- Cardano price rose 12% after dipping below a crucial support level at $1.451.

- ADA is currently hovering inside a critical resistance level, ranging from $1.525 to $1.624.

- Only a decisive close above $1.636 will confirm the start of a run-up.

Cardano price created a bottom on June 12 after a massive downswing since June 3. The higher high set up on June 13 signaled the start of a new uptrend.

While the rally has taken shape, there is no confirmation that it will continue to head higher. Moreover, on-chain metrics reveal that ADA will face stiff resistance as it ascends.

Cardano price awaits confirmation

Cardano price set up two swing lows at $1.356 and $1.40 on June 12 and June 13, respectively, after a 28% sell-off since June 3. While ADA has rallied nearly 13% over the past 12-hours, it needs to produce a decisive close above the 50% Fibonacci retracement level at $1.636 to have any shot at the swing highs at $1.833 or $1.949.

Currently, Cardano price is trading inside a supply zone that extends from $1.525 to $1.624. This area will provide the most resistance for the bulls and might even halt the upswing.

Failing to breach this barrier will result in a downswing that could push ADA to the support level at $1.451. If the selling pressure continues to mount, the so-called “Ethereum killer” might retest the swing low at $1.322.

ADA/USDT 4-hour chart

Supporting this downswing is IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, revealing stacked resistance levels of underwater investors.

From $1.57 to $1.71, roughly 408,000 addresses purchased nearly 6.16 billion ADA tokens. These investors are “out of the money” and might want to sell to breakeven if Cardano price rises. Therefore, a short-term surge in bullish momentum will not be enough to surge past this thicket of underwater investors.

ADA IOMAP chart

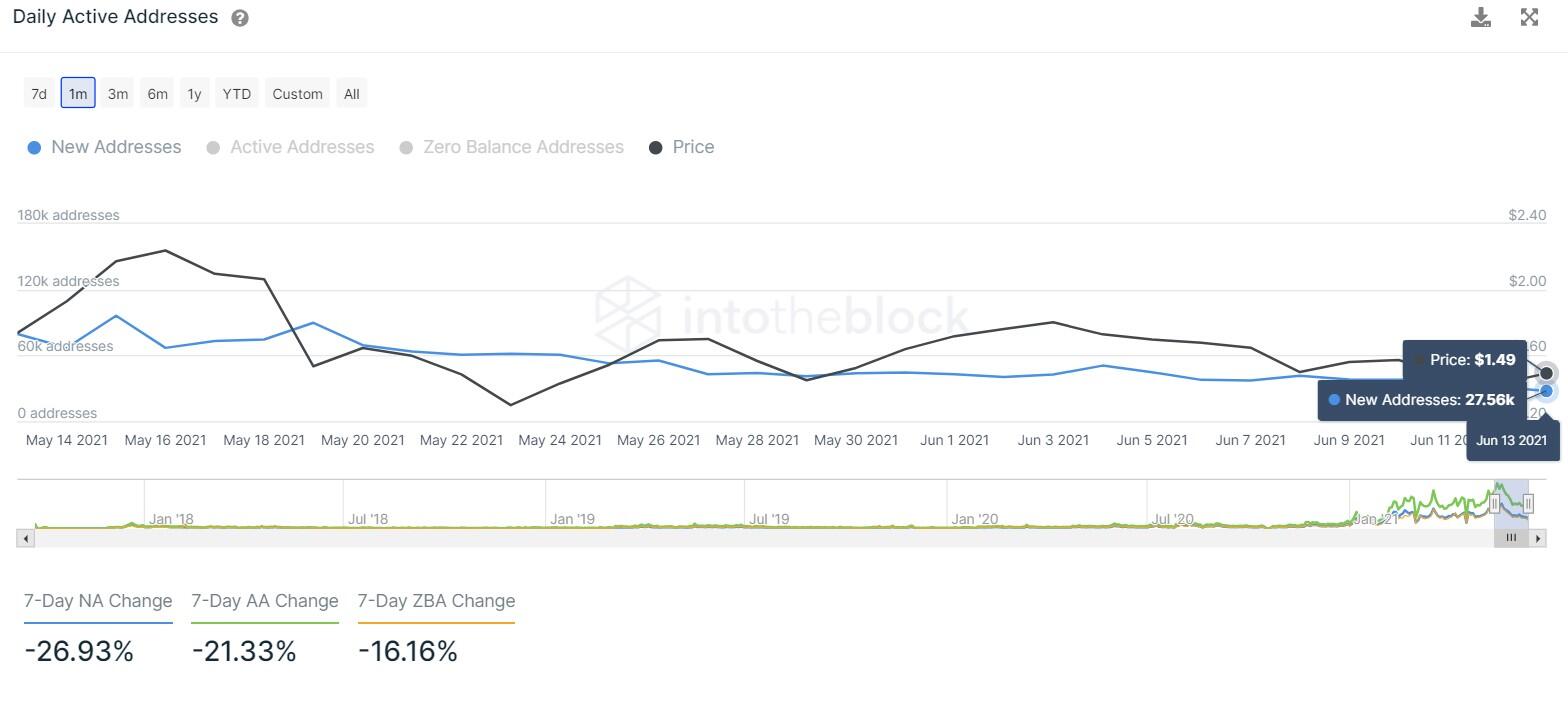

Moreover, the number of new addresses joining the Cardano network has reduced from 79,500 to 27,560 over the past month. This 65% decline indicates that investors are not interested in ADA at the current price levels and are either reallocating their funds or booking profits.

ADA new addresses chart

On the flip side, if ADA bulls manage to climb above $1.636, it will invalidate the bearish thesis and signal a new uptrend. In that case, Cardano price might surge 11% to tag the swing high at $1.833. Breaching through this level opens up the path to $1.949, the range high and the resistance level at $2.037.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.