- Cardano sits on top of strong support that starts at $0.104.

- On-chain metrics cast doubt that the price will be able to break from the range.

Cardano (ADA), the 10th largest digital asset with the current market capitalization of $3.4 billion, has been doing well recently. The coin has gained over 3% in the recent 24 hours and managed to settle above a critical support area. At the time of writing, ADA/USD is changing hands at $0.10, off the intra-week high reached at $0.11 on November 11.

Cardano technical picture is supportive

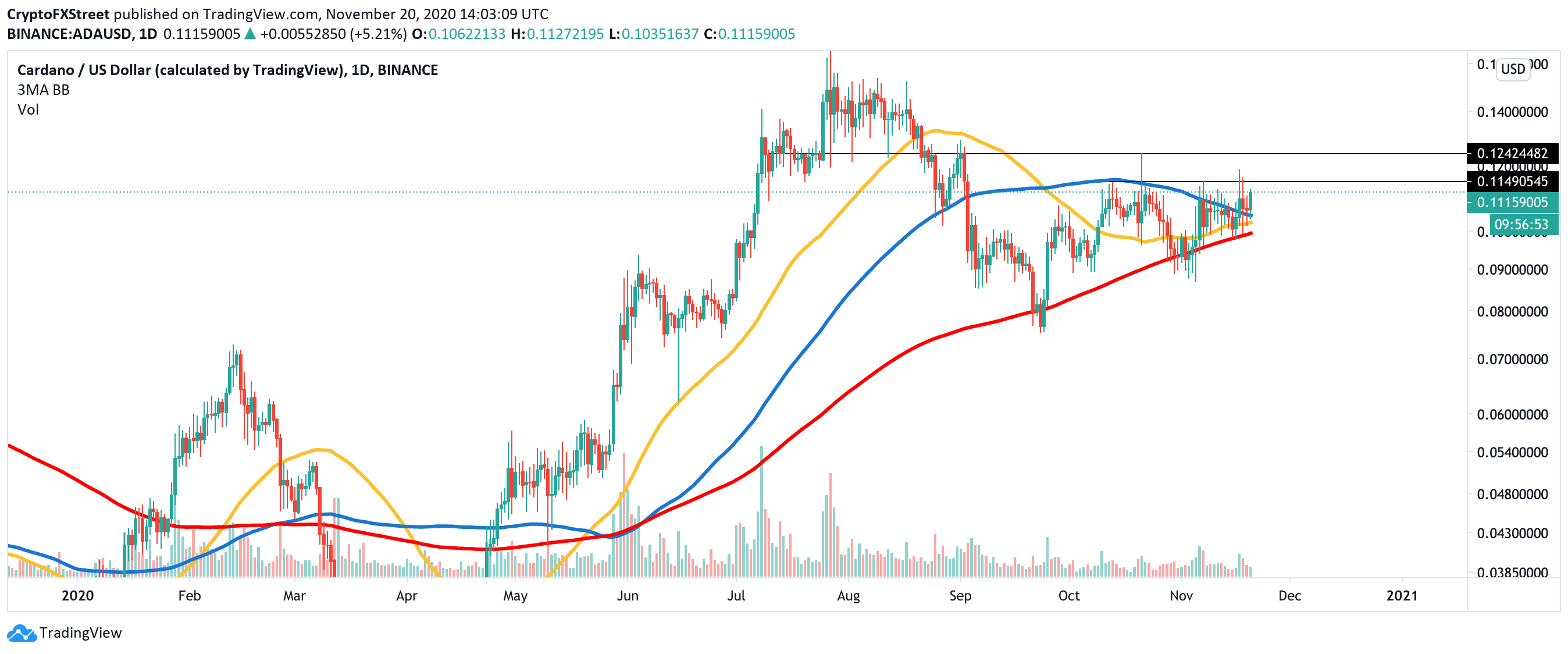

ADA bottomed at $0.08 on September 23 and has been moving within a bullish channel ever since. The upside momentum seems to have vanished. The price failed to clear a local resistance on approach to $0.11. However, the technicals and on-chain metrics imply that the price might have regained support and now is ready to resume the recovery.

On a daily chart, ADA/USD has settled above the bunch of EMAs, including 50, 100 and 200 EMAs, which is a positive signal as it means that the price may bounce from the support created by the 100 EMA at $0.104. The next barrier is formed by the EMA200 that serves as a backstop for the coin since the end of April. Currently, it sits at $0.09.

ADA/USD daily chart

The first local resistance sits at $0.11. This area has been tested by the price on numerous occasions since the end of October but to no avail. Once it is out of the way, the upside is likely to gain traction with the next focus on the significant barrier located on the approach to $0.124.

On-chain metrics are less reassuring

This idea is supported by the In/Out of the Money Around Price (IOMAP) model, which shows that there is little to no resistance ahead until $0.124. Meanwhile, on the downside, the price sits on top of a strong support area that goes from the current price all the way down to $0.095.

ADA's IOMAP data

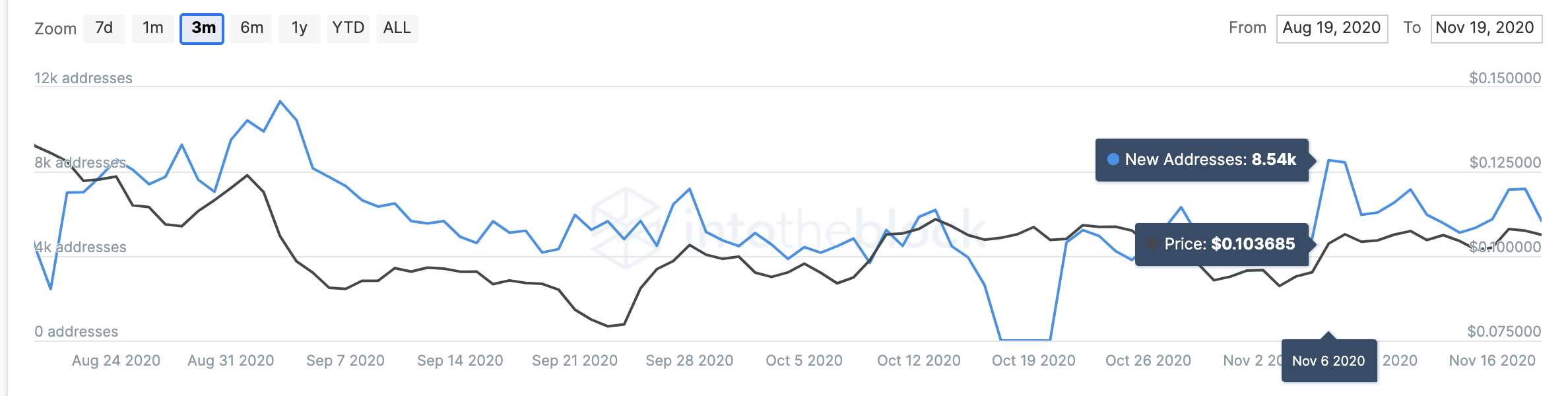

Meanwhile, the network growth seems to have peaked on November 6 as the number of new addresses created daily decreased from 8,540 to 7,180 by the time of writing. This is an alarming signal meaning that the network has been shrinking recently.

ADA New Addresses

Key levels to watch

From the technical perspective, ADA/USD is well-positioned to rebound from $0.099 and retest the support created by $0.124. Nevertheless, a sustainable move below $0.104 will invalidate the immediate bullish scenario and bring $0.095 into focus.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Hedera price surges more than 25% following a spike in trading volume

Hedera price surges more than 25% on Monday after rallying 64% last week. The rally was fueled by Canary Capital, which submitted an S-1 registration to the US SEC for an HBAR ETF, offering investors exposure to the crypto asset’s price.

Robinhood CEO calls UK approach to crypto “backwards”

Robinhood CEO Vlad Tenev criticized the UK’s restrictive crypto policies, comparing them to regulated gambling. Concerns grow over crypto trading addiction, with a significant amount of traders relating it to gambling.

Bonk holds near record-high as traders cheer hefty token burn

Bonk (BONK) price extends its gains on Monday after surging more than 100% last week and reaching a new all-time high on Sunday. This rally was fueled by the announcement on Friday that BONK would burn 1 trillion tokens by Christmas.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC consolidates after a new all-time high

Bitcoin price consolidates between the $87,000 to $93,000 zone. Ethereum's price is nearing its support level of $3,000; a close below would cause a further correction.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

Analytics and Charts (1)-637414780389181287.png)