- Cardano builds further on the change to more positive sentiment yesterday.

- ADA price looks set to begin a recovery back to $1.40.

- Current market sentiment will be essential to help bulls, possibly towards $1.70.

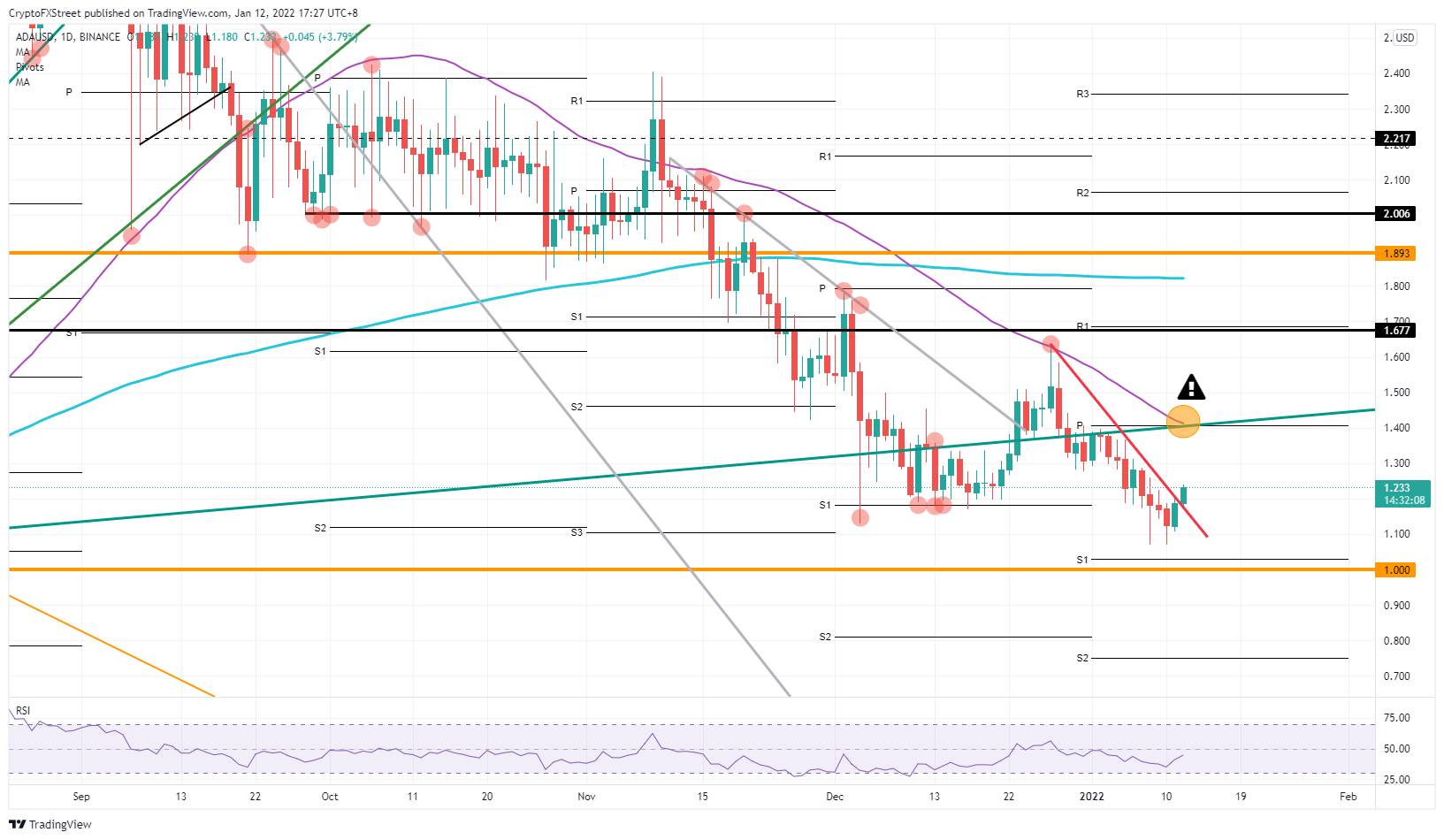

Cardano (ADA) price is looking enticing to investors with a solid recovery yesterday and a continuation of that recovery during the European session this morning. More inflow is expected as the road is wide open for a return towards $1.40. Depending on the tailwinds, bulls will need every little bit of help to get there, however, as some substantial technical resistances are seen all falling in line together at $1.40, limiting possible upside.

Cardano investors could make 37% gains if they plan their trade right

Cardano price punched a hole in the wall made by bears that saw their downtrend cut short by a bullish knee-jerk reaction and breakout above the red descending trend line. With that reversal – helped by the recovery in global markets yesterday – bulls have no hurdles now to start ramping price action back up to $1.40. From there it starts to get tricky, however, as investors will want to book some 16% of gains at that point and will also face three heavy technical resistance elements all at the same level.

ADA bulls need to face the 55-day Simple Moving Average coming in that has already proven its resistance potential on December 27. Add to that the monthly pivot that has been well respected at the beginning of January and the green ascending trend line. If bulls can crack that region by turning all previously mentioned elements into support, expect another leg higher towards $1.70, and profits mount to 37%.

ADA/USD daily chart

Markets are very nervous about the FED’s rate path in 2022, and sentiment could easily switch overnight if the FED hints at more rate hikes, as expected. This could see investors fleeing the scene again and cryptocurrencies being cut out of portfolios as ‘First Out’. Expect bears to drill on the monthly S1 support level at $1.0 and a historical low. A dip further would see a slowdown in the correction around $0.75 with the monthly S2 support level as a guide.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH consolidates below $2,000 as Standard Chartered alters its prediction for 2025

Ethereum remained just below $2,000 in the Asian session on Tuesday as Standard Chartered's Global Head of Digital Assets Research, Geoffrey Kendrick, updated the bank's 2025 price forecast for ETH.

Solana price faces 50-day resistance as SOL futures debut on CME Group with $5M volume on fifth anniversary

Solana (SOL) stagnated around the $128 mark on Monday despite multiple bullish catalysts. The recent SOL unlocks by Alameda Research, ahead of FTX creditor repayments, have created a persistent bearish overhang since early March.

Canary Capital proposes first-ever Sui ETF following S-1 filing with the SEC

SUI saw slight gains on Monday as Canary Capital submitted an S-1 application with the Securities & Exchange Commission (SEC) to launch a Sui exchange-traded fund (ETF). This adds to the growing list of altcoin ETF filings awaiting approvals from the regulator.

Outflows in crypto funds reach $6.4 billion over five weeks amid long-term holder accumulation

Crypto exchange-traded funds (ETFs) extended their outflow streak last week, totaling $1.7 billion, bringing the total outflows in the past 5 weeks to $6.4 billion, per CoinShares weekly report on Monday.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.