Cardano Price Prediction: ADA bulls need to take a breather before a 100% upswing to $2.08

- Cardano price shows resilient bulls pushing the coin to new all-time highs regularly.

- Now, a 10% to 15% pullback seems to be coming ADA’s way before a 100% bull rally.

- This bull rally will put Cardano price at a new all-time high of $2.08.

- A bearish scenario will come into play if ADA bulls fail to defend the correction around the $1-mark.

Cardano price shows a rejection around the SuperTrend indicator’s sell-signal that was flashed on February 28. Since then, ADA has dropped 10% and shows signs of continuation. Although Cardano's current state might seem bearish, it will provide the buyers an opportunity to come back a lot stronger and push the so-called “Ethereum killer” to record levels.

Cardano price to face a setback before liftoff

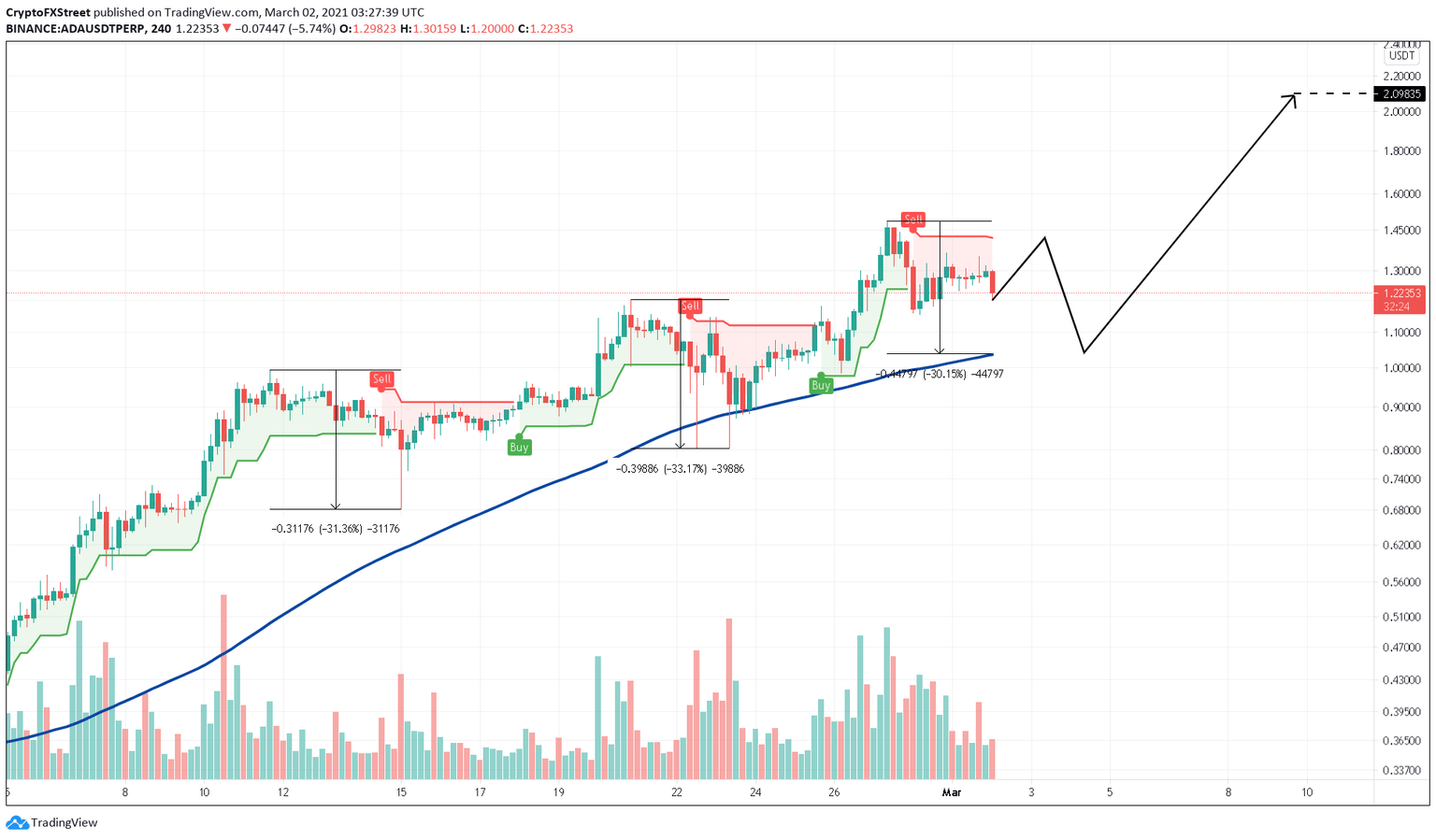

Cardano price rallies seem to be correcting approximately 30% since hitting the $1 level. Like the current downtrend, the last two pullbacks were due to the SuperTrend indicator’s sell signal. Additionally, each of these downswings ranged anywhere from 30% to 33%. Therefore, if something similar were to happen this time, Cardano could drop 15% from its current price at $1.23 before it kickstarts a bull rally.

Interestingly, this pullback coincides with the 100 four-hour moving average (MA) at $1.03.

ADA/USDT 4-hour chart

Based on IntotheBlock’s In/Out of the Money Around Price (IOMAP) model, nearly 32,500 addresses who purchased 1.65 billion ADA at an average price of $1.26 are “Out of the Money.” So, any buying pressure could be absorbed by these investors who may want to breakeven. This selling activity will create a downward pressure pushing ADA lower and supporting the short-term bearish thesis. Furthermore, IOMAP cohorts show that 52,300 addresses hold roughly $1.29 billion ADA at $1.10. So, the 15% drop could be cut short to 10%.

Either way, Cardano price seems primed for a pullback to $1.10 or $1.03 before bulls come charging in.

Cardano IOMAP chart

However, after the pullback, the so-callled "Ethereum killer" can be expected to surge past the aforementioned resistance barriers as the inverse head and shoulders pattern is still in play. Based on this technical formation, Cardano price could soar 100% from $1.03 to tap the target at $2.08.

ADA/USD 1-week chart

While the pullback seems likely, eager bulls could invalidate the short-term bearish thesis by pushing past the SuperTrend indicator’s sell signal at $1.42. This move will kickstart a bull rally pushing the Cardano price to a new all-time high.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.