Cardano Price Prediction: Risk management is key for ADA at these price levels

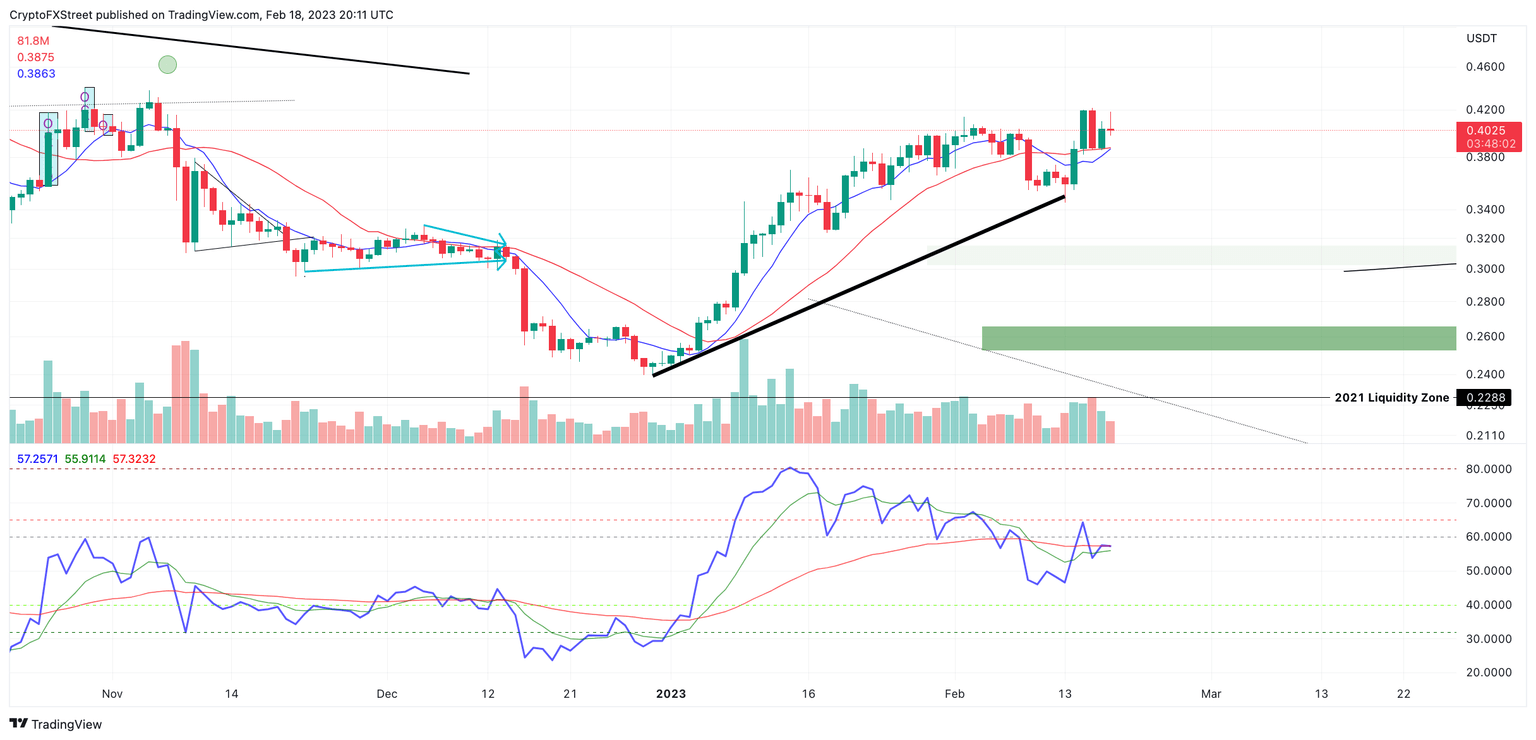

- Cardano price consolidates after a 5% rally and shows potential for a bullish cross of two significant moving averages.

- ADA could be setting up a rally toward the $0.430 zone.

- The invalidation of the bullish thesis is $0.385.

Cardano price has been showing signs of a continued bullish trend after a spike on January 17. As the market consolidates, traders should keep a close eye on the smart contract token for a profitable trade.

Cardano price signal caution for traders

Cardano price is going into a weekend consolidation after a 5% rally on January 17. The last-minute spike was catalyzed by the support of both the 8-day exponential and 21-day simple moving average. At the time of writing, the indicators are coiling and set to produce a bullish cross. If the cross manifests, the Cardano price could rally towards higher targets.

Cardano price currently hovers at $0.450. The Relative Strength Index (RSI) suggests that caution should be applied when aiming for higher price levels as this week's swing high at $0.420 shows divergences with the previous upswings near the $0.400 barrier down towards the $0.300 zone. This could be an early signal of a market reversal, but traders can only identify this in hindsight of a downward move.

Considering these factors, healthy risk management should be applied but maintain a bullish thesis. The next target for bulls to aim for would be the $0.430 zone, resulting in a 9% increase from Cardano's current price.

ADA.USDT 1-Day Chart

Invalidation of the bullish thesis is currently below the swing low above the coiling moving averages at $0.385. This will enable traders to make bullish moves while keeping their risks exceptionally low. If the invalidation point is breached, traders can expect a decline as low as the $0.300 zone to challenge the RSI's origin point of the divergence. Such a move would result in a 25% decrease from Cardano's current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.