Cardano price could trap sellers with an explosive move to $1.35

- Cardano price is coiling into a wedge-like pattern.

- ADA price has printed three impulsive waves.

- An invalidation for the bullish narrative will be a touch at $1.13.

Cardano price action could fool many traders as the price action is displaying mixed signals. Traders should dive deeper into the technicals before placing an entry.

Cardano price action has “Sneaky Smart Money” written all over it

Cardano price has begun forming a wedge-like pattern since March 18th that many traders refer to as an ending diagonal. Ending diagonals are usually in wave five positions and are historically known for being the last pattern to ascend the price before a correction occurs.

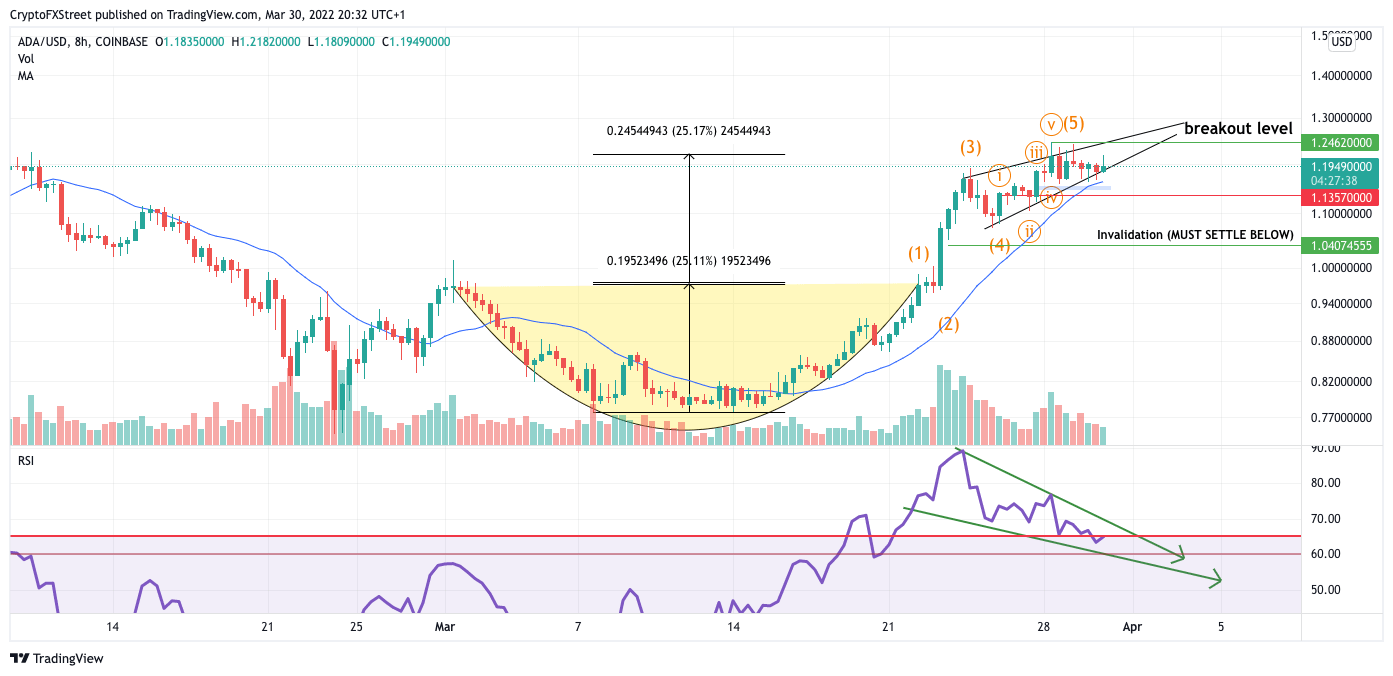

Many counter-trend traders enjoy ending diagonal patterns because of the impulsive counter-trend rallies they bring forth. Traders may also be noticing the Relative Strength Index has a diverging wedge pattern on the 8-hour chart. This scenario could be enticing traders to place prominent short positions on Cardano price, targeting $1.15 and even $1.07.

ADA/USD 8-Hr Chart

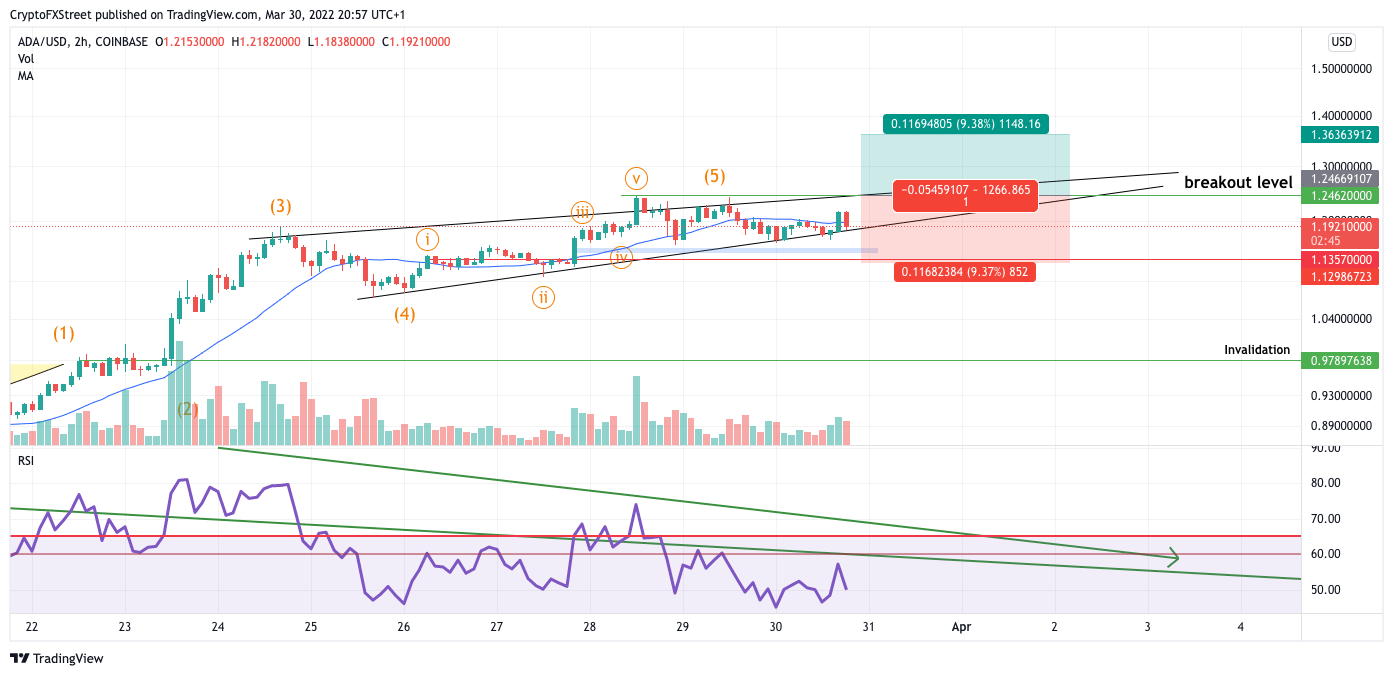

However, the wedge-like pattern may be a bear trap when analyzing the ADA price action on the 2-hour chart. Shorters looking for the 10% move south may get fooled as the wedge pattern breaks a golden rule for ending diagonals.

Termination triangles cannot have an impulsive wave within the pattern.

Cardano price action does make an impulsive wave where waves 1, 3 and 5 are impulsive while wave four does not fall into the wave one position. This scenario may be early evidence of “Smart Money Involvement” looking to trap leveraged traders on the wrong side of the trade.

Thus, traders should continue with an overall bullish bias as the Cardano price has successfully established three impulse waves. A breach of the highs at $1.25 could be followed by an upswing to the next target of $1.35.

ADA/USD 2-Hr Chart

An invalidation for the bullish bias will be a touch of the $1.13 price point. If this were to occur, Cardano price could continuously fall between $1 and $0.97, representing a 17% correction from the current levels.

Author

FXStreet Team

FXStreet