Cardano price ready for a 25% breakout towards $0.22, according to technicals

- Cardano price remains contained inside a parallel channel on the 4-hour chart.

- Several indicators suggest the digital asset is poised for a massive breakout towards $0.22.

Cardano has been trading inside a parallel channel for over a month and it’s getting closer to a breakout. Bulls have managed to secure several critical support levels and are now ready to push ADA above a key resistance point.

Cardano price needs to crack $0.17 to see a massive breakout

On the 4-hour chart, Cardano has established a parallel channel and bulls have pushed the digital asset above the 50-SMA, 100-SMA, and 200-SMA, turning all three into support levels.

ADA/USD 4-hour chart

At this point, it seems that the bulls have the upper hand, but still need to crack the key resistance level at $0.173 before a breakout. If Cardano price can climb above this point, it would most likely get driven towards $0.22.

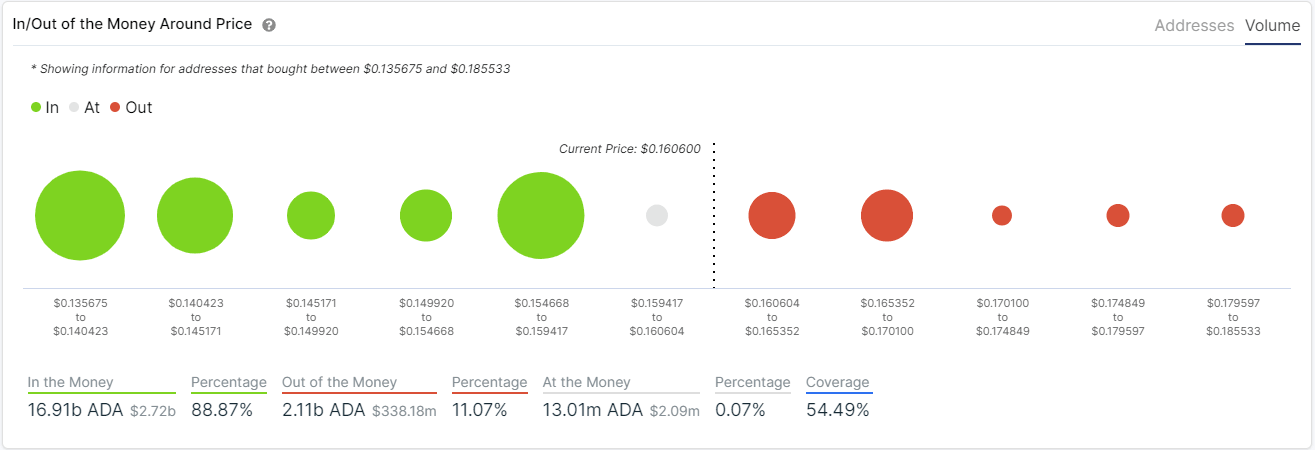

ADA IOMAP chart

Additionally, the In/Out of the Money Around Price (IOMAP) chart shows practically no resistance above. The most critical area seems to be located between $0.166 and $0.17 which coincides with the upper trendline of the parallel channel, giving credence to the bullish outlook.

Bears would need to drive Cardano price below the three moving averages, to have any chance of pushing ADA towards the lower trendline at $0.13. A breakdown below this crucial support level would take the digital asset down to $0.1.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.