Cardano Price Prediction: 224 million dormant tokens hit circulation signaling a whale dump

- Cardano price coils in triangular fashion on the 3-day chart.,

- Santiment’s 3-year Dormant Circulation Indicator shows a massive influx of circulating coins, signaling an upcoming sell-off.

- Invalidation of the bearish thesis is a closing candle above $0.595.

Cardano price appears to be setting up for another decline. Key levels have been identified for bears looking to enter the market.

Cardano price shows bearish control

Cardano price has been facing a brutal bearish dominance throughout the summer. The self-proclaimed Ethereum killer has been an underperformer for several weeks. While other smart contract tokens cryptocurrencies like Ethereum and Binance coin saw well over 50% returns this summer, the ADA price only managed to recover 30% of its losses since the early July sell-off.

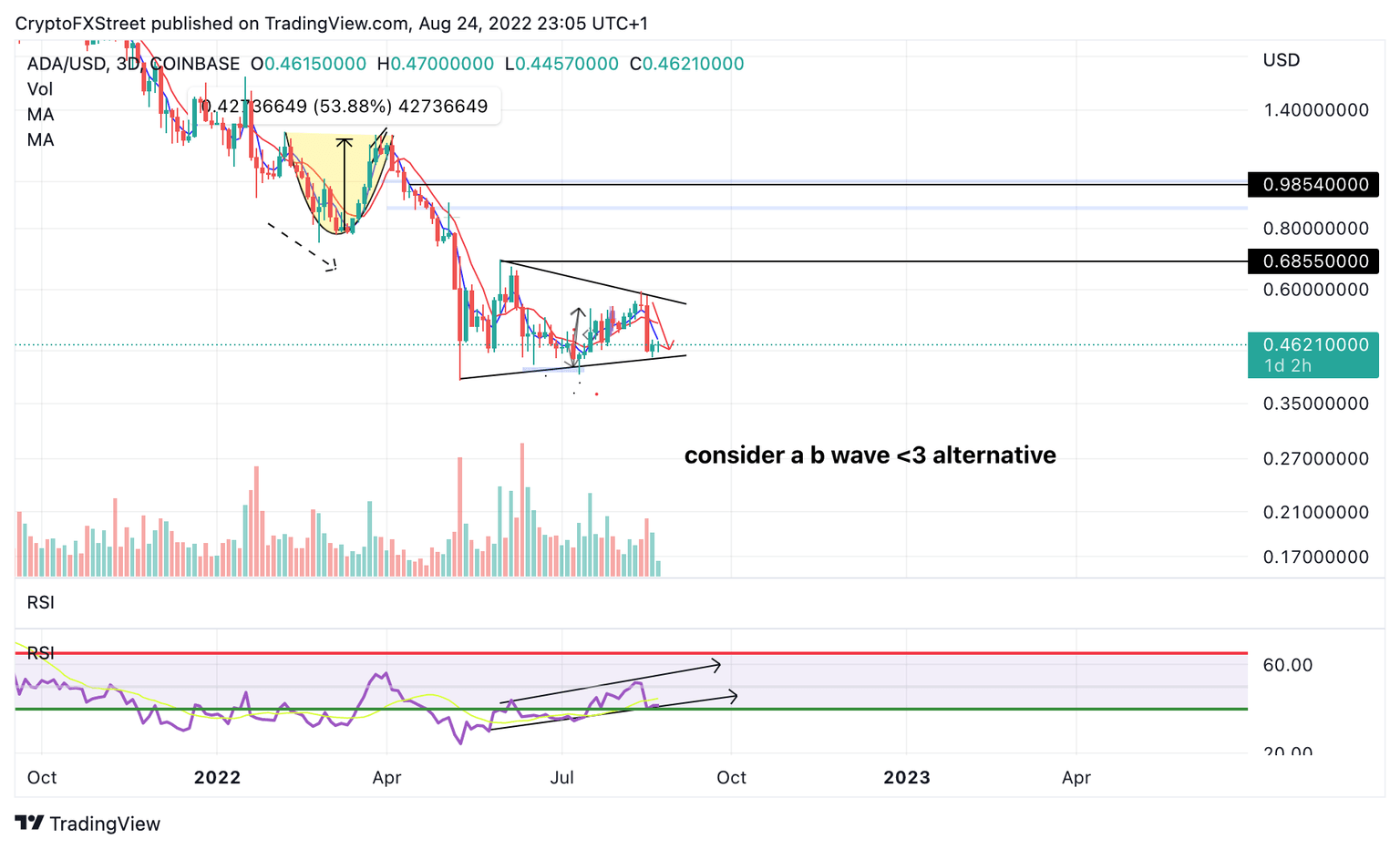

Cardano price currently trades at $0.465, 25% lower than where it auctioned just a few days prior at $0.59. Diving deeper into the technicals, ADA is coiling within a contracting triangle. The Volume Profile Indicator and Relative Strength Index confounds the idea of the triangle thesis as subtle bullish and divergences are displayed in accompaniment with a tapering transaction history.

ADA/USDT 3-Day Chart

Furthermore, Santiments' 3-Year Dormant Circulation Indicator shows a massive uptick of 2.24 Million tokens being moved. This is an identical influx of dormant coins that turned active back in September when ADA price traded near $2.25. As a result of the influx of coins in circulation, the Cardano price lost more than 50% of its market value just a few weeks later.

Santiment - 3 Year Dormant Circulation Indicator

When combined, it appears tThat Cardano price could be setting up for another decline; the coiling triangle suggests between 25-35% in the coming weeks. Investors looking to join the bears could wait for a definitive 3-day close below $0.430 as the catalyst making entry signal. Invalidation of the bearish thesis is a breach above $0.595. If the bulls can hurdle this barrier, they may induce an additional 50% rally in the other direction targeting $0.68 in the short term.

In the following video, our analysts deep dive into the price action of Cardano, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.