- Cardano price could be awaiting a significant breakout this year following an abundance of development activity in 2021.

- The Ethereum killer ranked first by development activity and active contributors count in the past year.

- If ADA could slice above $1.50, a 32% surge toward $1.98 could be on the radar.

Cardano price could be preparing for a massive breakout as a recent report suggests that the blockchain ranks first in development activity. Based on publicly available Github information, another statistic indicates that ADA could expect more upside potential as the blockchain project leads the pack in terms of average development activity contributors count in 2021.

Cardano development activity exploded in 2021

According to a recent Santiment report, the Cardano blockchain has ranked first in total development activity in 2021.

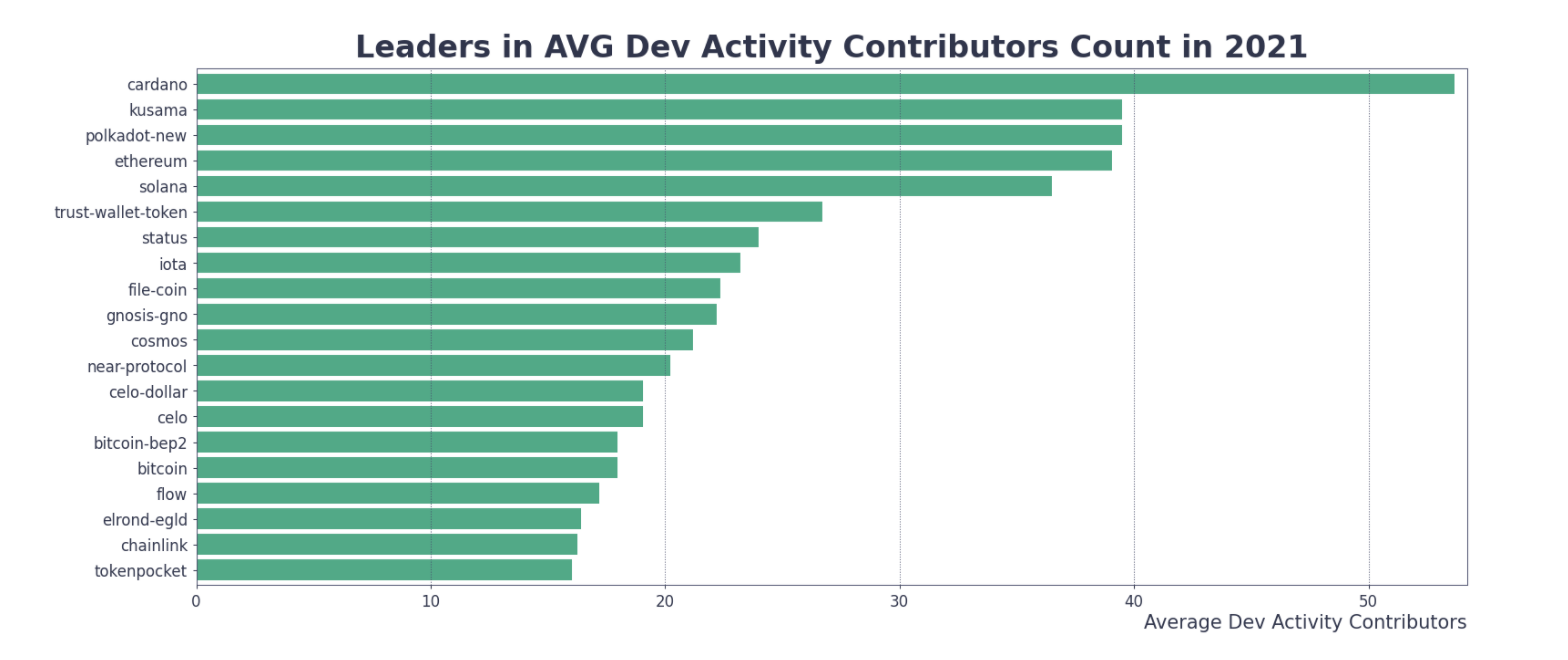

While development activity may not have a direct impact on short-term market trends, it reveals the team’s month-to-month commitment to creating a working product and upgrading its features to fit its long-term roadmap. Kusama and Polkadot follow Cardano closely, two of the top three projects, while Ethereum ranked fourth.

Cardano also led the pack in active contributors count in 2021, with an average of 53 daily contributors to their Github repo.

According to Santiment, the aforementioned statistics shed light on the entire cryptocurrency ecosystem, and that large projects such as Cardano with active developer communities are “naturally going to dominate.”

Cardano price awaits 32% upswing

Cardano price has formed a symmetrical triangle pattern on the 12-hour chart, suggesting that ADA could continue to consolidate until a decisive break that points to the token’s next move.

The Ethereum killer could be awaiting a 32% surge if the token manages to slice above the topside trend line of the prevailing chart pattern at $1.50.

Before the anticipated bullish test of the upper boundary, Cardano price will face resistance at the 21 twelve-hour Simple Moving Average (SMA), coinciding with the 38.2% Fibonacci retracement level at $1.40, then at the 50% retracement level at $1.45.

ADA/USDT 12-hour chart

An additional headwind may appear at the 100 twelve-hour SMA at $1.49 before ADA tags the upper boundary of the governing technical pattern. If Cardano price breaks above $1.50, a 32% upswing toward $1.98 could be on the radar.

However, if selling pressure increases, Cardano price will discover immediate support at the 50 twelve-hour SMA at $1.33, then at the 23.6% Fibonacci retracement level at $1.32. Additional lines of defense may emerge at the August 3 low at $1.26, then at the December 4 low at $1.18.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.