Cardano price rebounds swiftly with $1 in sight

- Cardano price action makes a solid turnaround as bulls get ready for the rally to $1.00

- ADA price looks set to hit $0.90 later in the US session.

- Expect to see a substantial influx of investors as a longer-term relief rally looks to be underway.

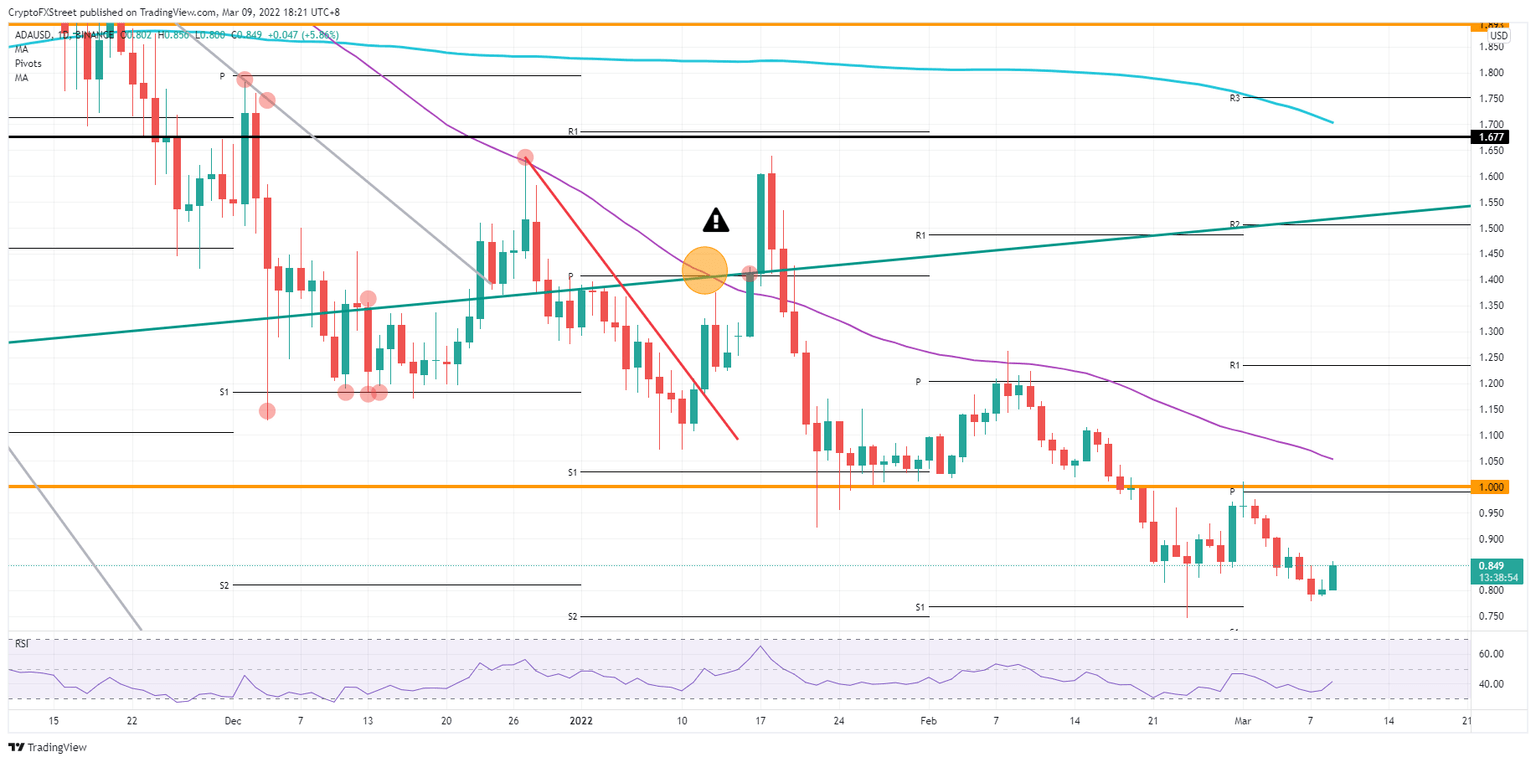

Cardano (ADA) price has been on a turnaround since yesterday as markets focus on the continuing peace talks, and Ukraine is now willing to step away from membership with NATO. These elements sparked a massive inflow of buyers during the ASIA PAC and the European session as the Relative Strength Index performed a knee-jerk reaction against bears. Expect to see intraday ADA price action hit $0.90 and by tomorrow or Friday $1.00 depending on additional positive elements added to the current environment.

Cardano price puts $1 tag on peace talks

Cardano price action is set to pop around 10% today, with already 6% of gains booked during the ASIA PAC and the European session, the inflow of bulls during the US session will add another 4%. In terms of price value, that would mean somewhere around $0.90, prepositioning investors for another 15% of gains by Friday and printing $1.00 on the quote board. This would erase most of the losses incurred in March. With still a few weeks to go, March could become the most profitable month in the lifespan of Cardano.

ADA price reaction intraday looks to be only one-way south as we will see another acceleration going into the US session. Expect possibly into the US closing bell to see a final push that could hit $0.90 in the process. With this, bulls will gladly sit on their hands going into Thursday and Friday as $1.00 is only 15% off from where Cardano price action would open tomorrow.

Cardano/USD daily chart

Should the situation in Ukraine deteriorate yet again as peace talks stall or fail, expect ADA price action to fall back to the opening price at $0.80. In a two-tier stage, first, this week's low will be retested at $0.78, followed by the February 24 low at $0.75. That would mean an intraday loss of 7%, still on the cards.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.