Cardano price slides below multi-month support despite ADA's NFT milestone

- Cardano price fails to reflect the growth in Cardano-based NFT collections which exceeded the six million mark in just 17 months.

- The NFT market overall, however, continues to lose money, with volumes barely expected to cross $500 million in November.

- Cardano’s price fell by 10% in 48 hours, inching closer to almost two-year lows.

Cardano price does not seem to be reflecting the strides the altcoin has made in the Non-Fungible To.ken (NFT) space. Whilst still not yet significant, Cardano-based NFT volume continues to grow gradually. This is an achievement in itself, given the current condition of the NFT market in general, in which every chain and collection is suffering.

Cardano NFTs touch new highs

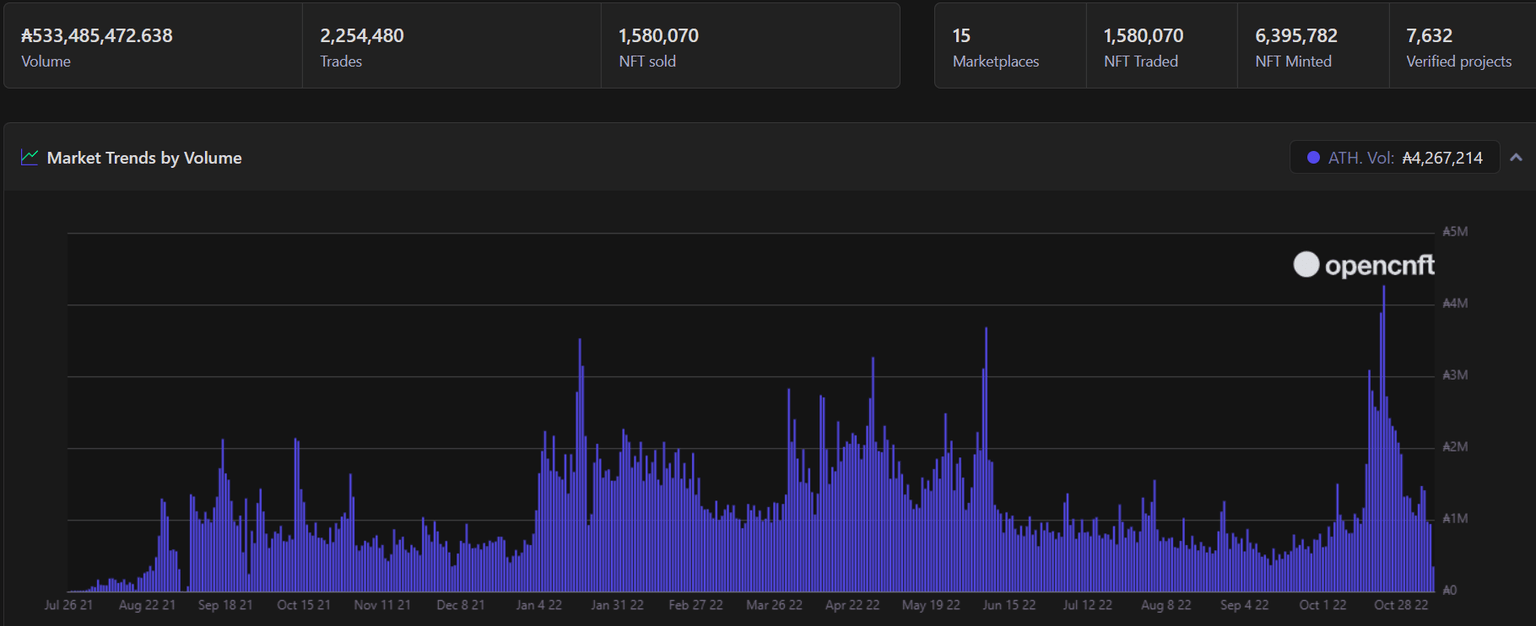

Cardano-based NFTs came to life back in July 2021, and since then, the blockchain has seen multiple ups and downs. Along with the chain, the NFTs volumes also fluctuated, peaking last month at $4.2 million in a single day.

Following the same this month, the total number of NFTs minted on the chain crossed the 6 million mark, touching 6.4 million.

However, the volume of NFTs traded this week has been some of the lowest of 2022. This is in line with the rest of the NFT market as well, where sales have been a major concern. The month of October was already quite disappointing, amassing only $491.2 million in NFT sales.

A little less than September’s $526.7 million, the declining sales have made it difficult for volume to cross the $500 million. Even so, the total sales in November are expected to cross $500 million.

Cardano NFT sales

Whether or not that happens will depend on which direction the market moves in. At least in the case of the crypto market, up seems a little difficult.

Cardano price bows again

The altcoin registered a 10.07% decline in the last two days as prices reached $0.384. The last major rise noted by ADA was in mid-October for nine days when the price rose by 23.53%. At the time, Cardano was close to closing above the six-month-long support of $0.409 but failed to do so.

Fluctuating around the same level, ADA is expected to decline further before testing the line as resistance again. The current critical support is at $0.33, which is where Cardano could be if broader market cues don’t improve.

ADAUSD 1-day chart

Cardano price has room to rise, however, according to the Relative Strength Index (RSI), since the altcoin is nowhere near being overbought. Thus if an increase in buying pressure is observed over the next few days, ADA’s price could shoot up and flip $0.409 into support.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.