Cardano Price Prediction: ADA on the brink of 55% liftoff to record highs

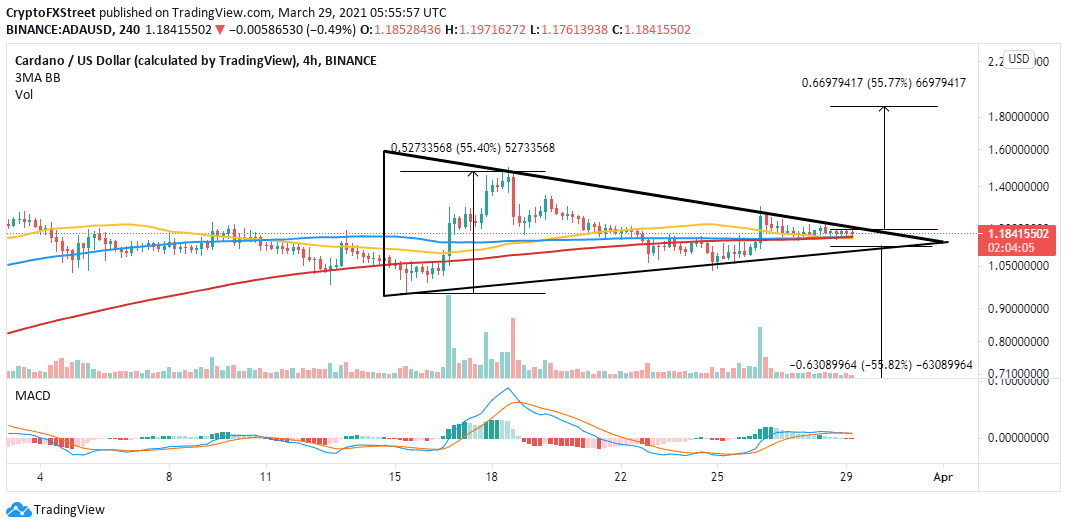

- Cardano exchanges hands within the confines of a symmetrical triangle, ready for a colossal breakout.

- Massive buy orders are expected as soon as ADA crosses above $1.48 (all-time high).

- The IOMAP highlights the possibility for sideways price action due to robust support and resistance zones.

Cardano is on the verge of a massive technical breakout as the European session is ushered in on Monday. The aspiring smart contract token has been in consolidation for several days. The sideways trading arrived after Cardano bulls secured support above $1. If the technical breakout materializes, ADA will be elevated more than 55% to new record highs, marginally above $1.8.

Cardano eyes symmetrical triangle breakout

The four-hour chart brings to light the formation of a symmetrical triangle pattern. This pattern is not exclusively bullish or bearish. However, a break above the upper trendline would pave the way for a 55% upswing to $1.8. Note that triangles have exact breakout targets measured from the highest to the lowest points.

ADA/USD 4-hour chart

Holding above the confluence formed by the 50 Simple Moving Average (SMA), the 100 SMA and the 200 SMA on the four-hour chart will ensure stability in the market, allowing bulls to focus on breaking the triangle resistance.

Looking at the side of the picture

The IOMAP chart suggests that the anticipated liftoff may either delay or be sabotaged altogether. Immense resistance is highlighted between $1.19 and $1.22. Here around 101,300 addresses previously bundled up approximately 3.1 billion ADA. Trading above this zone will not be a walk in the park for the bulls.

Cardano IOMAP chart

On the downside, robust support is in place to ensure that declines do not extend under $1. For instance, the region between $1.12 and $1.15 hosts an enormous ADA volume. Note that roughly 143,000 addresses previously purchased 3.9 billion ADA. With the key support and resistance in place, Cardano is bound to extend the sideways trading.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637525972565480565.png&w=1536&q=95)