- Cardano price action sees bulls defending S1 monthly Support at $1.18.

- ADA price looks ready for a bullish signal, as it continues testing the red ascending trend line.

- Expect a rally that could quickly pop back up towards $1.80.

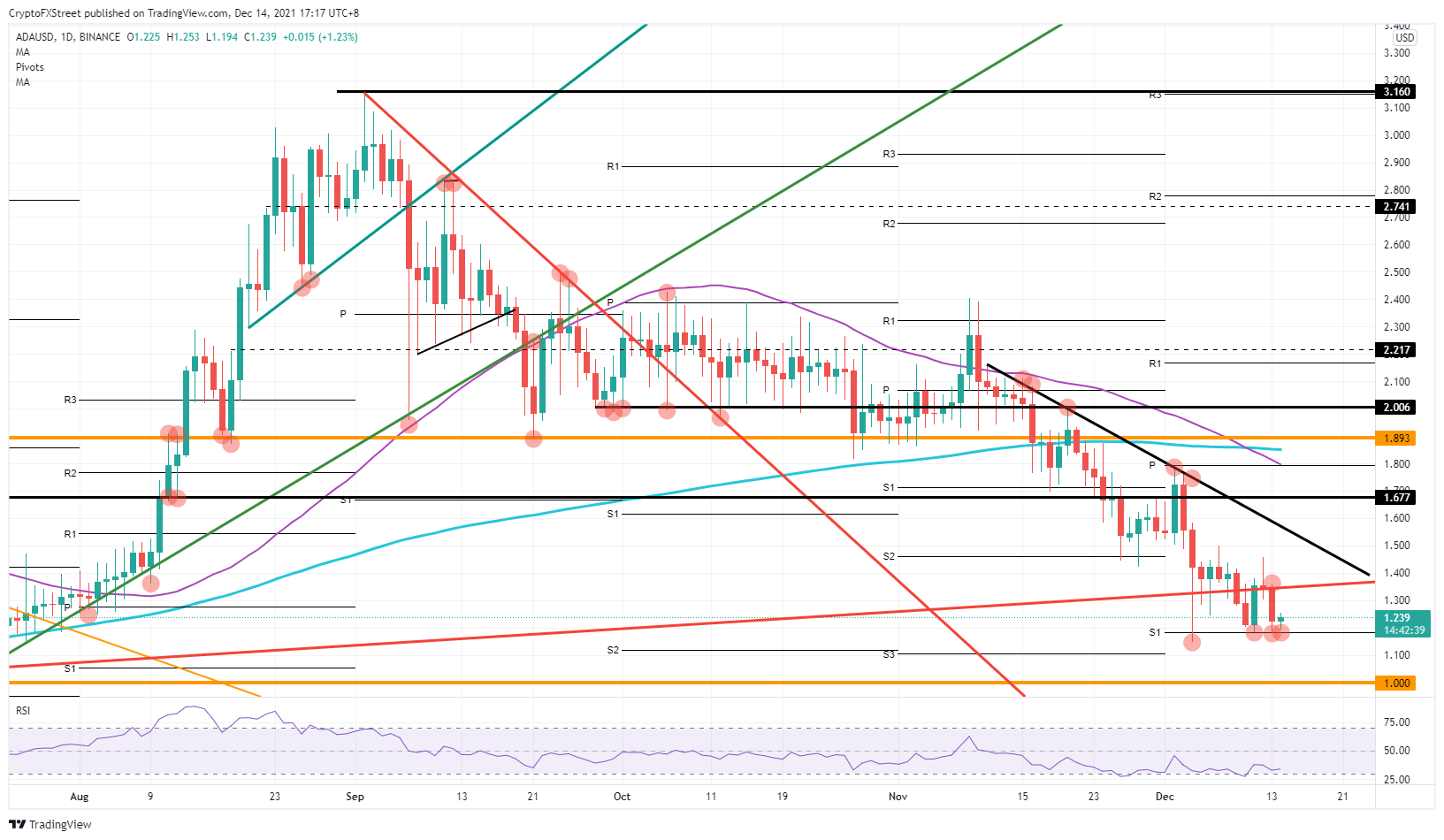

Cardano (ADA) price has been in a downtrend for over two weeks now and now bears are getting crushed against the monthly S1 support level for December, at $1.18. ADA bulls do not look like forfeiting this level as bears start to book profits and exit their positions. The Relative Strength Index (RSI) is quite close to being oversold suggesting a lack of scope for further downside. Today, a bullish candle looks to be forming that could match yesterday’s bearish candle if a tailwind in cryptocurrencies triggers some relief.

Cardano could see a U-turn

Cardano price is currently respecting the monthly S1 support level at $1.18, with bulls not giving way to bears who are attempting to push the ADA price in a further leg lower towards $1.0. Instead, short-sellers in ADA price action are fleeing the scene and booking profits as the RSI is trading very close to the oversold region again. Bulls are now taking control and could easily squeeze bears back up against the red ascending trend line that rejected price on Monday at around $1.35.

ADA price could enjoy some tailwinds from global equity markets which are enjoying positive sentiment again this morning during the European session, sentiment looks to spillover into cryptocurrencies. In case bulls can make a close above the red ascending trend line, expect a further lift and test against the black descending trendline. If bulls further squeeze bears out of their positions, expect a possible punch-through effect that could see ADA prices explode to $1.90 or even $2.0.

ADA/USD daily chart

A few risk elements should not be forgotten, such as the fact that several major central banks are coming out with their forecasts for 2022 and are reassessing their monetary policy stance. Expect hawkish tones to spark headwinds for cryptocurrencies, with ADA price probably rejected around $1.50, on that black descending trend line and keeping alive the downtrend further into December. ADA price would stay capped and start to trade further to the downside, breaking through the monthly S1 support level at $1.18. A penetration of that level would propel into a spiral move towards $1.0.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.