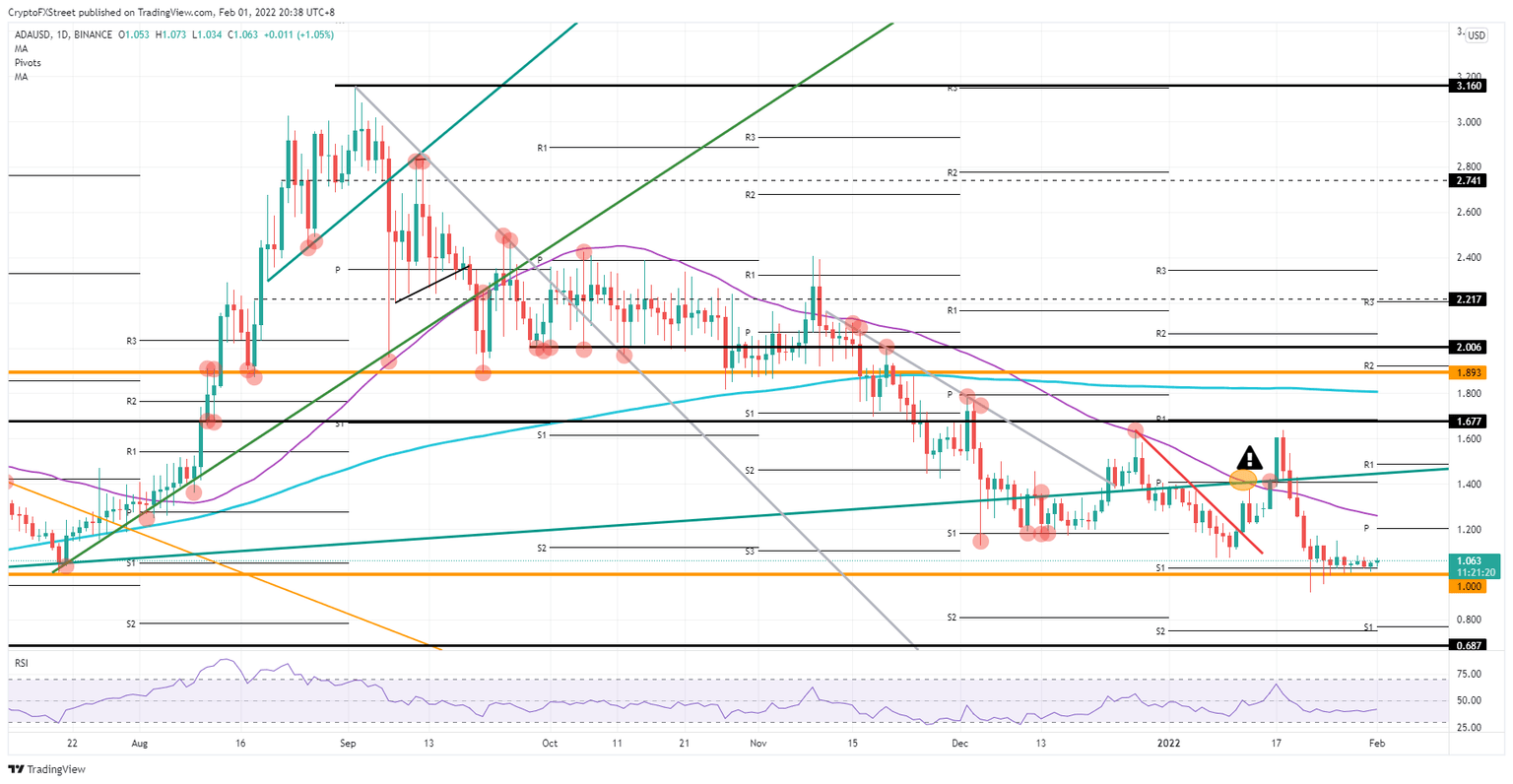

Cardano Price Prediction: ADA set for 20% gains

- Cardano bulls enter again on the dip below the S1 support from January.

- RSI slowly but surely grinding higher towards mid-50 levels.

- ADA set for a pop higher towards $1.26.

Cardano (ADA) price action grinded lower and tested – towards possibly making a break below – the orange support line at $1.00. Bulls, however, did a fantastic job of supporting the level, and US equities have started to fall in line, also making more gains. Now ADA bulls are set to start taking out some previous highs for the week, and traders can expect a pop higher towards $1.20 to test the new monthly pivot before hitting $1.26 as a short-term price target for this week.

ADA bulls are taking control with the start of a new month

Cardano price has been in a rough patch these past few days as the danger looms of a break below $1.00. Yet, instead, bulls have bought each dip, resulting in a squeeze to the upside, with lower highs since mid-January. A grind higher towards 50 on, the Relative Strength Index (RSI), however, signals the presence of bulls and optimism for more upside to come.

ADA price will see a further uplift as US equities probably book another good day like yesterday and look to start the new month on a better note than it ended January, which suffered overall net losses for the month. Expect this renewed risk-on sentiment to push ADA price towards $1.20 in the first leg, testing the monthly pivot for February assuming it holds any relevance. The ultimate profit level for this week, however, will be $1.26, where the 55-day Simple Moving Average (SMA) comes in as a cap, and which has already been proven in the past, both on December 27 and November 11.

ADA/USD daily chart

Although geopolitics are fading into the background, the recent fade in the dollar could quickly shift back and see dollar strength weighing on the valuation of Cardano coins. With that, the price could be set to push back towards $1.00 and break again below it, looking for bulls to save the day, yet again. If bulls forfeit their obligations, the road might be open towards the monthly S1 at $0.7

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.