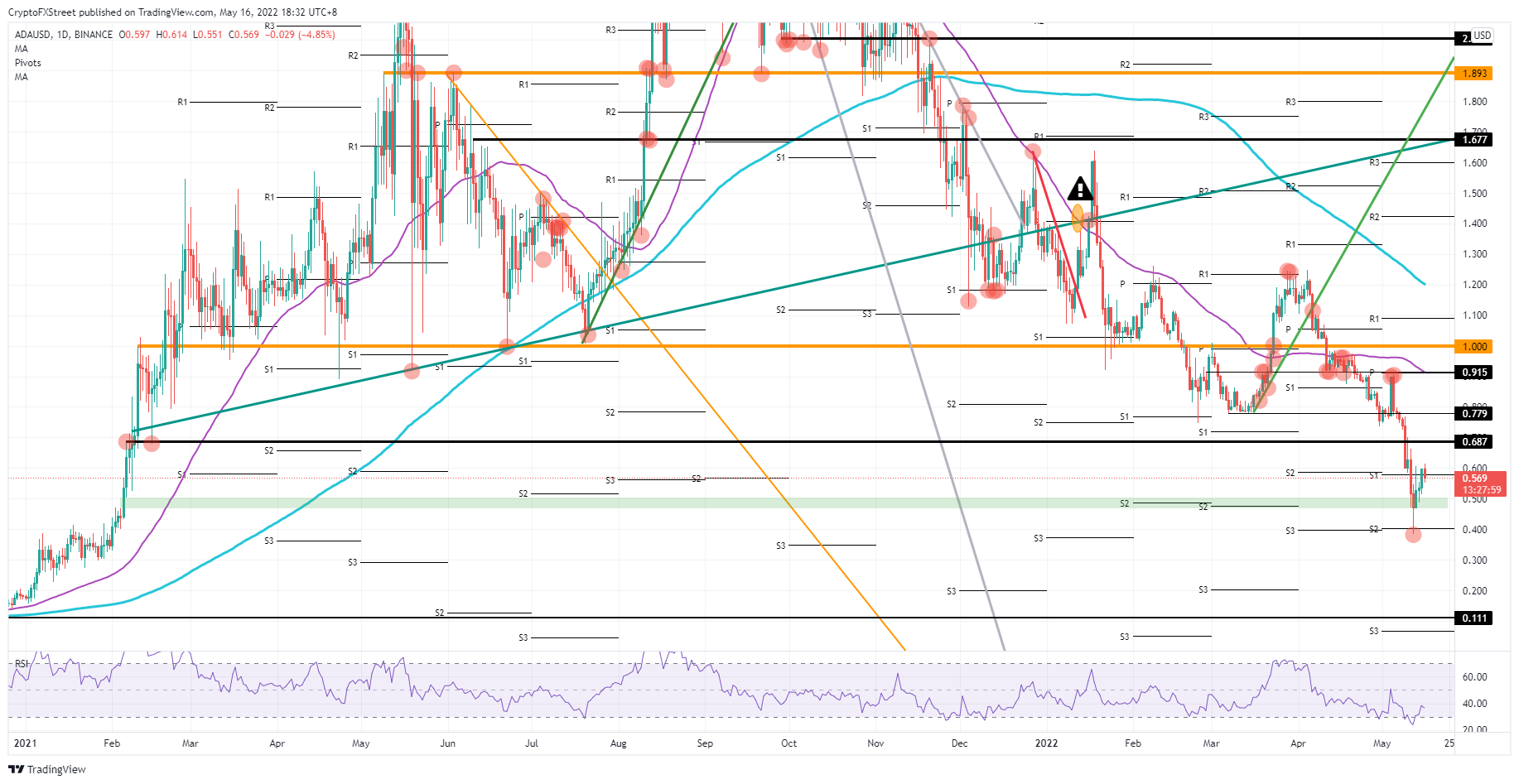

- Cardano price sees bulls unable to hold price action above monthly S1 support at $0.60.

- ADA price could fall back into the distribution zone between $0.47 and $0.50.

- Downside risk comes from the distribution zone becoming exhausted by buyers, with a break lower inevitably testing the $0.383 low.

Cardano price (ADA) sees price action turning 180 degrees on Monday after a series of harmful data points from China put cryptocurrency traders back in a negative mood . To make matters worse, more and more big names are entirely pulling out of Russia, with Mcdonald's as one of the latest amongst them. All these elements are weighing on global growth and global risk sentiment, making it very hard for cryptocurrencies to have any tailwinds, and could spell another 32% drop for ADA.

ADA price could undergo another 32% correction

Cardano price has issues respecting support this morning, as a pure technical play would likely see price open and return to the monthly S1 around $0.60 this morning, to then bounce and rocket higher towards $0.687. Instead, price action broke through the monthly S1 after a slew of negative economic data out of China put investors on edge on the first trading day of a new week. Adding to the negative sentiment, Mcdonald's announced it would cancel and exit all operations in Russia, meaning a severe write-off and downward forecast for earnings in the coming quarters. Tail risks are only being added, with almost none fading to the background, setting the scene for ADA to see investors exit even quicker.

ADA price is thus on the back foot together with the whole cryptocurrency asset class. Expect to see losses dug out even further towards $0.47, which is the low end of a distribution zone. With investors turning their back on cryptocurrencies, expect to see a nosedive to below $0.47, and then towards $0.38, with at least a retest on May 12.

ADA/USD daily chart

With all these key events already happening on the week's first trading day, the news flow could start to quiet down and open a window of opportunity for some recovery. ADA price could climb back above the monthly S1 and breakthrough $0.687. From there, the next profit level is set at $0.915, with the 55-days Simple Moving Average cap hanging above there.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TON Foundation appoints new CEO after $400M investment: Will Toncoin price reach $5 in 2025?

The TON Foundation has named Maximilian Crown as its new Chief Executive Officer following a wave of strategic restructuring. Crown joins TON amid heightened focus on scaling blockchain adoption via Telegram’s vast user base.

SEC postpones decision on several crypto ETF filings after Paul Atkins assumes leadership

The SEC released several documents on Thursday stating that it is delaying its decision on crypto exchange-traded fund filings from Grayscale, Bitwise and Canary Capital as it seeks more time to conclude whether or not to approve the applications.

Ondo Finance hits $3B market cap as CEO Nathan Allman meets SEC to discuss tokenized US securities

Ondo Finance met with officials of the SEC and the law firm Davis Polk to discuss the regulation of tokenized US securities. Topics included registration requirements, broker-dealer rules and proposed compliant models for tokenized securities issuance.

Tron DAO announces $70B USDT supply: Here's how TRX price could react

TRON’s USDT circulation just surpassed $70 billion, signaling rising network utility as TRX price approaches a technically significant breakout. On Wednesday, TRON DAO confirmed that the circulating supply of Tether (USDT) on its blockchain has surpassed $70 billion.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.