Cardano Price Prediction: ADA eyes 40% rise with on-chain metrics backing the claim

- Cardano price is undergoing a retracement that will likely set the stage for a 38% run-up to $1.75.

- ADA needs to flip the $1.60 resistance barrier into support to reach its destination at $1.75.

- The transaction data and the recent uptick in average transaction size support the bullish thesis for the so-called “Ethereum killer.

Cardano price has set up liquidity pools that are likely to be taken advantage of going forward. The most probable direction for ADA seems to be bullish, with on-chain metrics providing a tailwind to the claim.

Cardano price to collect buy-stop liquidity

Cardano price set up a double top at $1.75 on December 2 and retraced 32% to $1.13. A few days later, ADA created a double bottom at $1.13 and surged 18%. However, the recent upward correction will likely set the stage for the incoming bullishness to be sustained.

A bounce off the $1.26 support level that sets up a new swing high above $1.47 will confirm the start of an uptrend. In this scenario, Cardano price will encounter the $1.60 resistance level. Flipping this barrier into a support floor will suggest that the buyers are taking control. This move will open the path for collecting the buy-stop liquidity resting above the $1.75 hurdle. In total, the climb would constitute a 38% gain.

ADA/USDT 4-hour chart

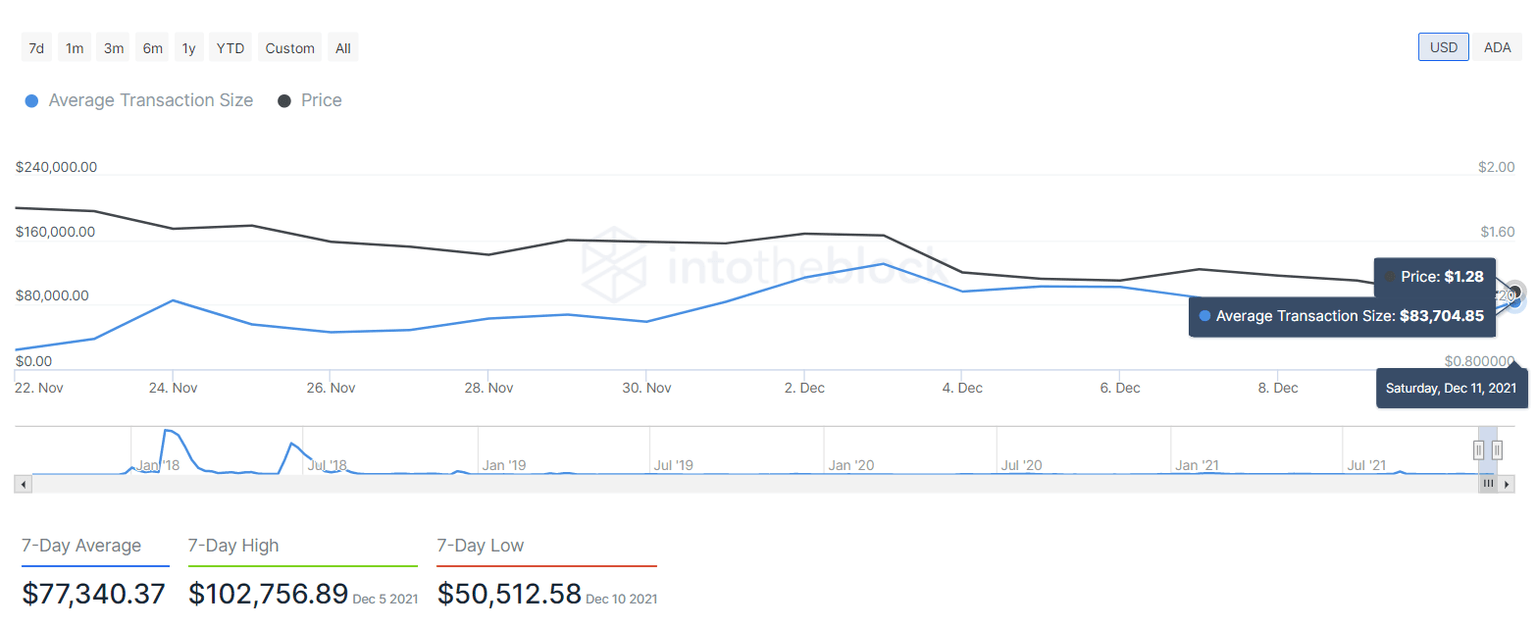

Supporting the bullish outlook for Cardano price is the recent uptick in the average transaction size from $23,877 to $83,704. This 250% spike in transfer size indicates that investors are interested in the price of ADA at the current levels and are actively pouring money into it.

ADA average transaction size

Moreover, IntoTheBlock’s Global In/Out of the Money (GIOM) model is another contributing factor to Cardano’s bullishness, and it shows that ADA will face little-to-no imminent resistance.

Two significant clusters of underwater investors appear at $1.42 and $1.60. Here, roughly 381,000 and 441,000 addresses purchased nearly 4.32 billion and 5.25 billion ADA tokens, respectively. Therefore, an uptick in buying pressure that propels Cardano price into these clusters is likely to be met with selling momentum from holders trying to break even. Hence, ADA bulls need to clear these two levels to reach their destination at $1.75.

ADA GIOM

While things are looking good for Cardano price, there is a high chance ADA might retrace below $1.19 to collect liquidity. Investors can scoop the so-called “Ethereum killer” for a discount in this situation.

However, if Cardano price produces a lower low below $1.12, it will invalidate the bullish thesis. In this case, ADA could slip down to retest the 1.02 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.