Cardano Price Prediction: ADA presents a double scenario

- Cardano price has recovered 5% after witnessing the largest daily loss this year.

- ADA could present a double scenario headed into the third trading weekend of the month.

- A breach of the $0.32 level would likely spark a steeper decline.

Cardano price displays U-turn signals following the 11% decline witnessed earlier in the week. Still, more evidence is needed to say that bears are done shorting the price confidently.

Cardano price retaliates

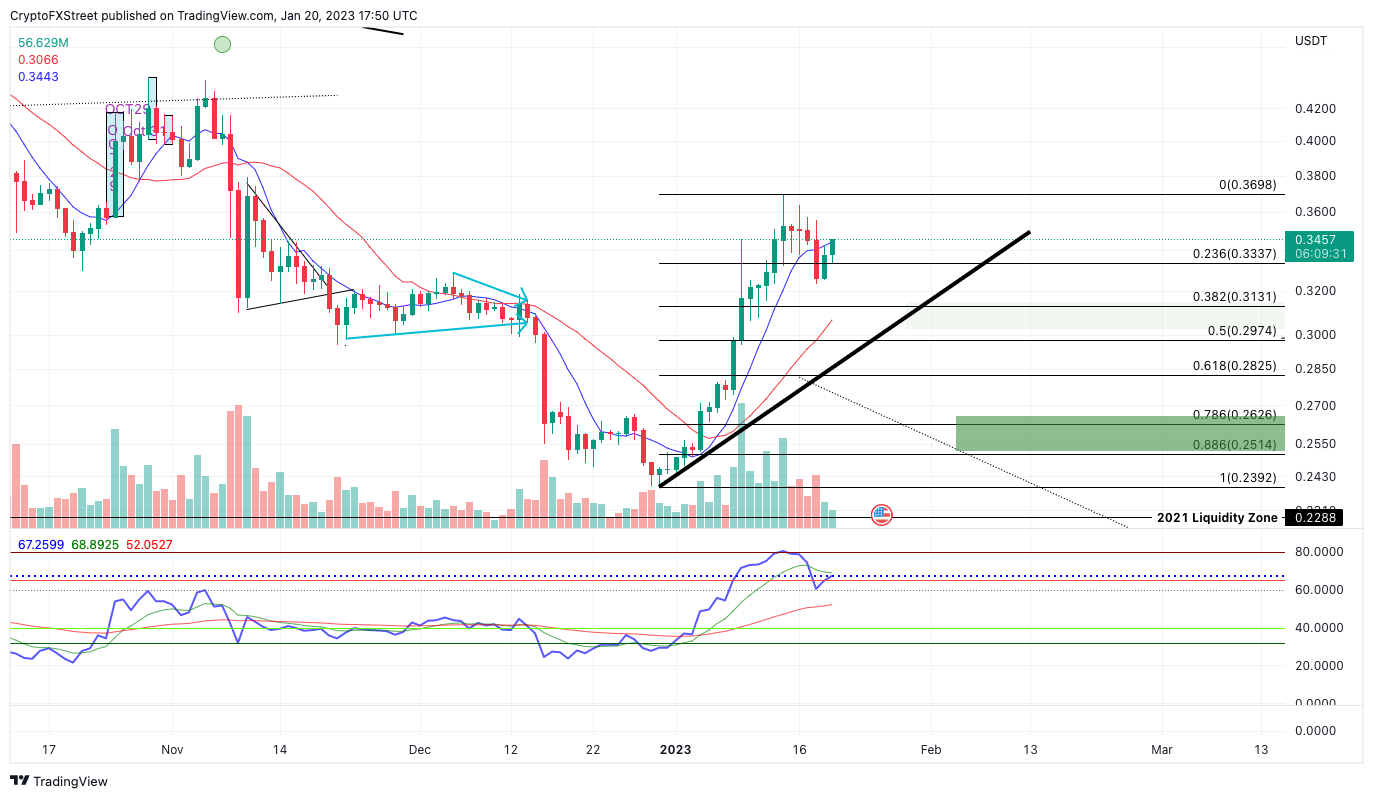

Cardano price shows early retaliation signals following five consecutive days of negative returns. The 5-day slump, which occurred after the bulls established a new monthly high at $0.3698, took 11% of the market value of the hands of ADA investors. On January 19, the bulls stopped the stair-stepping decline and have since prompted a 5% countertrend spike.

Cardano price currently auctions at $0.3459. Since January 1, the ADA price has increased by 55%. The current move north prompts questions about whether the rise is a continuation of the trend or a smart money trap. During the decline, the bears produced a candlestick close beneath the 8-day exponential moving average, a gesture that the uptrend had met its limit. Still, the bears have yet to show an uptick in volume larger than the bullish trend. Currently, the ADA is presenting a double scenario and could be a challenging asset for all market participants going into the weekend.

ADA/USDT1-day chart

For the bulls, a key level to aim for is November’s swing high at $0.44, which would result in a 30% upswing from ADA’s current price. The uptrend trade depends on the recent swing low at $0.325 holding as support.

On the contrary, the bears could flex their guns again and forge a decline into the 21-day simple moving average at $0.30.The bearish scenario sets up a downswing of 11%. The invalidation of the downtrend trade idea would be a breach above the newfound monthly high at $0.369.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.