Cardano price retreats from seven-month highs after flipping DOGE, MATIC in Q1

- Cardano price pulled back to trade at $0.421 after marking a seven-month high.

- Quarter on quarter, Cardano’s DeFi presence has grown by 172%, boasting a TVL of $138 million.

- ADA holders seem to have regained confidence in the altcoin, with transaction volume noting a 650% increase in three months.

Cardano price observed a rather spectacular Q1 this year as, along with the token, the blockchain also noted growth on all fronts. This triggered an optimistic outlook in the investors that had been missing since the lackluster Alonzo upgrade of August 2021.

Cardano price rise brings back investors’ confidence

In three and a half months, Cardano price has managed to chart more than 85% in gains before slipping by 7% over the last four days. Trading at $0.423, ADA has surpassed the likes of Dogecoin and Polygon in terms of market capitalization to take back the spot of the seventh biggest crypto asset.

ADA/USD 1-day chart

Its performance in the Decentralized Finance (DeFi) space also seems to be improving. The quarter-on-quarter total value locked (TVL) across Cardano’s 19 protocols has increased by a stellar 172% from $50 million to $138 million.

However, despite this development, Cardano still has not established itself in the ever-growing DeFi space, in which its competitors, such as Arbitrum, have already gained domination.

Regardless, the network has regained a crucial element that would be critical to its consistent growth hereon, the user base. ADA holders, who have been skeptical in their behavior for almost a year and a half now, are returning to their bullish state, evidence of which can be found in their participation.

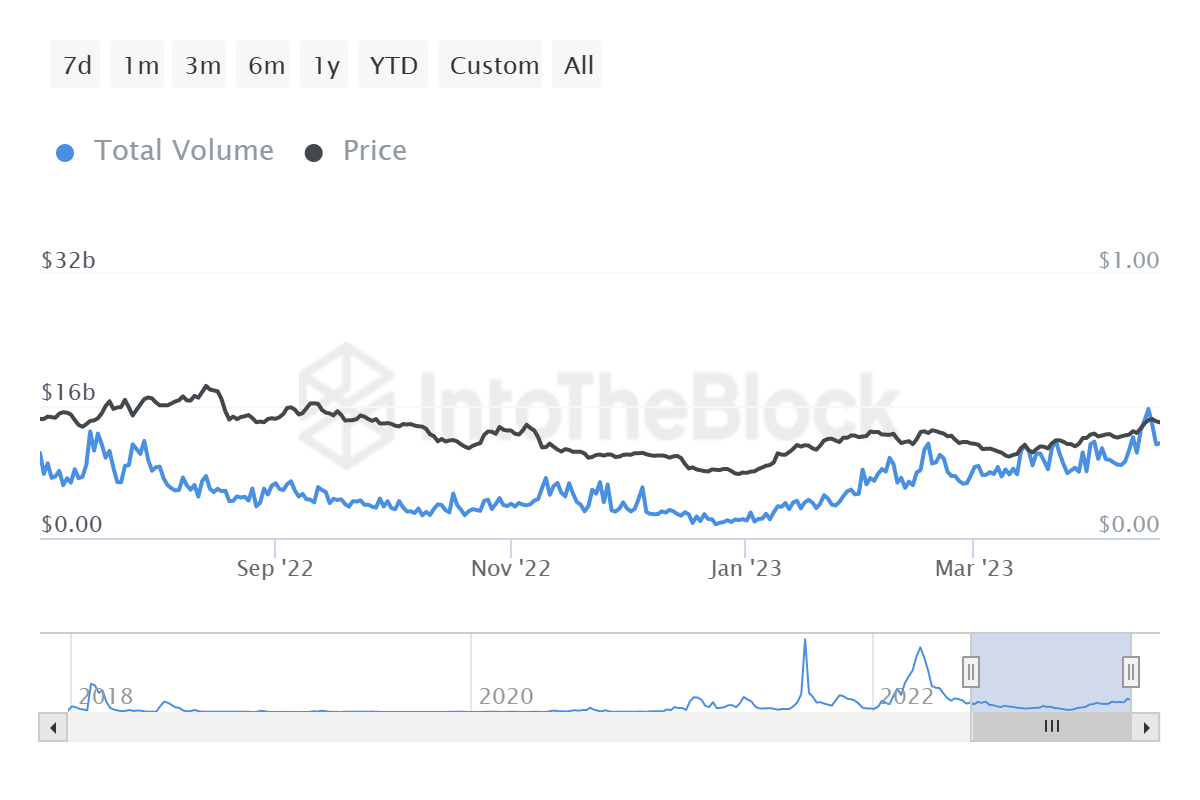

On-chain transaction volume, which had been dipping since April 2021, began increasing again as the year started. In the span of three months, the volume has shot up from $2 billion on average to $15.6 billion at its peak this week. This signifies a 650% increase over the first quarter.

Cardano transaction volume

Furthermore, ADA whales have also refrained from selling since the beginning of the year, which has been one of the biggest driving factors in Cardano price rally. Although heavy accumulation would have supported a larger rise, the lack of selling at the hands of cohorts holding between 100,000 to 10 million ADA, has kept investors’ faith intact for recovery.

Cardano whale activity

This newfound confidence was visible in the overall discussions surrounding Cardano as well, given its social presence shot up by 300% in the last three months. Even though most of the growth came towards the end of March, this is the most demand ADA has seen since April 2022. At the moment, Cardano is part of every three queries out of 100 regarding crypto, which was the blockchain’s average back in July 2021.

Cardano social presence

If ADA holders can sustain this optimistic attitude throughout the second quarter as well, Cardano price could chart some more gains potentially feeding further into Cardano enthusiasts' impossible dreams of a $1 trillion market capitalization.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B21.19.11%2C%252019%2520Apr%2C%25202023%5D-638175202199956723.png&w=1536&q=95)

%2520%5B21.20.43%2C%252019%2520Apr%2C%25202023%5D-638175202397694513.png&w=1536&q=95)