Cardano price remains still after Vasil hard fork, what’s next?

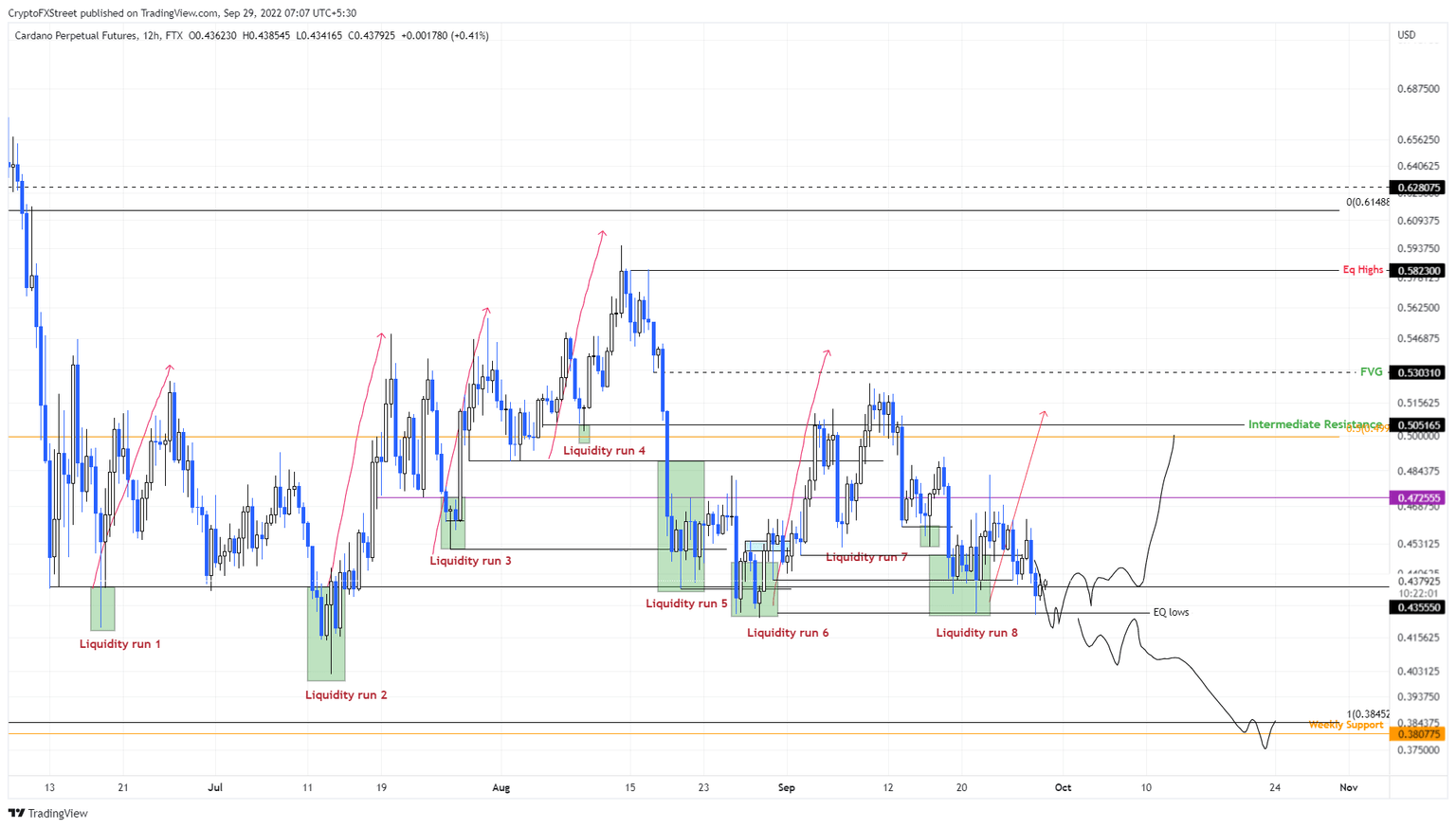

- Cardano price shows a string of equal lows formed at $0.425, indicating a potential liquidity run in the near future.

- Investors can enter the ADA market after the sell-stop liquidity below $0.425 is swept.

- A daily candlestick close below $0.425 without a quick recovery above $0.435 will invalidate the bullish outlook.

Cardano price has remained neutral despite the blockchain undergoing a massive upgrade this week via the Vasil hard fork. This update is multi-faceted and brings a host of improvements to the so-called “Ethereum-killer”, including transaction throughput.

Other notable improvements include “diffusion pipelining”, which increases the Cardano blockchain network’s transaction processing capabilities while also improving the block propagation times.

The developers commemorated a successful implementation on September 28 on Twitter.

We’re pleased to announce that after a successful #Vasil upgrade on the 22nd of Sept, the new capabilities (including node & CLI support for reference inputs, inline datums, reference scripts), along with a new #Plutus cost model, are now available on the #Cardano mainnet! pic.twitter.com/USja3TcJNi

— Input Output (@InputOutputHK) September 27, 2022

Although a major milestone for the developers and users alike, Cardano price failed to react to it. In fact, ADA has been consolidating and has remained highly correlated to Bitcoin price.

Cardano price and the signals before a run-up

Cardano price has been producing liquidity fractals, which are essentially a sweep of the previously formed swing low followed by a quick rally. So far, ADA has produced eight of these and will likely produce one more before buyers step on the gas pedal.

The so-called “Ethereum-killer” has produced three equal lows at $0.425 and has sell-stops resting below it. Therefore, a swift move to the downside to collect this liquidity, followed by a swift recovery above $0.435, will indicate that market makers are at work and also signal a bullish outlook.

In such a case, investors can expect Cardano price to trigger a 15% run-up to $0.505, where a local top could form. Depending on the momentum, ADA could extend higher and fill the imbalance, aka Fair Value Gap (FVG), at $0.530.

In total, this move would constitute a 25% gain for Cardano price, and interested investors can look to get in after a sweep of the equal lows at $0.425.

ADA/USDT 4-hour chart

While this outlook seems promising, Cardano price moves at the whim of Bitcoin price volatility. Therefore, a daily candlestick close below the equal lows at $0.425 could turn sour if ADA fails to recover above it. Moreover, a secondary confirmation of the lack of bullish strength will be seen if the altcoin fails to move above the $0.435 resistance level.

Such a development will invalidate the bullish outlook for Cardano price and potentially trigger a 10% crash to $0.380.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.