Cardano Price Prediction: ADA could explode 25% due to this divergence setup

- Cardano price sets up a bullish divergence setup on the daily chart.

- The resolution of this formation could result in a 25% ascent to $0.306.

- Invalidation of the bullish thesis will occur if ADA produces a lower low below $0.231.

Cardano price has been on a downtrend for more than two months, showing seller domination. But the recent development gives hope for sidelined buyers as a quick uptrend might emerge.

Also read: Cardano price plummets despite rise in development activity and transaction volume, why?

Cardano price ready to move higher

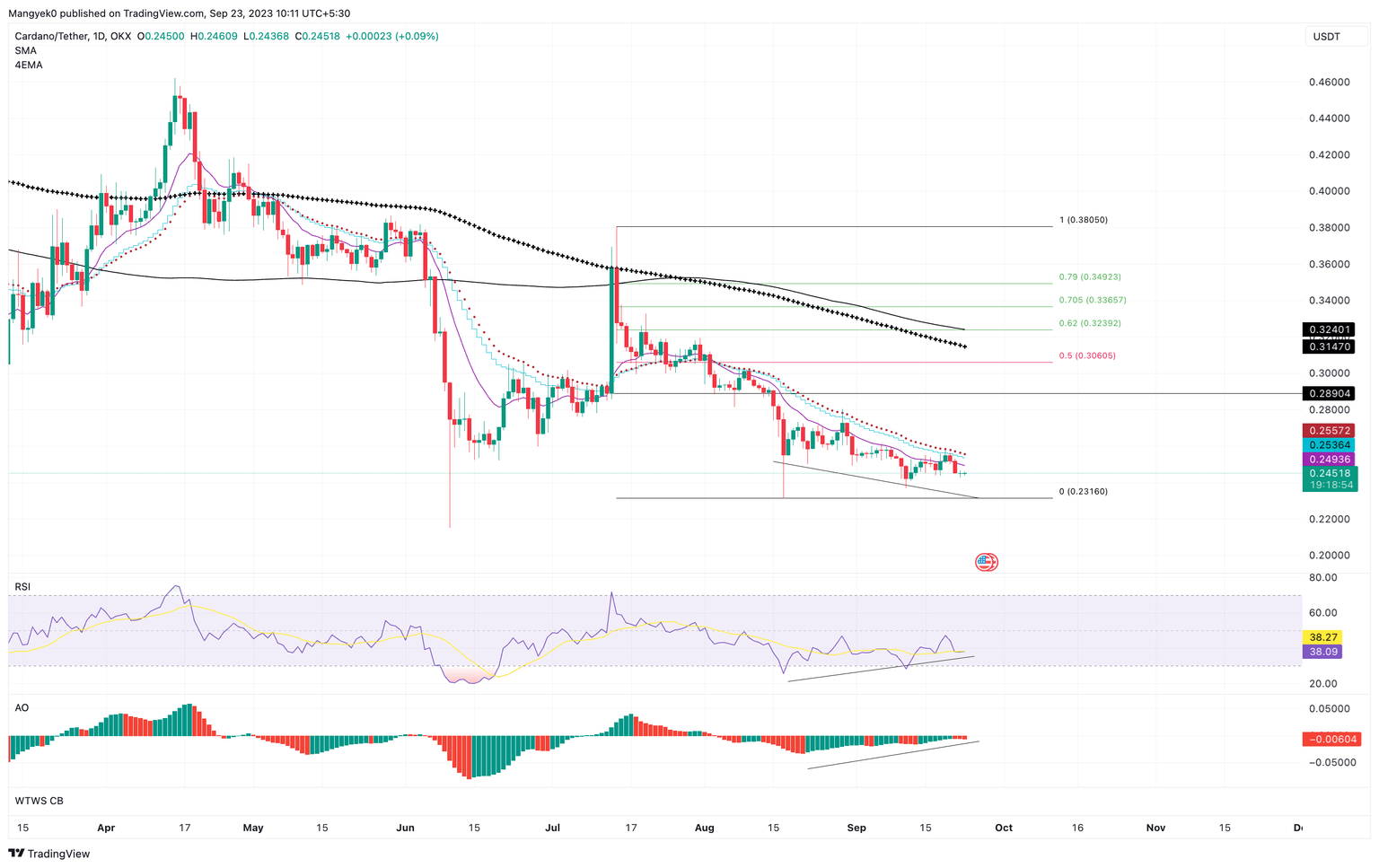

Cardano price set up a range, extending from $0.380 to $0.231 as it shed 39% between July 14 and August 17. Currently, ADA trades at $0.245 and has produced three distinctive lower lows in the last month. But, the Relative Strength Index (RSI) and Awesome Oscillator (AO) have produced higher lows. This non-conformity is termed bullish divergence and often results in the underlying asset rallying explosively.

The result of this explosive breakout could lead Cardano price to rally 18% and tag the $0.289 hurdle. In some cases, ADA could tag the midpoint of the aforementioned range at $0.306, bringing the total gain to 25%.

A highly bullish case coupled with patient ADA holders could see Cardano price revisit the 200-day Exponential Moving Average (EMA) at $0.314. This move would constitute 28% gain.

ADA/USDT 1-day chart

While the bullish outlook for Cardano price makes logical sense, a continuation of the downtrend would hamper the bullish divergence. A decisive breakdown of the range low at $0.231 that results in the production of a lower low would invalidate the bullish thesis.

Such a development could see Cardano price could drop 7% and revisit the June 10 swing low at $0.214.

Like this article? Help us with some feedback by answering this survey:

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.