Cardano Price Prediction: A new yearly low before the bounce

- Cardano price shows shortterm bullish technicals likely to entice sidelined investors.

- On-chain metrics show an uptick in activity, suggesting the bottom is not yet in.

- The bears may be able to produce a new yearly low targeting $0.27 before validating the recent bullish technicals.

Cardano price has suffered a vicious downtrend move throughout November. As price consolidates, the technicals suggest a bounce occurs while on-chain metrics hint that investors are considering securing profits sooner than later. Key levels have been defined to gauge ADA's next potential move.

Cardano price is one to watch

Cardano price continues to disappoint as the bears have flexed a continued strength over the market throughout November. Since the start of the month, the self-proclaimed Ethereum killer token has lost 30% of its market value. A newfound yearly low at $0.2995 was established on Monday, November 21. As the bulls produce a temporary pullback, the technicals suggest a low could be near, but on-chain metrics suggest otherwise.

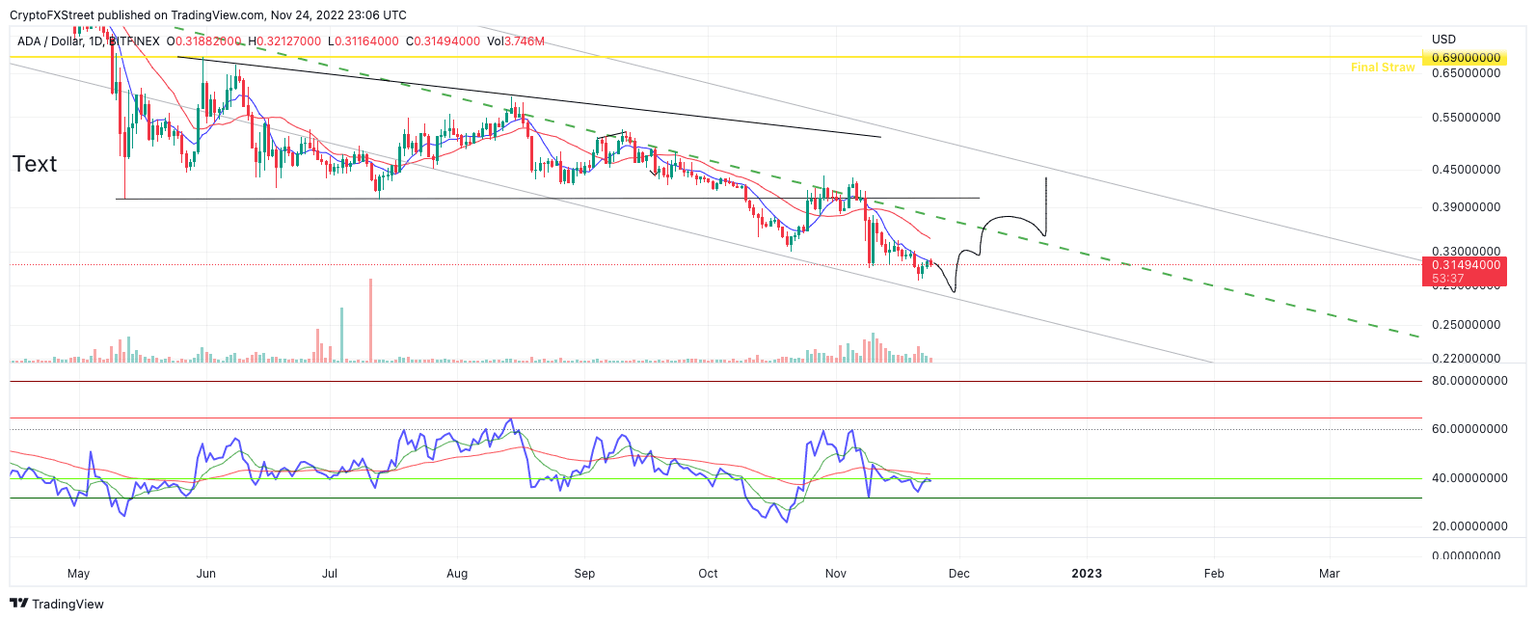

Cardano price currently auctions at $0.31. The newfound low shows an enticing bullish divergence signal, likely to keep sidelined bulls honed in on the smart contract token's price action throughout the weekend. Still, the bears have once again forged a rejection at the 8-day exponential moving average, which promotes the question, where are the bears aiming for?

ADA/USDT 1-Day Chart

Santiment's Onchain Analysis indicators may provide a context of what's happening beneath the Cardano hoo. The Total Supply and Active Addresses indicators show a persistent uptick throughout the month. Based on historical evidence, influxes in activity usually lead to more selloffs and convey the idea that a market bottom is not yet established.

Santiments's Total Supply and Active Addresses Indicators

Considering the technical and on-chain narratives, the ADA price could witness a bounce in the coming days. However, the move should only be considered shortterm. This thesis suggests ADA will produce a new yearly low near the $0.27 liquidity zones before creating a bounce to validate the bullish divergence witnessed on the RSI. If the new low manifests, the ADA price could than rally near $0.35 in the shortterm before long-term investors consider liquidating their positions.

Invalidation of the bullish countertrend has a wider safety stop to attempt to catch the potential falling knife. ADA should under no circumstances fall beneath $0.25. If the $0.25 zone is breached, ADA could fall into the 2020 liquidity zone near $0.19. Such a move would result in a 36% decrease from the current Cardano price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.

%2520%5B17.03.56%2C%252024%2520Nov%2C%25202022%5D-638049281982936354.png&w=1536&q=95)