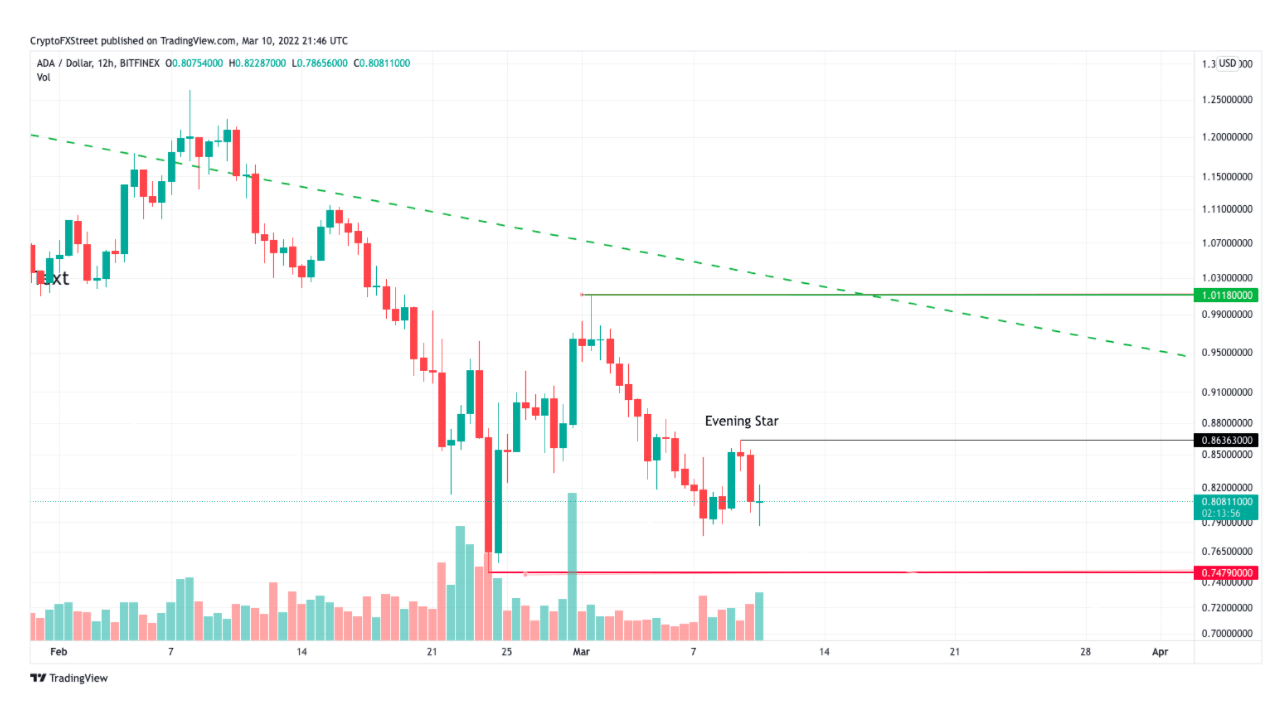

Cardano price sits on thin ice as bears target $0.75

- Cardano price has been controlled by bears.

- ADA printed an evening star on the 12h-hour.

- Further selling pressure could push it to $0.75.

Cardano price continues to trend lower as bears appear to have gained complete control. The technicals suggest that the correction is not over, and ADA could head further south.

Cardano price is still under pressure

Cardano price is currently in consolidation mode, printing an indecision candle on the 12-hour chart. Pauses in trend after decent sell-offs are common in the cryptocurrency market. Although there is a slight volume uptick on the current doji candlestick, being an early ADA buyer is not advised.

Bears can still maintain a stronghold on Cardano price and ultimately aim to wipe out the liquidity lying under last week's swing low at $0.75. Those who are looking to put further selling pressure on ADA should consider waiting for a pullback to around $0.83

ADA/USD 12-Hour Chart

Despite the bearish grip on Cardano price, there is still a chance that the bulls can pull off a reversal.

For one, last week's low at $0.75 is a clean 7% move away from Cardano price. Such a tight stop loss will surely entice day traders to scout the market for short-term plays.

If short-term bulls can maintain buying momentum into the mid $0.80 zone, newer sellers will face a challenge pushing the price back down. Any close above the current swing high at $0.86 will invalidate the bearish sentiment, clouding over Cardano price action.

A close above $0.86 should also give bulls confidence to send prices higher into $0.90 and $0.95 zones, respectively.

Author

FXStreet Team

FXStreet