicating a potential retest.

- ADA and RSI have formed bearish divergence on a weekly chart, adding credence to the short-term correction.

- Transaction data shows that any upswing will face gigantic resistance up to $2.76.

Cardano price has been on an exponential run in 2021, which seems to have exhausted its momentum. After the second swing high on August 30, ADA is now undergoing a full-blown retracement. While this correction started roughly a month ago, more seems to be on its way for the so-called “Ethereum-killer.”

Cardano technicals turn bearish

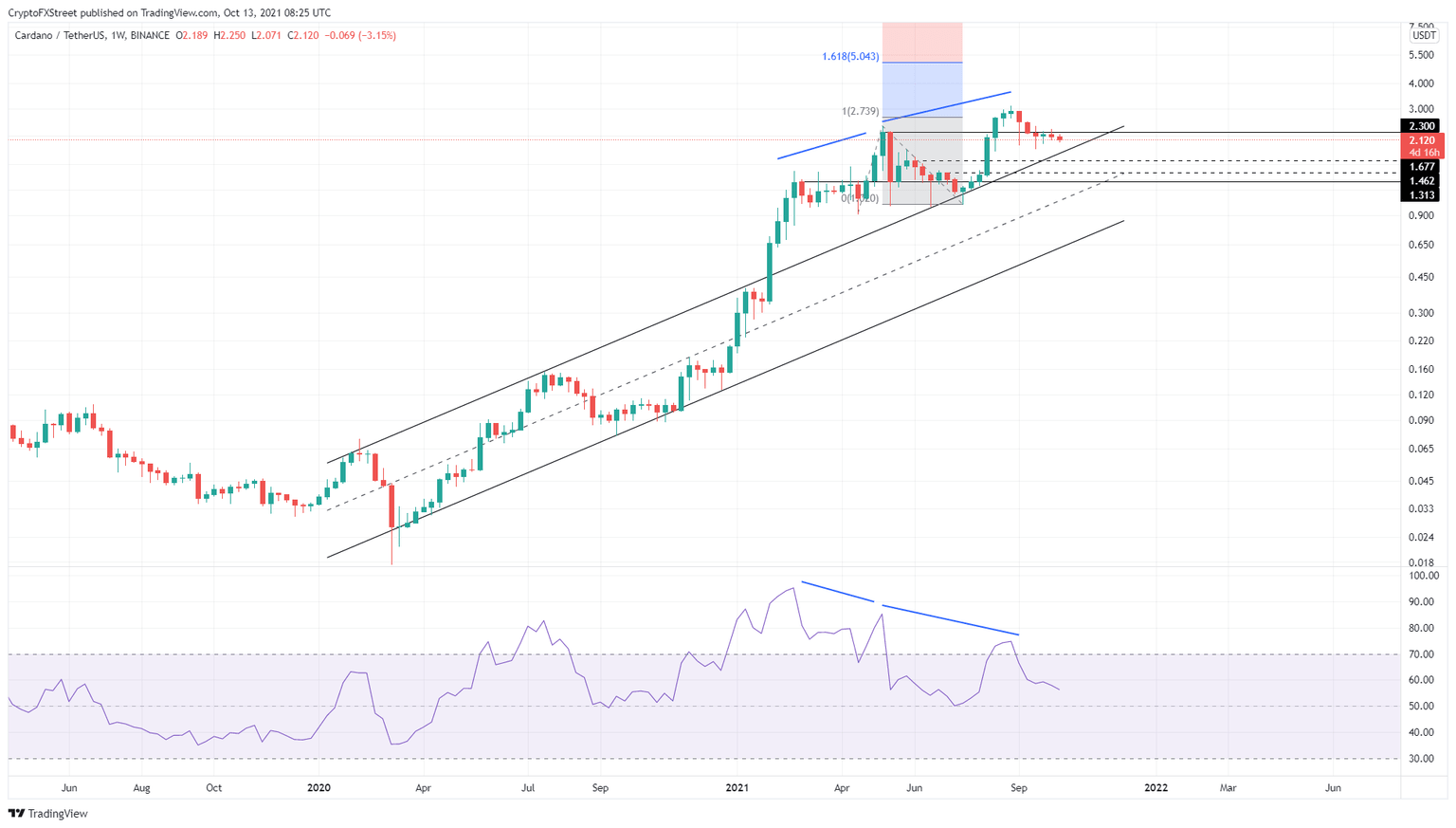

Cardano price created three higher highs and two higher lows on a weekly chart starting in early February 2020. Connecting these swing points showed the formation of an ascending parallel channel.

While Cardano price broke out of this pattern on February 1, 2020, things escalated quickly, pushing ADA from $0.33 to $2.47, a 643% ascent in roughly three months. This exponential upswing faced exhaustion, resulting in a 60% descent.

After this point, Cardano price failed to gather steam, which led to a sideways movement for roughly two months. This coiling up was followed by another leg up that produced a swing high at $3.10, much higher than the previous one.

The implication of the second local top is profound since the RSI set up lower highs during the same period. This forking between the price, which formed higher highs, while the indicator reveals a lower high indicates the formation of a bearish divergence.

This development is also why ADA saw a 60% correction.

As a result of the said divergence, Cardano price has retraced roughly 32% to where it currently stands. While the bigger picture remains bullish with higher highs and higher lows, ADA still has to correct before it can begin its uptrend.

Extending the parallel channel seen in 2020 shows that the previous swing low bounced off this setup. Therefore, if the correction continues, Cardano price will likely tag the same barrier again. From the current position, ADA still has roughly 20% to go before it revisits this level at $1.68.

While a bounce from this support floor is likely, investors should expect ADA to tag $1.46 in a highly bearish case.

ADA/USD 1-week chart

Immense headwinds await ADA

While the historical and the technical perspectives hint at a downswing for Cardano price, on-chain metrics suggest that ADA will face massive headwinds going higher. IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that the number of “Out of the Money'' investors increases as the price goes higher.

For example, the GIOM shows that a whopping 281,000 addresses that purchased 8.14 billion ADA at an average price will be “Out of the Money” if Cardano price produces a decisive close below $2.05.

Going higher on the scale shows 58,740, 295,470 and 449,360 addresses that bought 1.84 billion, 3.69 billion and 4.85 billion ADA at an average price of $2.20, $2.32 and $2.76 are all underwater.

Therefore, any short-term buying pressure that pushes ADA higher will face immense selling pressure from investors who want to break even.

ADA GIOM chart

Hence, combining the bearish outlook observed from the technical and historical perspective with the on-chain data reveals that the only place Cardano price can go is lower. Moreover, increasing Bitcoin dominance tends to have a negative impact on altcoins. So far, BTC dominance has risen by roughly 15% since September 13.

The current weakness shown in the altcoin market is due to this sudden uptick. Going forward, this metric is likely to surge another 8-10%, which could be a tool in the bears’ arsenal.

BTC dominance chart

While things are looking bad for Cardano price, the fundamentals are seeing a significant uptick, especially since the introduction of the Alonzo hard fork in September. The DeFi ecosystem on the Cardano blockchain is picking up momentum.

In a recent announcement OccamX, a decentralized, exchange launched on September 4. Launched by the Occamfi team, the DEX is one among many to hit the developing ecosystem on ADA, which was made possible due to the introduction of the much-awaited smart contract capabilities.

On that front, Cardano co-founder Charles Hoskin stated that the second wave of DeFi is “up for grabs” after implementing the Alonzo hard fork. He added that Cardano is positioned itself at the center of this second wave, including interoperability, liquidity, and the ability to move assets across different chains.

Other notable development taking place on the Cardano blockchain includes the recently launched NFT market place SpaceBudz. The platform was launched by Berry Pool operator, who is also the creator of the popular ADA wallet Nami.

While the market is currently lull due to the increase in Bitcoin dominance, things will pick up when it’s altcoins’ time to rally. When that happens, the selling pressure posed by the cluster of underwater investors will be overwhelmed by massive capital inflows and easily slice through them.

In such a situation, if ADA can produce a decisive close above $2.76 and hopefully $3, it will convert the underwater investors’ selling pressure into buying pressure and lure sidelined investors to jump on the bandwagon kick-starting a new uptrend.

In such a situation, Cardano price could rally to $5, coinciding with the 161.8% Fibonacci retracement level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.