- Cardano price was able to close above a critical support zone on Monday, reducing fears of a bearish continuation move.

- 18% rise expected as ADA moves towards its first primary resistance cluster.

- Downside risks remain but are likely limited.

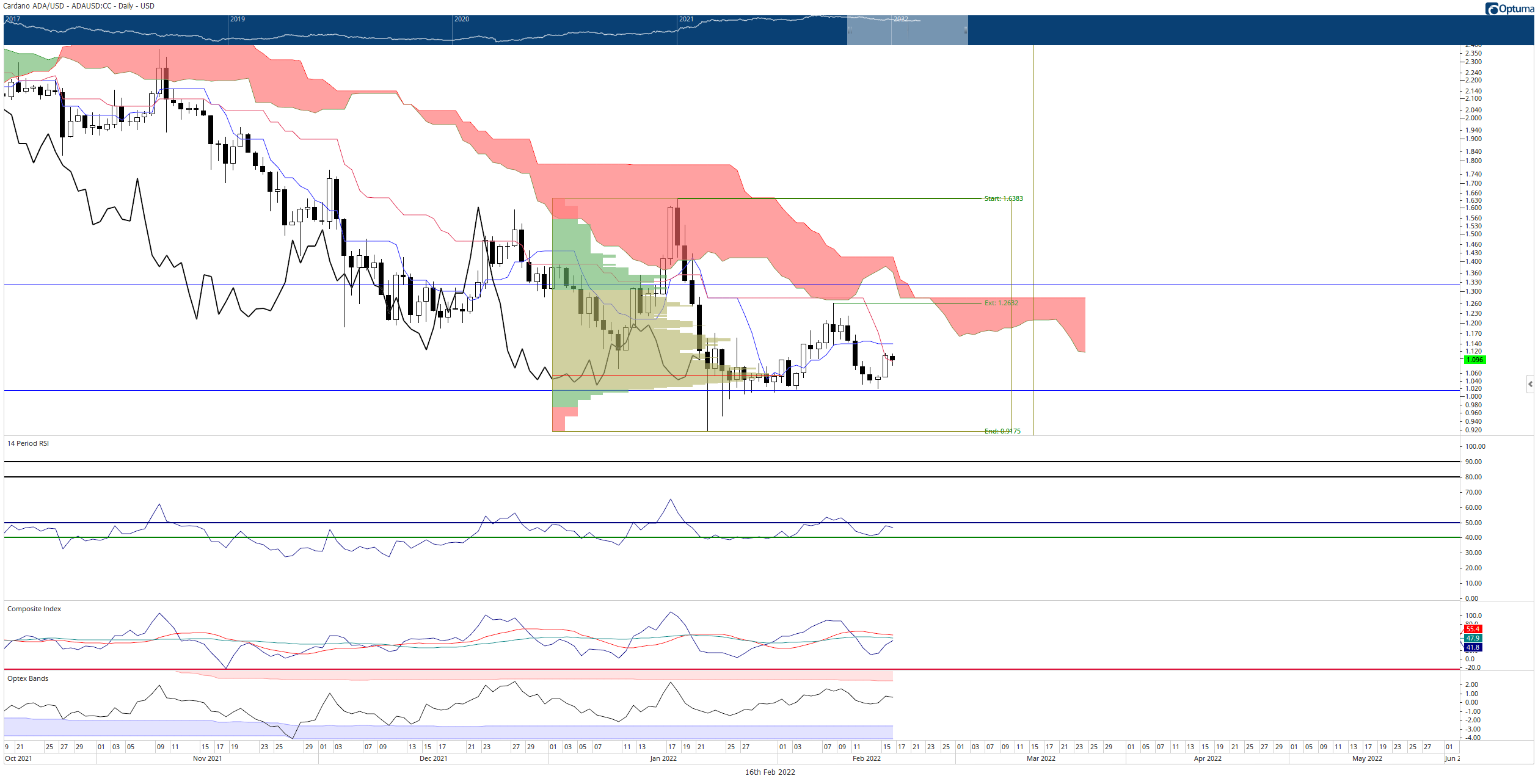

Cardano price experienced a nice jump higher on Monday, closing the session with a 5.5% gain. Concerns about crossing and staying above the Kijun-Sen continued until almost, literally, the last minute of the daily candlestick. Bulls have one more nearby resistance level before ADA would likely move towards $1.30 – the primary resistance level on its chart.

Cardano price action must close at or above $1.15 to maintain the current bullish momentum

Cardano price action is likely setting up for a move to restest the critical resistance zone at $1.30. But before $1.30 can be tested, Cardano needs to move and close above the next Ichimoku resistance level on its daily chart: the Tenkan-Sen.

The Tenkan-Sen is the weakest level within the Ichimoku system and is more of an indicator of near-term momentum than a typical moving average. The slope of the Tenkan-Sen displays the strength of the current momentum, but it also acts as support and resistance. If bulls can push Cardano price to a close at or above $1.15, ADA will then be above the Tenkan-Sen.

From there, it is a relatively easy road to $1.30 – but that is where things become more complex. The level at $1.30 is the primary resistance cluster before Cardano price begins a new expansion towards new all-time highs. The $1.30 value area contains the 38.2% Fibonacci retracement, top of the daily Ichimoku Cloud (Senkou Span B), the extended 2021 Volume Point Of Control, and the weekly Tenkan-Sen. Above $1.30 is a wide-open expansion move with little in the way of Cardano moving back to the $3 level.

ADA/USD Daily Ichimoku Kinko Hyo Chart

However, downside risks do remain. Any daily or weekly close at or below $1.02 could trigger a flash-crash towards the 2022 lows near $0.91 and would likely extend even lower towards the 61.8% Fibonacci retracement near $0.78.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

TON Foundation appoints new CEO after $400M investment: Will Toncoin price reach $5 in 2025?

The TON Foundation has named Maximilian Crown as its new Chief Executive Officer following a wave of strategic restructuring. Crown joins TON amid heightened focus on scaling blockchain adoption via Telegram’s vast user base.

SEC postpones decision on several crypto ETF filings after Paul Atkins assumes leadership

The SEC released several documents on Thursday stating that it is delaying its decision on crypto exchange-traded fund filings from Grayscale, Bitwise and Canary Capital as it seeks more time to conclude whether or not to approve the applications.

Ondo Finance hits $3B market cap as CEO Nathan Allman meets SEC to discuss tokenized US securities

Ondo Finance met with officials of the SEC and the law firm Davis Polk to discuss the regulation of tokenized US securities. Topics included registration requirements, broker-dealer rules and proposed compliant models for tokenized securities issuance.

Tron DAO announces $70B USDT supply: Here's how TRX price could react

TRON’s USDT circulation just surpassed $70 billion, signaling rising network utility as TRX price approaches a technically significant breakout. On Wednesday, TRON DAO confirmed that the circulating supply of Tether (USDT) on its blockchain has surpassed $70 billion.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.