Cardano Price Prediction: ADA soars 18%, eyes $0.8104 following increased buying pressure and recent rumors

Cardano price today: $0.6830

- ADA's rally could be due to rumors of the federal government leveraging Cardano to build a blockchain-based election voting system.

- ADA's exchange flows, and open interest shows increased appetite among bullish investors.

- ADA could rally to $0.8104 after bouncing off the 14-day EMA.

Cardano (ADA) is up 18% on Friday following rumors of the federal government leveraging its blockchain to build a blockchain-based election voting system. ADA has also seen increased attention from bulls, as its exchange net flows and open interest reveal increased buying pressure among investors.

Cardano bulls step up buying pressure following recent rumors

Cardano's ADA has been one of the crypto market's star performers since Donald Trump's presidential election victory. In the past nine days, ADA has posted gains of over 100%. Despite the market cooling off on Friday, the altcoin continued its charge, rising above the $0.6837 mark.

A potential reason for the increased bullish action in the past 24 hours is rumors that the recently formed Department of Government Efficiency (DOGE) is considering using Cardano to build a federal blockchain election voting and identity verification system. However, neither the DOGE nor key Cardano community members confirmed the rumors.

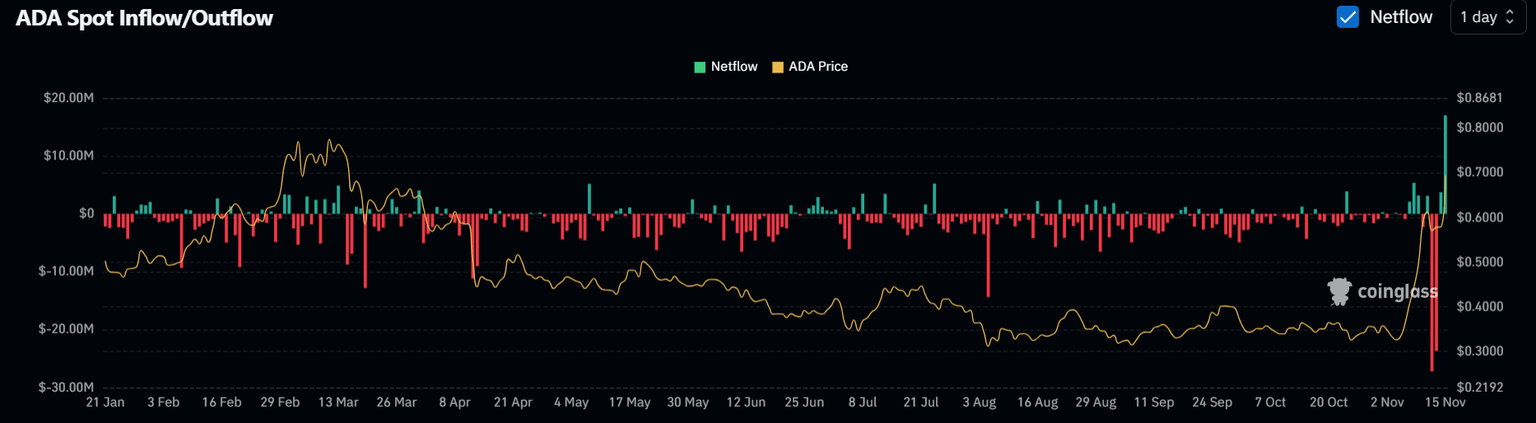

Meanwhile, ADA's exchange net flows showed increased buying pressure from bulls after its price touched $0.57, per Coinglass data. ADA witnessed net exchange outflows of $50.89 million between Tuesday and Wednesday — its highest since 2024. Exchange net outflows indicate higher buying pressure among investors.

ADA Exchange Net Flows

While exchange flows have flipped to inflows in the past two days, price action shows buying pressure is still dominant in the ADA market.

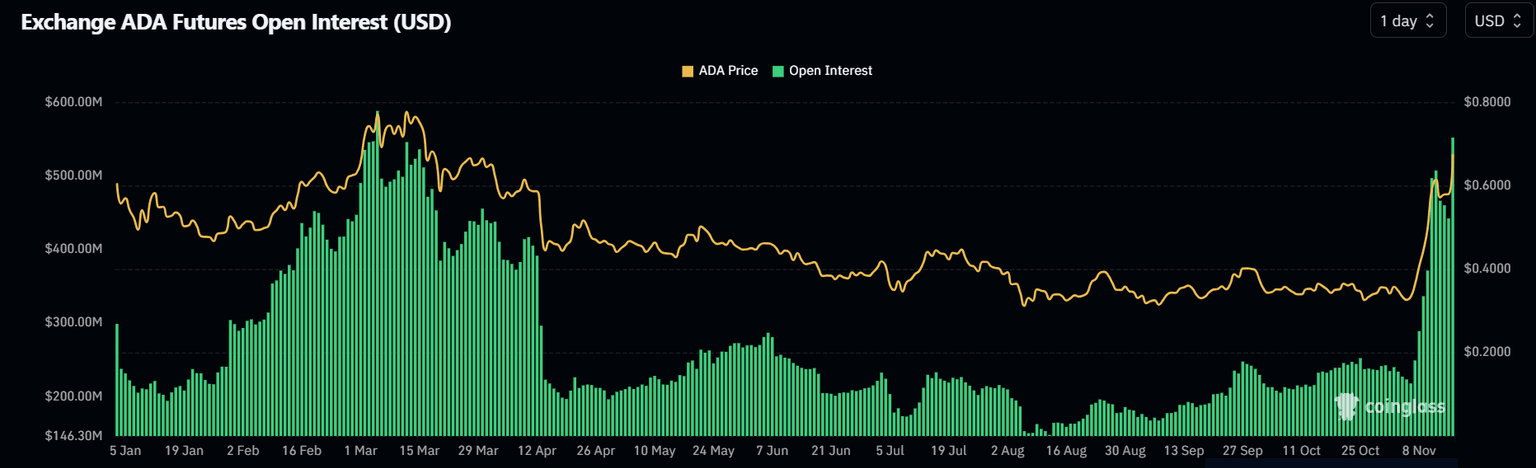

On the derivatives front, traders have also shown a high preference for ADA, sending its open interest above $550 million for the first time since March.

ADA Open Interest

Open interest is the total number of outstanding contracts in a derivatives market. When prices rise alongside open interest, it indicates strong bullish momentum.

Cardano Price Prediction: ADA eyes $0.8 after bouncing off 14-day EMA

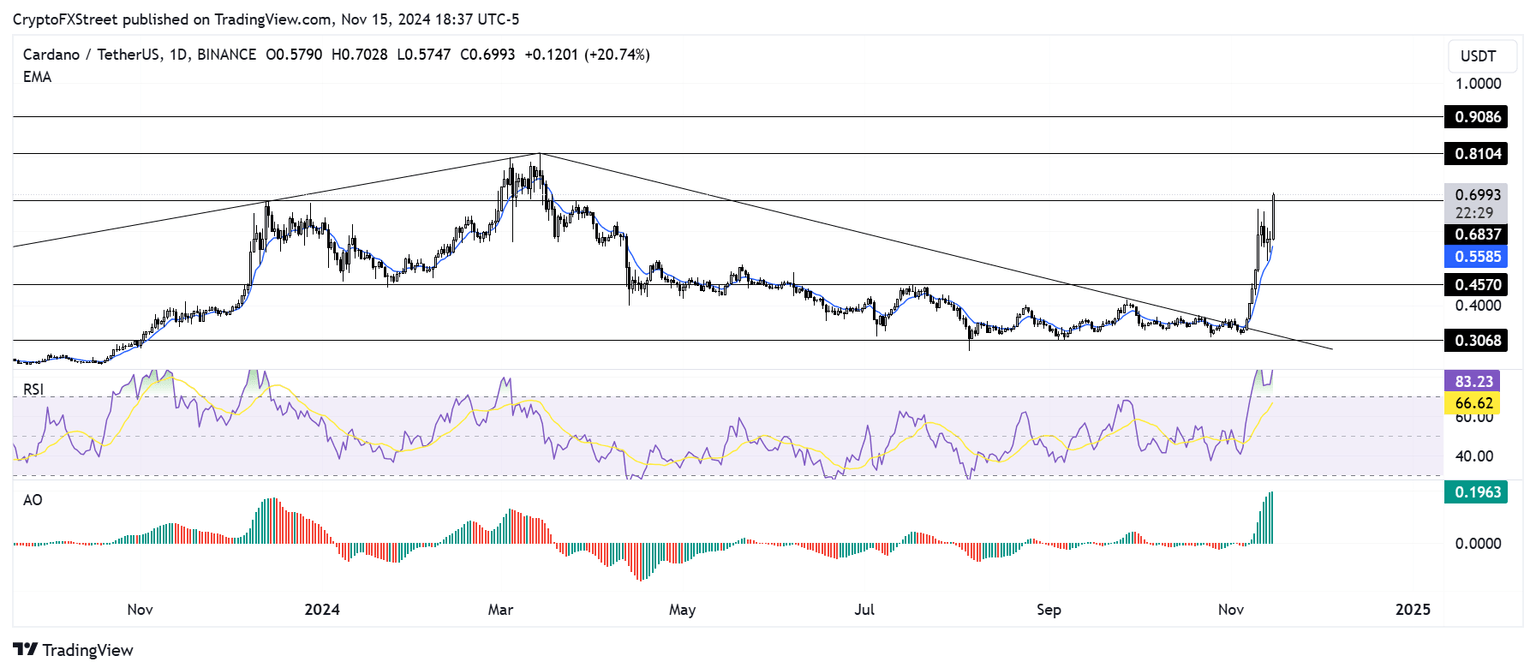

Cardano has risen nearly 18% in the past 24 hours since bouncing off the 14-day Exponential Moving Average (EMA) on Thursday.

The altcoin is testing the resistance level at $0.6837. A firm close above this resistance could see ADA continue the uptrend to tackle its yearly high resistance of $0.8104.

ADA/USDT daily chart

The bullish momentum is strengthened by ADA's extended rally since breaking out of a seven-month bearish trend on November 6.

The Relative Strength Index (RSI) is in the overbought region, indicating ADA may see a potential correction.

A daily candlestick close below $0.4570 will invalidate the bullish thesis.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi