Cardano price to recover losses as ADA targets $3

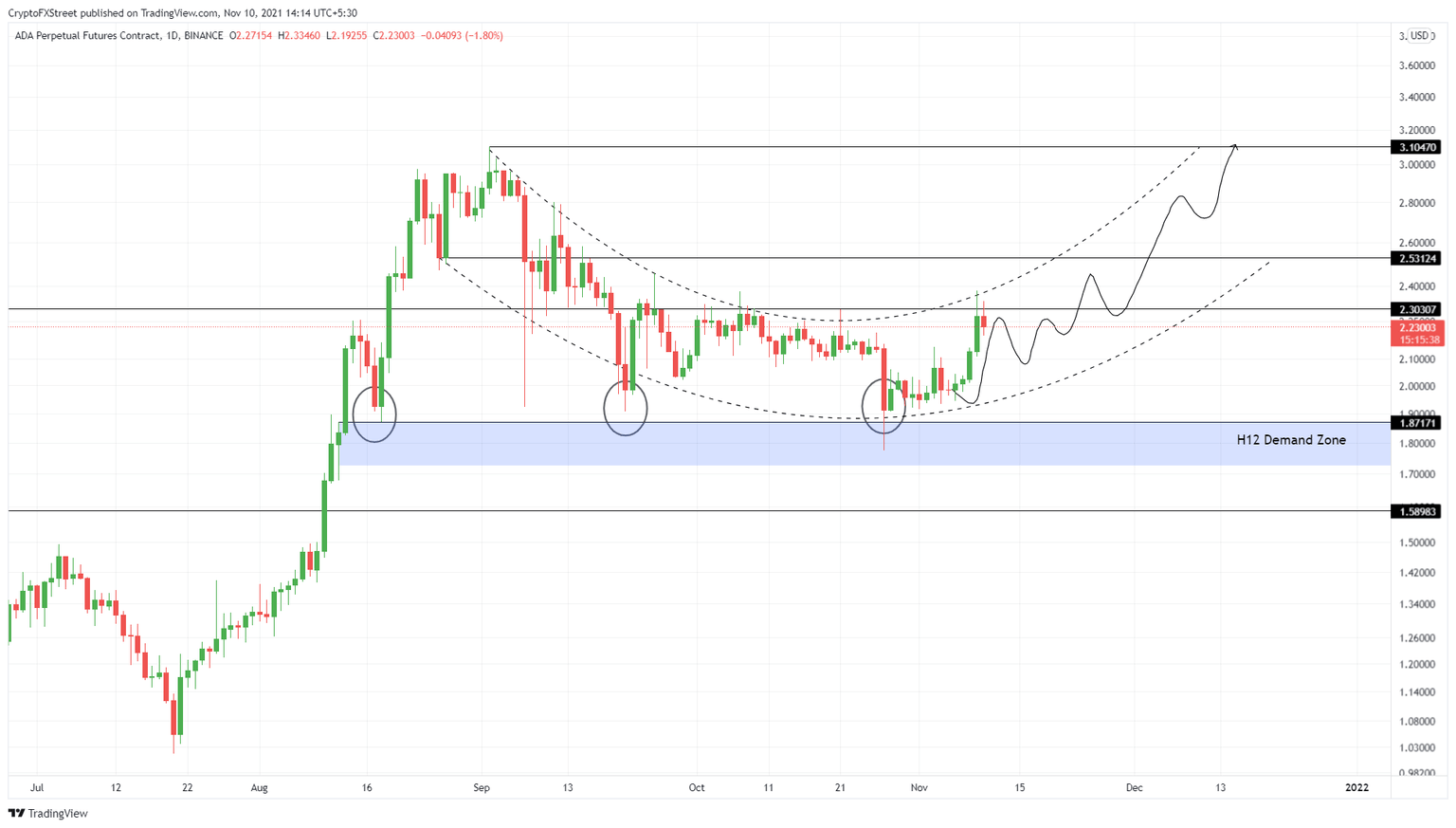

- Cardano price sticks to the rounding bottom pattern and is currently facing blockade at $2.30.

- A daily close above this barrier opens the path to $3 for ADA.

- A lower low below the $1.72-to-$1.87 support floor will invalidate the bullish thesis.

Cardano price has stuck to its reversal trend and is currently grappling with a crucial overhead barrier. Clearing this level would release the tension and allow ADA to climb higher.

Cardano price continues its ascent

Cardano price is trending upwards after a bounce off the 12-hour demand zone, ranging from $1.72 to $1.87. Since then, ADA has rallied 25% and is now trying to flip the $2.30 resistance level into a support platform.

If successful, the breakout will open up the avenue for Cardano price to rally toward the next pitstop at $2.53. An increased buying pressure around this level will propel the so-called “Ethereum killer” to the next crucial point at $3.10, the all-time high.

This move would constitute a 40% surge from the current position. However, investors need to remember that the upswing hinges on ADA bulls clearing the immediate hurdle at $2.30.

ADA/USDT 1-day chart

While the optimistic scenario sounds appealing, a failure to clear $2.30 will indicate that the sellers are not done with ADA. In this situation, Cardano price could revisit the rounding bottom at $2.05 or retest the 12-hour demand zone, extending from $1.72 to $1.87.

This move will allow buyers to replenish their momentum and restart the bullish thesis for Cardano price. If ADA produces a lower low below $1.72, however, it will invalidate the bullish thesis. In case of a bearish continuation, ADA could trigger a crash to the $1.59 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.