Cardano Price Prediction: ADA in the run, ready to push to $1.60

- Cardano price is a bit shaky after a weekend rebound, but gains are paired back on Monday.

- The recent dip looks nice for a buy of ADA around $1.31.

- A fan-formation shows a very sensible price reaction and confirms more upside.

Cardano price was among the victims this Monday morning in the sell-off that flooded cryptocurrency markets. Big names like Bitcoin and Ethereum trended higher during the weekend, but they all paired gains and looked for support around Friday's levels.

Cardano price may look heavy, but nothing has changed to risk-on mood

Investors must have had a perfect weekend watching their cryptocurrency portfolio increase in value. The feeling on Monday morning, however, must have undercut their euphoric feeling from Sunday evening. This weekend it looked like cryptocurrencies were out of the woods after a few weeks of heavy selling and the long road to what looked like recovery.

But no need to panic just yet.

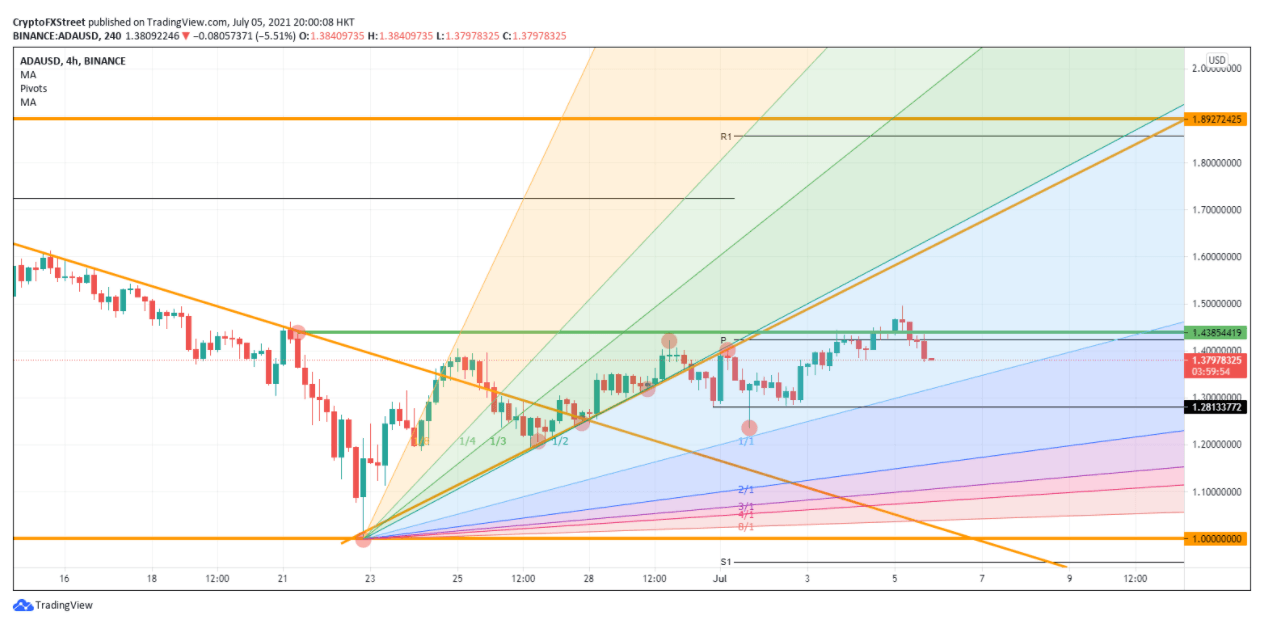

A closer look at Cardano price action shows that it is respecting a fan technical play. The 1/1 trend line was very well supported on July 1, with buyers pushing ADA price toward $1.50.

We get confirmation that this fan is being well respected as we see hours and days before the ½ fan line and the ⅓ fan line reflected in the wigs of the candles. Even the ⅛ fan is confirming the trend, which is a technical indicator to be aware of.

Looking forward, this means that some further downside is possible for now, but the 1/1 fan line should be respected around $1.33. If that level breaks, Cardano price has the $1.30 psychological level and the $1.28 triple bottom from this weekend as additional support.

ADA/USD 4 hour chart

The rejection at $1.50 is standard. It is a fundamental psychological level and, for buyers, an excellent place to take some profit. But if the sell-off continues on this US holiday, look for Cardano price to test around $1.20, which should fall in place with the 2/1 fan line.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.